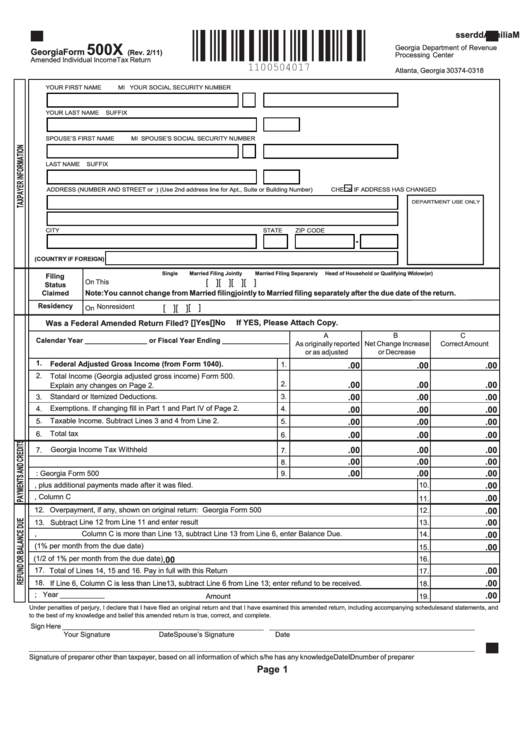

Print

Clear

M

a

l i

n i

g

A

d

d

e r

s

s

500X

Georgia Department of Revenue

Georgia Form

(Rev. 2/11)

Processing Center

Amended Individual IncomeTax Return

P.O. Box 740318

Atlanta, Georgia 30374-0318

YOUR FIRST NAME

MI

YOUR SOCIAL SECURITY NUMBER

YOUR LAST NAME

SUFFIX

SPOUSE’S FIRST NAME

MI

SPOUSE’S SOCIAL SECURITY NUMBER

LAST NAME

SUFFIX

ADDRESS (NUMBER AND STREET or P.O. BOX) (Use 2nd address line for Apt., Suite or Building Number)

CHECK IF ADDRESS HAS CHANGED

DEPARTMENT USE ONLY

CITY

STATE

ZIP CODE

(COUNTRY IF FOREIGN)

Married Filing Separarely

Head of Household or Qualifying Widow(er)

Single

Married Filing Jointly

Filing

[ ]

[ ]

[ ]

[ ]

On This Return.............

Status

Claimed

Note: You cannot change from Married filing jointly to Married filing separately after the due date of the return.

Residency

[ ]

Nonresident

[ ]

[ ]

On This Return..............

Full Year Resident

Part Year Resident From_________To_________

Was a Federal Amended Return Filed? [ ] Yes

[ ] No

If YES, Please Attach Copy.

A

B

C

Calendar Year ________________ or Fiscal Year Ending _________________

Net Change Increase

As originally reported

Correct Amount

or Decrease

or as adjusted

1.

Federal Adjusted Gross Income (from Form 1040).

.00

.00

.00

1.

2.

Total Income (Georgia adjusted gross income) Form 500.

2.

.00

.00

.00

Explain any changes on Page 2.

Standard or Itemized Deductions.

3.

.00

.00

.00

3.

Exemptions. If changing fill in Part 1 and Part IV of Page 2.

4.

4.

.00

.00

.00

5 .

Taxable Income. Subtract Lines 3 and 4 from Line 2.

.00

.00

.00

5.

6.

Total tax

.00

.00

.00

6.

Georgia Income Tax Withheld

.00

.00

.00

7.

7.

.00

.00

.00

8.

8.

Other Credits

.00

.00

.00

9.

Estimated Tax Payments: Georgia Form 500

9.

.00

10. Amount paid with original return, plus additional payments made after it was filed.

10.

11. Total of Lines 7 through 10, Column C

.00

11.

12. Overpayment,

.00

if any, shown on original return: Georgia Form 500

12.

.00

13. Subtract

Line 12 from Line 11 and enter result

13.

14. If Line 6,

Column C is more than Line 13, subtract Line 13 from Line 6, enter Balance Due.

14.

.00

15. Add interest (1% per month from the due date)

.00

15.

16. Late pay penalty (1/2 of 1% per month from the due date)

16.

.00

.00

17. Total of Lines 14, 15 and 16. Pay in full with this Return

17.

18.

.00

If Line 6, Column C is less than Line13, subtract Line 6 from Line 13; enter refund to be received.

18.

19. Amount to be credited to Estimated Tax; Year ___________

.00

Amount

19.

Under penalties of perjury, I declare that I have filed an original return and that I have examined this amended return, including accompanying schedules and statements, and

to the best of my knowledge and belief this amended return is true, correct, and complete.

Sign Here ___________________________________

Your Signature

Date

Spouse’s Signature

Date

Signature of preparer other than taxpayer, based on all information of which s/he has any knowledge

Date

ID number of preparer

Page 1

1

1 2

2