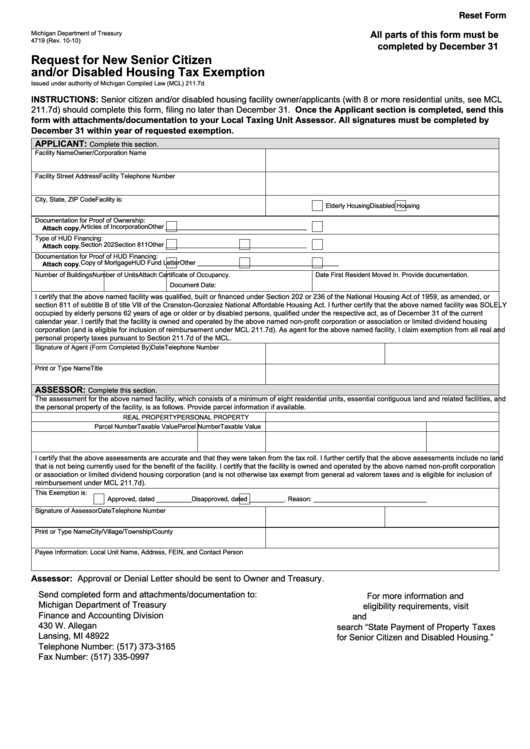

Reset Form

All parts of this form must be

Michigan Department of Treasury

4719 (Rev. 10-10)

completed by December 31

Request for New Senior Citizen

and/or Disabled Housing Tax Exemption

Issued under authority of Michigan Compiled Law (MCL) 211.7d.

INSTRUCTIONS: Senior citizen and/or disabled housing facility owner/applicants (with 8 or more residential units, see MCL

211.7d) should complete this form, filing no later than December 31. Once the Applicant section is completed, send this

form with attachments/documentation to your Local Taxing Unit Assessor. All signatures must be completed by

December 31 within year of requested exemption.

APPLICANT:

Complete this section.

Facility Name

Owner/Corporation Name

Facility Street Address

Facility Telephone Number

City, State, ZIP Code

Facility is:

Elderly Housing

Disabled Housing

Documentation for Proof of Ownership:

Articles of Incorporation

Other ________________________________________

Attach copy.

Type of HUD Financing:

Section 202

Section 811

Other ________________________________________

Attach copy.

Documentation for Proof of HUD Financing:

Copy of Mortgage

HUD Fund Letter

Other ________________________________________

Attach copy.

Number of Buildings

Number of Units

Attach Certificate of Occupancy.

Date First Resident Moved In. Provide documentation.

Document Date:

I certify that the above named facility was qualified, built or financed under Section 202 or 236 of the National Housing Act of 1959, as amended, or

section 811 of subtitle B of title Vlll of the Cranston-Gonzalez National Affordable Housing Act. I further certify that the above named facility was SOLELY

occupied by elderly persons 62 years of age or older or by disabled persons, qualified under the respective act, as of December 31 of the current

calendar year. I certify that the facility is owned and operated by the above named non-profit corporation or association or limited dividend housing

corporation (and is eligible for inclusion of reimbursement under MCL 211.7d). As agent for the above named facility, I claim exemption from all real and

personal property taxes pursuant to Section 211.7d of the MCL.

Signature of Agent (Form Completed By)

Date

Telephone Number

Print or Type Name

Title

ASSESSOR:

Complete this section.

The assessment for the above named facility, which consists of a minimum of eight residential units, essential contiguous land and related facilities, and

the personal property of the facility, is as follows. Provide parcel information if available.

REAL PROPERTY

PERSONAL PROPERTY

Parcel Number

Taxable Value

Parcel Number

Taxable Value

I certify that the above assessments are accurate and that they were taken from the tax roll. I further certify that the above assessments include no land

that is not being currently used for the benefit of the facility. I certify that the facility is owned and operated by the above named non-profit corporation

or association or limited dividend housing corporation (and is not otherwise tax exempt from general ad valorem taxes and is eligible for inclusion of

reimbursement under MCL 211.7d).

This Exemption is:

Approved, dated __________

Disapproved, dated __________. Reason: ________________________________

Signature of Assessor

Date

Telephone Number

Print or Type Name

City/Village/Township/County

Payee Information: Local Unit Name, Address, FEIN, and Contact Person

Assessor: Approval or Denial Letter should be sent to Owner and Treasury.

Send completed form and attachments/documentation to:

For more information and

Michigan Department of Treasury

eligibility requirements, visit

Finance and Accounting Division

and

430 W. Allegan

search “State Payment of Property Taxes

Lansing, MI 48922

for Senior Citizen and Disabled Housing.”

Telephone Number: (517) 373-3165

Fax Number: (517) 335-0997

1

1