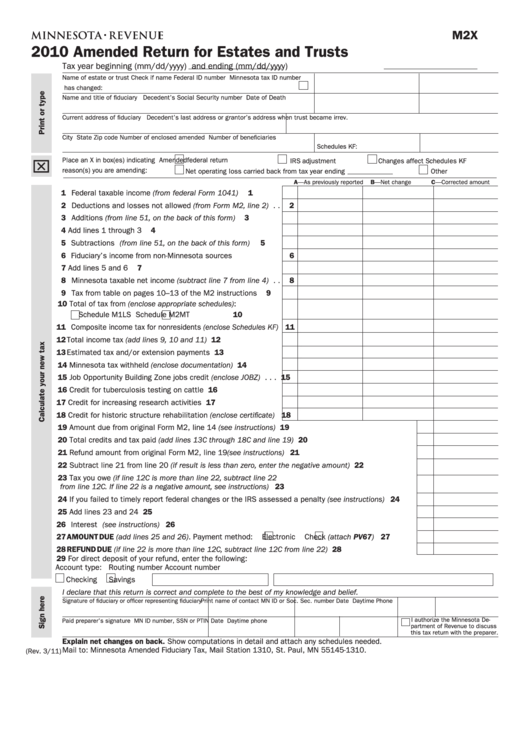

M2X

2010 Amended Return for Estates and Trusts

Tax year beginning (mm/dd/yyyy)

and ending (mm/dd/yyyy)

Name of estate or trust

Check if name

Federal ID number

Minnesota tax ID number

has changed:

Name and title of fiduciary

Decedent’s Social Security number

Date of Death

Current address of fiduciary

Decedent’s last address or grantor’s address when trust became irrev.

City

State

Zip code

Number of enclosed amended

Number of beneficiaries

Schedules KF:

x

Place an X in box(es) indicating

Amended federal return

IRS adjustment

Changes affect Schedules KF

reason(s) you are amending:

Net operating loss carried back from tax year ending

Other

A—As previously reported

B—Net change

C—Corrected amount

1 Federal taxable income (from federal Form 1041) . . . . . . . . .

1

2 Deductions and losses not allowed (from Form M2, line 2) . .

2

3 Additions (from line 51, on the back of this form) . . . . . . . . .

3

4 Add lines 1 through 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5 Subtractions (from line 51, on the back of this form) . . . . . . .

5

6 Fiduciary’s income from non-Minnesota sources . . . . . . . . . .

6

7 Add lines 5 and 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

8 Minnesota taxable net income (subtract line 7 from line 4) . .

8

9 Tax from table on pages 10–13 of the M2 instructions . . . . .

9

10 Total of tax from (enclose appropriate schedules):

Schedule M1LS

Schedule M2MT . . . . . . . . . . . 10

11 Composite income tax for nonresidents (enclose Schedules KF) 11

12 Total income tax (add lines 9, 10 and 11) . . . . . . . . . . . . . . . 12

13 Estimated tax and/or extension payments . . . . . . . . . . . . . . 13

14 Minnesota tax withheld (enclose documentation) . . . . . . . . . 14

15 Job Opportunity Building Zone jobs credit (enclose JOBZ) . . . 15

16 Credit for tuberculosis testing on cattle . . . . . . . . . . . . . . . . 16

17 Credit for increasing research activities . . . . . . . . . . . . . . . . 17

18 Credit for historic structure rehabilitation (enclose certificate) 18

19 Amount due from original Form M2, line 14 (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

20 Total credits and tax paid (add lines 13C through 18C and line 19) . . . . . . . . . . . . . . . . . . . . . . . . . . 20

21 Refund amount from original Form M2, line 19 (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

22 Subtract line 21 from line 20 (if result is less than zero, enter the negative amount) . . . . . . . . . . . . . 22

23 Tax you owe (if line 12C is more than line 22, subtract line 22

from line 12C. If line 22 is a negative amount, see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

24 If you failed to timely report federal changes or the IRS assessed a penalty (see instructions) . . . . . . 24

25 Add lines 23 and 24 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

26 Interest (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26

27 AMOUNT DUE (add lines 25 and 26). Payment method:

Electronic

Check (attach PV67) . . . . 27

28 REFUND DUE (if line 22 is more than line 12C, subtract line 12C from line 22) . . . . . . . . . . . . . . . . . 28

29 For direct deposit of your refund, enter the following:

Account type:

Routing number

Account number

Checking

Savings

I declare that this return is correct and complete to the best of my knowledge and belief.

Signature of fiduciary or officer representing fiduciary

Print name of contact

MN ID or Soc. Sec. number

Date

Daytime Phone

I authorize the Minnesota De-

Paid preparer’s signature

MN ID number, SSN or PTIN

Date

Daytime phone

partment of Revenue to discuss

this tax return with the preparer.

Explain net changes on back. Show computations in detail and attach any schedules needed.

Mail to: Minnesota Amended Fiduciary Tax, Mail Station 1310, St. Paul, MN 55145-1310.

(Rev. 3/11)

1

1 2

2