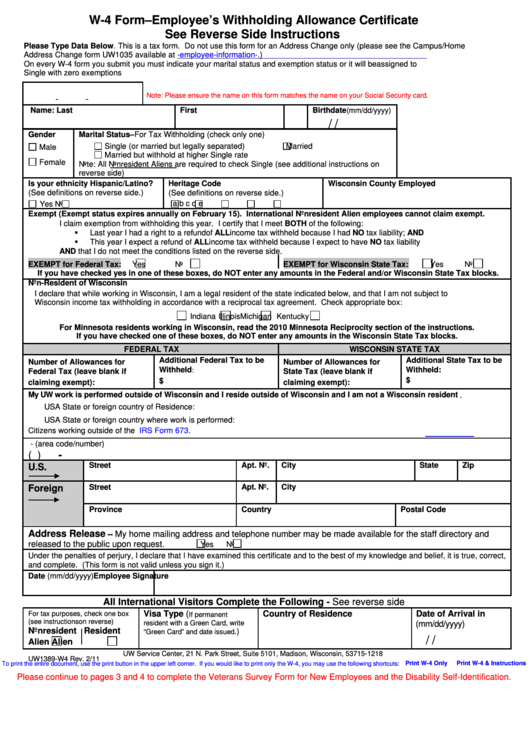

W-4 Form–Employee’s Withholding Allowance Certificate

See Reverse Side Instructions

Please Type Data Below. This is a tax form. Do not use this form for an Address Change only (please see the Campus/Home

Address Change form UW1035 available at )

On every W-4 form you submit you must indicate your marital status and exemption status or it will be assigned to

Single with zero exemptions

U.S. Social Security Number

Note: Please ensure the name on this form matches the name on your Social Security card.

-

-

Name: Last

First

M.I.

Birthdate

(mm/dd/yyyy)

/

/

Gender

Marital Status–For Tax Withholding (check only one)

Single (or married but legally separated)

Married

Male

Married but withhold at higher Single rate

Female

Note: All Nonresident Aliens are required to check Single (see additional instructions on

reverse side)

Is your ethnicity Hispanic/Latino?

Heritage Code

Wisconsin County Employed

(See definitions on reverse side.)

(See definitions on reverse side.)

Yes

No

a

b

c

d

e

Exempt (Exempt status expires annually on February 15). International Nonresident Alien employees cannot claim exempt.

I claim exemption from withholding this year. I certify that I meet BOTH of the following:

Last year I had a right to a refund of ALL income tax withheld because I had NO tax liability; AND

This year I expect a refund of ALL income tax withheld because I expect to have NO tax liability

AND that I do not meet the conditions listed on the reverse side.

EXEMPT for Federal Tax:

Yes

No

EXEMPT for Wisconsin State Tax:

Yes

No

If you have checked yes in one of these boxes, do NOT enter any amounts in the Federal and/or Wisconsin State Tax blocks.

Non-Resident of Wisconsin

I declare that while working in Wisconsin, I am a legal resident of the state indicated below, and that I am not subject to

Wisconsin income tax withholding in accordance with a reciprocal tax agreement. Check appropriate box:

Indiana

Illinois

Michigan

Kentucky

For Minnesota residents working in Wisconsin, read the 2010 Minnesota Reciprocity section of the instructions.

If you have checked one of these boxes, do NOT enter any amounts in the Wisconsin State Tax blocks.

FEDERAL TAX

WISCONSIN STATE TAX

Additional Federal Tax to be

Additional State Tax to be

Number of Allowances for

Number of Allowances for

Withheld:

Withheld:

Federal Tax (leave blank if

State Tax (leave blank if

claiming exempt):

$

claiming exempt):

$

My UW work is performed outside of Wisconsin and I reside outside of Wisconsin and I am not a Wisconsin resident.

USA State or foreign country of Residence:

USA State or foreign country where work is performed:

U.S. Citizens working outside of the U.S. may qualify for exemption from state and federal income tax by filing

IRS Form

673.

U.S. Home Telephone - (area code/number)

(

)

-

Street

Apt. No.

City

State

Zip

U.S.

Street

Apt. No.

City

Foreign

Province

Country

Postal Code

Address Release

My home mailing address and telephone number may be made available for the staff directory and

--

released to the public upon request.

Yes

No

Under the penalties of perjury, I declare that I have examined this certificate and to the best of my knowledge and belief, it is true, correct,

and complete. (This form is not valid unless you sign it.)

Date (mm/dd/yyyy)

Employee Signature

All International Visitors Complete the Following - See reverse side

For tax purposes, check one box

Visa Type (

Country of Residence

Date of Arrival in U.S.

If permanent

(see instructions on reverse)

resident with a Green Card, write

(mm/dd/yyyy)

Nonresident Resident

.)

“Green Card” and date issued

/

/

Alien

Alien

UW Service Center, 21 N. Park Street, Suite 5101, Madison, Wisconsin, 53715-1218

UW1389-W4 Rev. 2/11

To print the entire document, use the print button in the upper left corner. If you would like to print only the W-4, you may use the following shortcuts: Print W-4 Only

Print W-4 & Instructions

Please continue to pages 3 and 4 to complete the Veterans Survey Form for New Employees and the Disability Self-Identification.

1

1 2

2 3

3