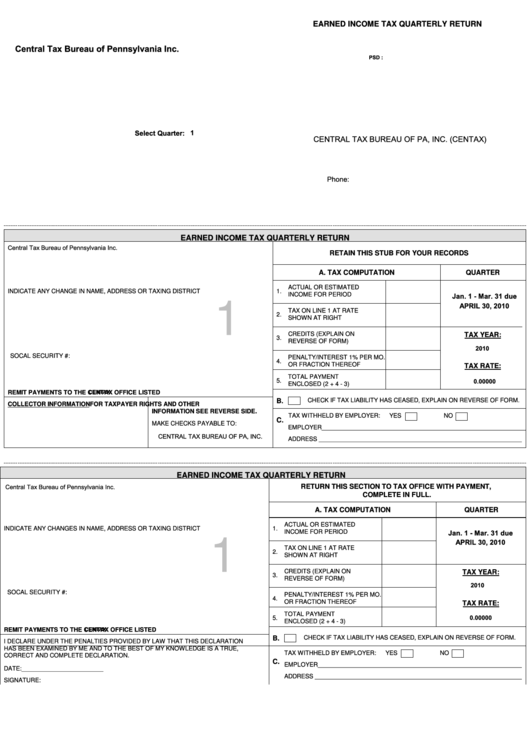

EARNED INCOME TAX QUARTERLY RETURN

Central Tax Bureau of Pennsylvania Inc.

PSD :

Select Quarter:

1

CENTRAL TAX BUREAU OF PA, INC. (CENTAX)

Phone:

EARNED INCOME TAX QUARTERLY RETURN

Central Tax Bureau of Pennsylvania Inc.

RETAIN THIS STUB FOR YOUR RECORDS

A. TAX COMPUTATION

QUARTER

ACTUAL OR ESTIMATED

INDICATE ANY CHANGE IN NAME, ADDRESS OR TAXING DISTRICT

1.

INCOME FOR PERIOD

Jan. 1 - Mar. 31 due

1

APRIL 30, 2010

TAX ON LINE 1 AT RATE

2.

SHOWN AT RIGHT

CREDITS (EXPLAIN ON

TAX YEAR:

3.

REVERSE OF FORM)

2010

SOCAL SECURITY #:

PENALTY/INTEREST 1% PER MO.

4.

OR FRACTION THEREOF

TAX RATE:

TOTAL PAYMENT

0.00000

5.

ENCLOSED (2 + 4 - 3)

CENTAX

REMIT PAYMENTS TO THE CENTAX OFFICE LISTED

CHECK IF TAX LIABILITY HAS CEASED, EXPLAIN ON REVERSE OF FORM.

B.

COLLECTOR INFORMATION

FOR TAXPAYER RIGHTS AND OTHER

INFORMATION SEE REVERSE SIDE.

TAX WITHHELD BY EMPLOYER:

YES

NO

C.

MAKE CHECKS PAYABLE TO:

EMPLOYER______________________________________________________________

CENTRAL TAX BUREAU OF PA, INC.

ADDRESS _____________________________________________________________

EARNED INCOME TAX QUARTERLY RETURN

Central Tax Bureau of Pennsylvania Inc.

RETURN THIS SECTION TO TAX OFFICE WITH PAYMENT,

COMPLETE IN FULL.

A. TAX COMPUTATION

QUARTER

ACTUAL OR ESTIMATED

INDICATE ANY CHANGES IN NAME, ADDRESS OR TAXING DISTRICT

1.

Jan. 1 - Mar. 31 due

INCOME FOR PERIOD

1

APRIL 30, 2010

TAX ON LINE 1 AT RATE

2.

SHOWN AT RIGHT

CREDITS (EXPLAIN ON

TAX YEAR:

3.

REVERSE OF FORM)

2010

SOCAL SECURITY #:

PENALTY/INTEREST 1% PER MO.

4.

OR FRACTION THEREOF

TAX RATE:

TOTAL PAYMENT

0.00000

5.

ENCLOSED (2 + 4 - 3)

CENTAX

REMIT PAYMENTS TO THE CENTAX OFFICE LISTED

CHECK IF TAX LIABILITY HAS CEASED, EXPLAIN ON REVERSE OF FORM.

B.

I DECLARE UNDER THE PENALTIES PROVIDED BY LAW THAT THIS DECLARATION

HAS BEEN EXAMINED BY ME AND TO THE BEST OF MY KNOWLEDGE IS A TRUE,

TAX WITHHELD BY EMPLOYER:

YES

NO

CORRECT AND COMPLETE DECLARATION.

C.

EMPLOYER______________________________________________________________

DATE:________________________ S.S.NO._______________________________________

ADDRESS ______________________________________________________________

SIGNATURE:

1

1 2

2