Instruction For Payroll Processor'S Disclosure Form

ADVERTISEMENT

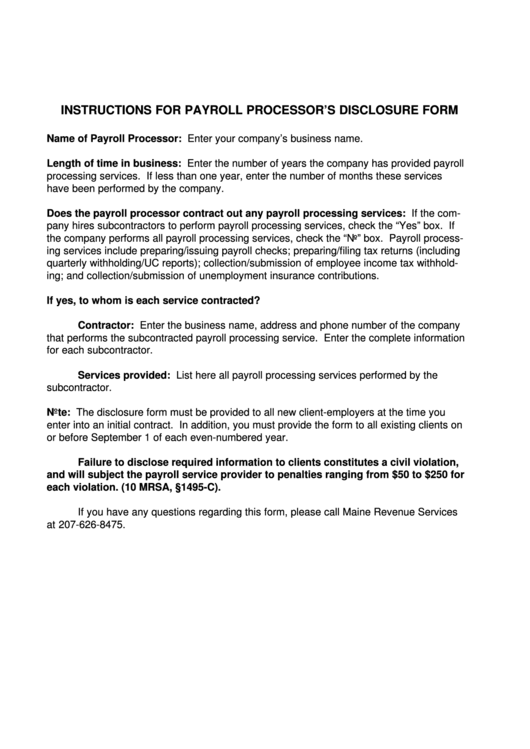

INSTRUCTIONS FOR PAYROLL PROCESSOR’S DISCLOSURE FORM

Name of Payroll Processor: Enter your company’s business name.

Length of time in business: Enter the number of years the company has provided payroll

processing services. If less than one year, enter the number of months these services

have been performed by the company.

Does the payroll processor contract out any payroll processing services: If the com-

pany hires subcontractors to perform payroll processing services, check the “Yes” box. If

the company performs all payroll processing services, check the “No” box. Payroll process-

ing services include preparing/issuing payroll checks; preparing/filing tax returns (including

quarterly withholding/UC reports); collection/submission of employee income tax withhold-

ing; and collection/submission of unemployment insurance contributions.

If yes, to whom is each service contracted?

Contractor: Enter the business name, address and phone number of the company

that performs the subcontracted payroll processing service. Enter the complete information

for each subcontractor.

Services provided: List here all payroll processing services performed by the

subcontractor.

Note: The disclosure form must be provided to all new client-employers at the time you

enter into an initial contract. In addition, you must provide the form to all existing clients on

or before September 1 of each even-numbered year.

Failure to disclose required information to clients constitutes a civil violation,

and will subject the payroll service provider to penalties ranging from $50 to $250 for

each violation. (10 MRSA, §1495-C).

If you have any questions regarding this form, please call Maine Revenue Services

at 207-626-8475.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1