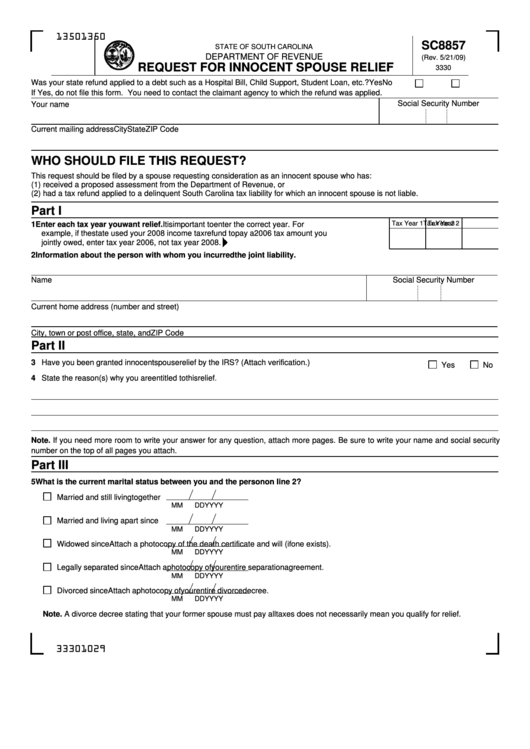

Form Sc8857 - Request For Innocent Spouse Relief

ADVERTISEMENT

1350

1350

SC8857

STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE

(Rev. 5/21/09)

REQUEST FOR INNOCENT SPOUSE RELIEF

3330

Was your state refund applied to a debt such as a Hospital Bill, Child Support, Student Loan, etc.?

Yes

No

If Yes, do not file this form. You need to contact the claimant agency to which the refund was applied.

Social Security Number

Your name

Current mailing address

City

State

ZIP Code

WHO SHOULD FILE THIS REQUEST?

This request should be filed by a spouse requesting consideration as an innocent spouse who has:

(1) received a proposed assessment from the Department of Revenue, or

(2) had a tax refund applied to a delinquent South Carolina tax liability for which an innocent spouse is not liable.

Part I

Tax Year 1

Tax Year 2

Tax Year 3

1 Enter each tax year you want relief. It is important to enter the correct year. For

example, if the state used your 2008 income tax refund to pay a 2006 tax amount you

jointly owed, enter tax year 2006, not tax year 2008.

2 Information about the person with whom you incurred the joint liability.

Name

Social Security Number

Current home address (number and street)

City, town or post office, state, and ZIP Code

Part II

3 Have you been granted innocent spouse relief by the IRS? (Attach verification.)

Yes

No

4 State the reason(s) why you are entitled to this relief.

Note. If you need more room to write your answer for any question, attach more pages. Be sure to write your name and social security

number on the top of all pages you attach.

Part III

5 What is the current marital status between you and the person on line 2?

Married and still living together

MM

DD

YYYY

Married and living apart since

MM

DD

YYYY

Widowed since

Attach a photocopy of the death certificate and will (if one exists).

MM

DD

YYYY

Legally separated since

Attach a photocopy of your entire separation agreement.

MM

DD

YYYY

Divorced since

Attach a photocopy of your entire divorce decree.

MM

DD

YYYY

Note. A divorce decree stating that your former spouse must pay all taxes does not necessarily mean you qualify for relief.

33301029

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4