Clear Form

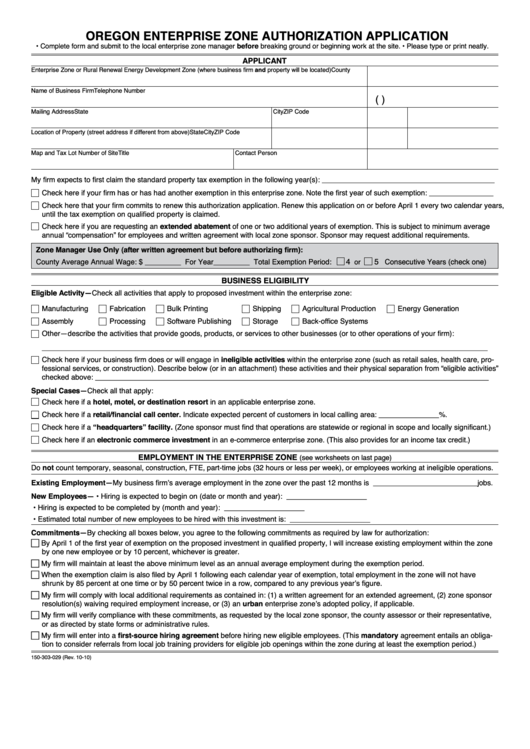

OREGON ENTERPRISE ZONE AUTHORIZATION APPLICATION

• Complete form and submit to the local enterprise zone manager before breaking ground or beginning work at the site. • Please type or print neatly.

APPLICANT

Enterprise Zone or Rural Renewal Energy Development Zone (where business firm and property will be located)

County

Name of Business Firm

Telephone Number

(

)

Mailing Address

City

State

ZIP Code

Location of Property (street address if different from above)

City

State

ZIP Code

Map and Tax Lot Number of Site

Contact Person

Title

My firm expects to first claim the standard property tax exemption in the following year(s): ___________________________________________

Check here if your firm has or has had another exemption in this enterprise zone. Note the first year of such exemption: ________________

Check here that your firm commits to renew this authorization application. Renew this application on or before April 1 every two calendar years,

until the tax exemption on qualified property is claimed.

Check here if you are requesting an extended abatement of one or two additional years of exemption. This is subject to minimum average

annual “compensation” for employees and written agreement with local zone sponsor. Sponsor may request additional requirements.

Zone Manager Use Only (after written agreement but before authorizing firm):

4

5

County Average Annual Wage: $ _________ For Year_________ Total Exemption Period:

Consecutive Years (check one)

or

BUSINESS ELIGIBILITY

Eligible Activity—Check all activities that apply to proposed investment within the enterprise zone:

Manufacturing

Fabrication

Bulk Printing

Shipping

Agricultural Production

Energy Generation

Assembly

Processing

Software Publishing

Storage

Back-office Systems

Other—describe the activities that provide goods, products, or services to other businesses (or to other operations of your firm):

_______________________________________________________________________________________________________________

Check here if your business firm does or will engage in ineligible activities within the enterprise zone (such as retail sales, health care, pro-

fessional services, or construction). Describe below (or in an attachment) these activities and their physical separation from “eligible activities”

checked above: __________________________________________________________________________________________________

Special Cases—Check all that apply:

Check here if a hotel, motel, or destination resort in an applicable enterprise zone.

Check here if a retail/financial call center. Indicate expected percent of customers in local calling area: _______________%.

Check here if a “headquarters” facility. (Zone sponsor must find that operations are statewide or regional in scope and locally significant.)

Check here if an electronic commerce investment in an e-commerce enterprise zone. (This also provides for an income tax credit.)

EMPLOYMENT IN THE ENTERPRISE ZONE

(see worksheets on last page)

Do not count temporary, seasonal, construction, FTE, part-time jobs (32 hours or less per week), or employees working at ineligible operations.

Existing Employment—My business firm’s average employment in the zone over the past 12 months is __________________________ jobs.

New Employees— • Hiring is expected to begin on (date or month and year):

____________________

• Hiring is expected to be completed by (month and year):

____________________

• Estimated total number of new employees to be hired with this investment is: ____________________

Commitments—By checking all boxes below, you agree to the following commitments as required by law for authorization:

By April 1 of the first year of exemption on the proposed investment in qualified property, I will increase existing employment within the zone

c

by one new employee or by 10 percent, whichever is greater.

My firm will maintain at least the above minimum level as an annual average employment during the exemption period.

c

When the exemption claim is also filed by April 1 following each calendar year of exemption, total employment in the zone will not have

c

shrunk by 85 percent at one time or by 50 percent twice in a row, compared to any previous year’s figure.

My firm will comply with local additional requirements as contained in: (1) a written agreement for an extended agreement, (2) zone sponsor

c

resolution(s) waiving required employment increase, or (3) an urban enterprise zone’s adopted policy, if applicable.

My firm will verify compliance with these commitments, as requested by the local zone sponsor, the county assessor or their representative,

c

or as directed by state forms or administrative rules.

My firm will enter into a first-source hiring agreement before hiring new eligible employees. (This mandatory agreement entails an obliga-

c

tion to consider referrals from local job training providers for eligible job openings within the zone during at least the exemption period.)

150-303-029 (Rev. 10-10)

1

1 2

2 3

3 4

4