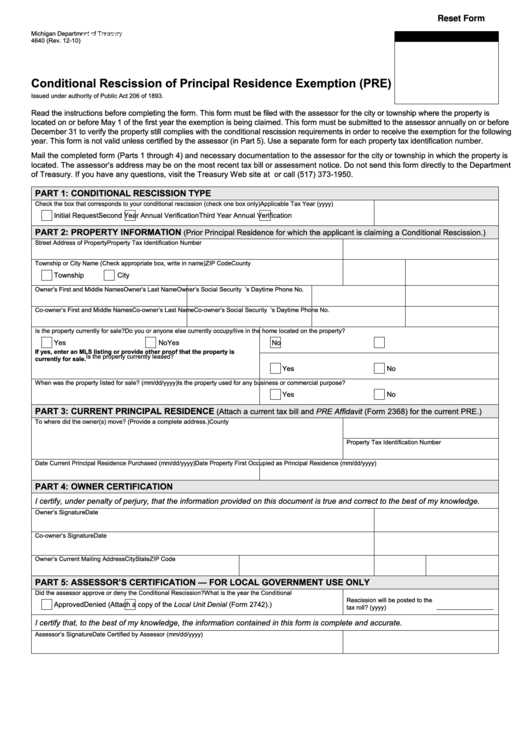

Reset Form

Michigan Department of Treasury

ASSESSOR’S DATE STAMP

4640 (Rev. 12-10)

Conditional Rescission of Principal Residence Exemption (PRE)

Issued under authority of Public Act 206 of 1893.

Read the instructions before completing the form. This form must be filed with the assessor for the city or township where the property is

located on or before May 1 of the first year the exemption is being claimed. This form must be submitted to the assessor annually on or before

December 31 to verify the property still complies with the conditional rescission requirements in order to receive the exemption for the following

year. This form is not valid unless certified by the assessor (in Part 5). Use a separate form for each property tax identification number.

Mail the completed form (Parts 1 through 4) and necessary documentation to the assessor for the city or township in which the property is

located. The assessor’s address may be on the most recent tax bill or assessment notice. Do not send this form directly to the Department

of Treasury. If you have any questions, visit the Treasury Web site at or call (517) 373-1950.

PART 1: CONDITIONAL RESCISSION TYPE

Check the box that corresponds to your conditional rescission (check one box only)

Applicable Tax Year (yyyy)

Initial Request

Second Year Annual Verification

Third Year Annual Verification

PART 2: PROPERTY INFORMATION

(Prior Principal Residence for which the applicant is claiming a Conditional Rescission.)

Street Address of Property

Property Tax Identification Number

Township or City Name (Check appropriate box, write in name)

ZIP Code

County

Township

City

Owner’s First and Middle Names

Owner’s Last Name

Owner’s Social Security No.

Owner’s Daytime Phone No.

Co-owner’s First and Middle Names

Co-owner’s Last Name

Co-owner’s Social Security No.

Co-owner’s Daytime Phone No.

Is the property currently for sale?

Do you or anyone else currently occupy/live in the home located on the property?

Yes

No

Yes

No

If yes, enter an MLS listing or provide other proof that the property is

Is the property currently leased?

currently for sale.

Yes

No

When was the property listed for sale? (mm/dd/yyyy)

Is the property used for any business or commercial purpose?

Yes

No

PART 3: CuRRENT PRINCIPAL RESIDENCE

(Attach a current tax bill and PRE Affidavit (Form 2368) for the current PRE.)

To where did the owner(s) move? (Provide a complete address.)

County

Property Tax Identification Number

Date Current Principal Residence Purchased (mm/dd/yyyy)

Date Property First Occupied as Principal Residence (mm/dd/yyyy)

PART 4: OWNER CERTIFICATION

I certify, under penalty of perjury, that the information provided on this document is true and correct to the best of my knowledge.

Owner’s Signature

Date

Co-owner’s Signature

Date

Owner’s Current Mailing Address

City

State

ZIP Code

PART 5: ASSESSOR’S CERTIFICATION — FOR LOCAL gOvERNMENT uSE ONLY

Did the assessor approve or deny the Conditional Rescission?

What is the year the Conditional

Rescission will be posted to the

Approved

Denied (Attach a copy of the Local Unit Denial (Form 2742).)

tax roll? (yyyy)

I certify that, to the best of my knowledge, the information contained in this form is complete and accurate.

Assessor’s Signature

Date Certified by Assessor (mm/dd/yyyy)

1

1 2

2