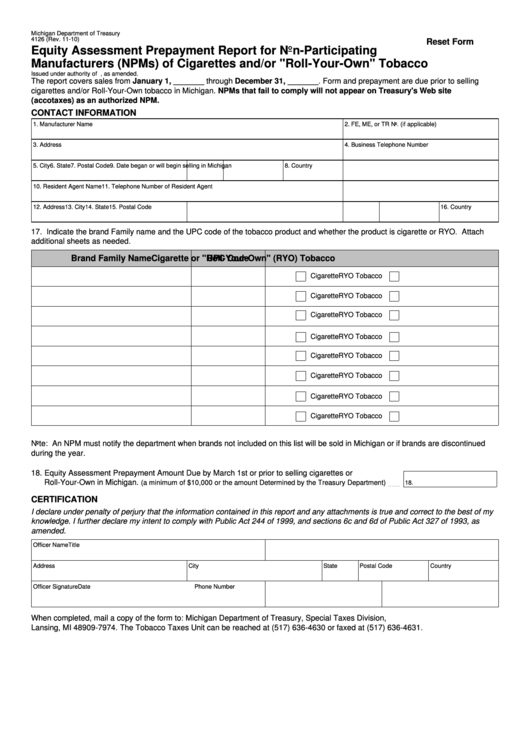

Michigan Department of Treasury

4126 (Rev. 11-10)

Reset Form

Equity Assessment Prepayment Report for Non-Participating

Manufacturers (NPMs) of Cigarettes and/or "Roll-Your-Own" Tobacco

Issued under authority of P.A. 327 of 1993, as amended.

The report covers sales from January 1, _______ through December 31, _______. Form and prepayment are due prior to selling

cigarettes and/or Roll-Your-Own tobacco in Michigan. NPMs that fail to comply will not appear on Treasury's Web site

( ) as an authorized NPM.

CONTACT INFORMATION

1. Manufacturer Name

2. FE, ME, or TR No. (if applicable)

3. Address

4. Business Telephone Number

5. City

6. State

7. Postal Code

8. Country

9. Date began or will begin selling in Michigan

10. Resident Agent Name

11. Telephone Number of Resident Agent

12. Address

13. City

14. State

15. Postal Code

16. Country

17. Indicate the brand Family name and the UPC code of the tobacco product and whether the product is cigarette or RYO. Attach

additional sheets as needed.

Brand Family Name

UPC Code

Cigarette or "Roll-Your-Own" (RYO) Tobacco

Cigarette

RYO Tobacco

Cigarette

RYO Tobacco

Cigarette

RYO Tobacco

Cigarette

RYO Tobacco

Cigarette

RYO Tobacco

Cigarette

RYO Tobacco

Cigarette

RYO Tobacco

Cigarette

RYO Tobacco

Note: An NPM must notify the department when brands not included on this list will be sold in Michigan or if brands are discontinued

during the year.

18. Equity Assessment Prepayment Amount Due by March 1st or prior to selling cigarettes or

Roll-Your-Own in Michigan.

(a minimum of $10,000 or the amount Determined by the Treasury Department)

18.

CERTIFICATION

I declare under penalty of perjury that the information contained in this report and any attachments is true and correct to the best of my

knowledge. I further declare my intent to comply with Public Act 244 of 1999, and sections 6c and 6d of Public Act 327 of 1993, as

amended.

Officer Name

Title

Address

City

State

Postal Code

Country

Officer Signature

Date

Phone Number

When completed, mail a copy of the form to: Michigan Department of Treasury, Special Taxes Division, P.O. Box 30474

Lansing, MI 48909-7974. The Tobacco Taxes Unit can be reached at (517) 636-4630 or faxed at (517) 636-4631.

1

1 2

2