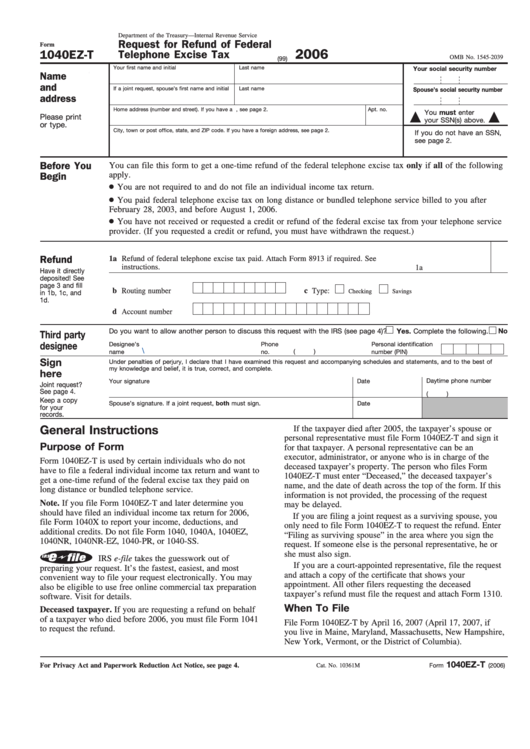

Department of the Treasury—Internal Revenue Service

Request for Refund of Federal

Form

2006

1040EZ-T

Telephone Excise Tax

OMB No. 1545-2039

(99)

Your first name and initial

Last name

Your social security number

Name

and

If a joint request, spouse’s first name and initial

Last name

Spouse’s social security number

address

Home address (number and street). If you have a P.O. box, see page 2.

Apt. no.

You must enter

Please print

your SSN(s) above.

or type.

City, town or post office, state, and ZIP code. If you have a foreign address, see page 2.

If you do not have an SSN,

see page 2.

You can file this form to get a one-time refund of the federal telephone excise tax only if all of the following

Before You

apply.

Begin

You are not required to and do not file an individual income tax return.

You paid federal telephone excise tax on long distance or bundled telephone service billed to you after

February 28, 2003, and before August 1, 2006.

You have not received or requested a credit or refund of the federal excise tax from your telephone service

provider. (If you requested a credit or refund, you must have withdrawn the request.)

1a

Refund of federal telephone excise tax paid. Attach Form 8913 if required. See

Refund

instructions.

1a

Have it directly

deposited! See

page 3 and fill

b Routing number

c Type:

Checking

Savings

in 1b, 1c, and

1d.

d

Account number

Do you want to allow another person to discuss this request with the IRS (see page 4)?

Yes. Complete the following.

No

Third party

Designee’s

Phone

Personal identification

designee

\

(

)

name

no.

number (PIN)

Sign

Under penalties of perjury, I declare that I have examined this request and accompanying schedules and statements, and to the best of

my knowledge and belief, it is true, correct, and complete.

here

Your signature

Date

Daytime phone number

Joint request?

See page 4.

(

)

Keep a copy

Spouse’s signature. If a joint request, both must sign.

Date

for your

records.

If the taxpayer died after 2005, the taxpayer’s spouse or

General Instructions

personal representative must file Form 1040EZ-T and sign it

for that taxpayer. A personal representative can be an

Purpose of Form

executor, administrator, or anyone who is in charge of the

Form 1040EZ-T is used by certain individuals who do not

deceased taxpayer’s property. The person who files Form

have to file a federal individual income tax return and want to

1040EZ-T must enter “Deceased,” the deceased taxpayer’s

get a one-time refund of the federal excise tax they paid on

name, and the date of death across the top of the form. If this

long distance or bundled telephone service.

information is not provided, the processing of the request

Note. If you file Form 1040EZ-T and later determine you

may be delayed.

should have filed an individual income tax return for 2006,

If you are filing a joint request as a surviving spouse, you

file Form 1040X to report your income, deductions, and

only need to file Form 1040EZ-T to request the refund. Enter

additional credits. Do not file Form 1040, 1040A, 1040EZ,

“Filing as surviving spouse” in the area where you sign the

1040NR, 1040NR-EZ, 1040-PR, or 1040-SS.

request. If someone else is the personal representative, he or

she must also sign.

IRS e-file takes the guesswork out of

If you are a court-appointed representative, file the request

preparing your request. It’s the fastest, easiest, and most

and attach a copy of the certificate that shows your

convenient way to file your request electronically. You may

appointment. All other filers requesting the deceased

also be eligible to use free online commercial tax preparation

taxpayer’s refund must file the request and attach Form 1310.

software. Visit for details.

Deceased taxpayer. If you are requesting a refund on behalf

When To File

of a taxpayer who died before 2006, you must file Form 1041

File Form 1040EZ-T by April 16, 2007 (April 17, 2007, if

to request the refund.

you live in Maine, Maryland, Massachusetts, New Hampshire,

New York, Vermont, or the District of Columbia).

For Privacy Act and Paperwork Reduction Act Notice, see page 4.

1040EZ-T

Cat. No. 10361M

Form

(2006)

1

1