Documentation For The Forest Management Planning Credit36 Mrsa

ADVERTISEMENT

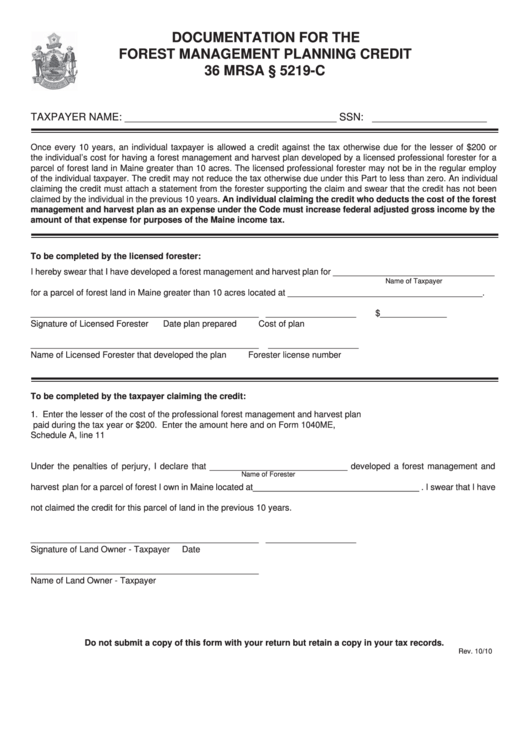

DOCUMENTATION FOR THE

FOREST MANAGEMENT PLANNING CREDIT

36 MRSA § 5219-C

TAXPAYER NAME: _____________________________________ SSN: ____________________

Once every 10 years, an individual taxpayer is allowed a credit against the tax otherwise due for the lesser of $200 or

the individual’s cost for having a forest management and harvest plan developed by a licensed professional forester for a

parcel of forest land in Maine greater than 10 acres. The licensed professional forester may not be in the regular employ

of the individual taxpayer. The credit may not reduce the tax otherwise due under this Part to less than zero. An individual

claiming the credit must attach a statement from the forester supporting the claim and swear that the credit has not been

claimed by the individual in the previous 10 years. An individual claiming the credit who deducts the cost of the forest

management and harvest plan as an expense under the Code must increase federal adjusted gross income by the

amount of that expense for purposes of the Maine income tax.

To be completed by the licensed forester:

I hereby swear that I have developed a forest management and harvest plan for __________________________________

Name of Taxpayer

for a parcel of forest land in Maine greater than 10 acres located at _________________________________________.

________________________________________________

___________________

$______________

Signature of Licensed Forester

Date plan prepared

Cost of plan

________________________________________________

___________________

Name of Licensed Forester that developed the plan

Forester license number

To be completed by the taxpayer claiming the credit:

1.

Enter the lesser of the cost of the professional forest management and harvest plan

paid during the tax year or $200. Enter the amount here and on Form 1040ME,

Schedule A, line 11 ......................................................................................................... 1. ___________________

Under the penalties of perjury, I declare that _____________________________ developed a forest management and

Name of Forester

harvest plan for a parcel of forest I own in Maine located at___________________________________ . I swear that I have

not claimed the credit for this parcel of land in the previous 10 years.

________________________________________________

___________________

Signature of Land Owner - Taxpayer

Date

________________________________________________

Name of Land Owner - Taxpayer

Do not submit a copy of this form with your return but retain a copy in your tax records.

Rev. 10/10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1