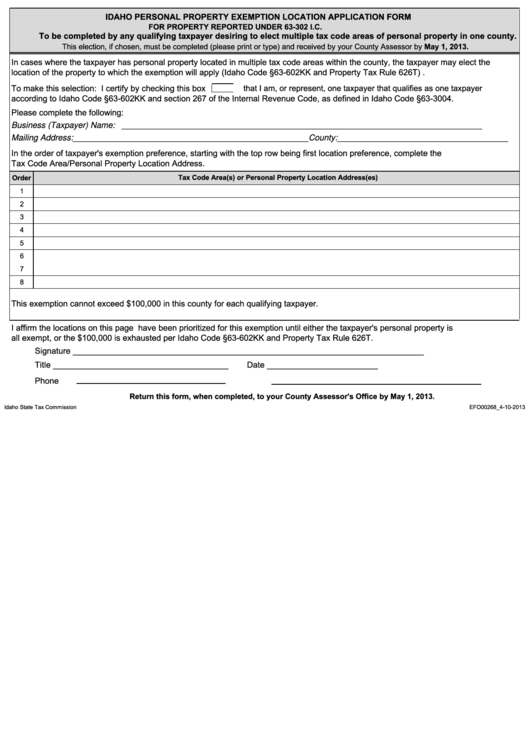

IDAHO PERSONAL PROPERTY EXEMPTION LOCATION APPLICATION FORM

.

FOR PROPERTY REPORTED UNDER 63-302 I.C

To be completed by any qualifying taxpayer desiring to elect multiple tax code areas of personal property in one county.

This election, if chosen, must be completed (please print or type) and received by your County Assessor by May 1, 2013.

In cases where the taxpayer has personal property located in multiple tax code areas within the county, the taxpayer may elect the

location of the property to which the exemption will apply (Idaho Code §63-602KK and Property Tax Rule 626T) .

To make this selection: I certify by checking this box

that I am, or represent, one taxpayer that qualifies as one taxpayer

according to Idaho Code §63-602KK and section 267 of the Internal Revenue Code, as defined in Idaho Code §63-3004.

Please complete the following:

Business (Taxpayer) Name: ______________________________________________________________________________

Mailing Address:___________________________________________________County:_____________________________________

In the order of taxpayer's exemption preference, starting with the top row being first location preference, complete the

Tax Code Area/Personal Property Location Address.

Order

Tax Code Area(s) or Personal Property Location Address(es)

1

2

3

4

5

6

7

8

This exemption cannot exceed $100,000 in this county for each qualifying taxpayer.

I affirm the locations on this page have been prioritized for this exemption until either the taxpayer's personal property is

all exempt, or the $100,000 is exhausted per Idaho Code §63-602KK and Property Tax Rule 626T.

Signature ____________________________________________________________________________

Title ______________________________________

Date ________________________

Phone No.

Email

Return this form, when completed, to your County Assessor's Office by May 1, 2013.

Idaho State Tax Commission

EFO00268_4-10-2013

1

1