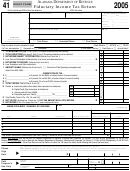

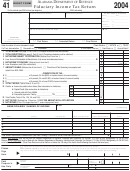

Instructions For Form 41 - Fiduciary Income Tax - Oregon Department Of Reveue - 2005

ADVERTISEMENT

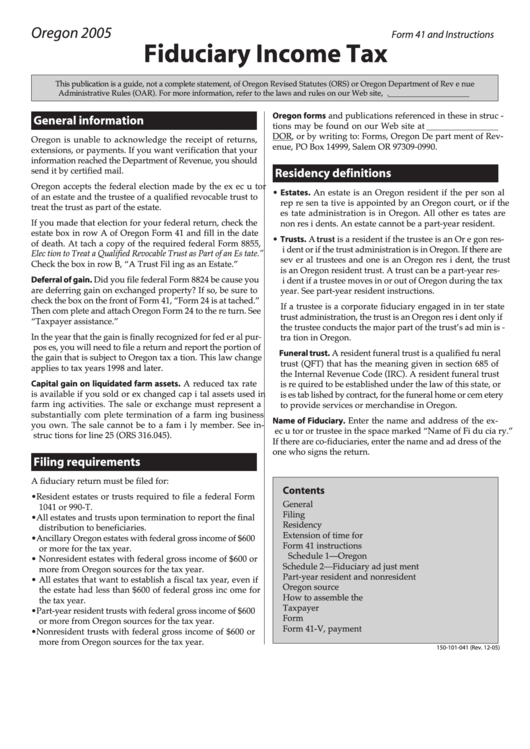

Oregon 2005

Form 41 and Instructions

Fiduciary Income Tax

This publication is a guide, not a complete statement, of Oregon Revised Statutes (ORS) or Oregon Department of Rev e nue

Administrative Rules (OAR). For more information, refer to the laws and rules on our Web site,

Oregon forms and publications referenced in these in struc -

General information

tions may be found on our Web site at

DOR, or by writing to: Forms, Oregon De part ment of Rev-

Oregon is unable to acknowledge the receipt of returns,

enue, PO Box 14999, Salem OR 97309-0990.

extensions, or payments. If you want verification that your

information reached the Department of Revenue, you should

send it by certified mail.

Residency definitions

Oregon accepts the federal election made by the ex ec u tor

• Estates. An estate is an Oregon resident if the per son al

of an estate and the trustee of a qualified revocable trust to

rep re sen ta tive is appointed by an Oregon court, or if the

treat the trust as part of the estate.

es tate administration is in Oregon. All other es tates are

If you made that election for your federal return, check the

non res i dents. An estate cannot be a part-year resident.

estate box in row A of Oregon Form 41 and fill in the date

• Trusts. A trust is a resident if the trustee is an Or e gon res-

of death. At tach a copy of the required federal Form 8855,

i dent or if the trust administration is in Oregon. If there are

Elec tion to Treat a Qualified Revocable Trust as Part of an Es tate.”

sev er al trustees and one is an Oregon res i dent, the trust

Check the box in row B, “A Trust Fil ing as an Estate.”

is an Oregon resident trust. A trust can be a part-year res-

Deferral of gain. Did you file federal Form 8824 be cause you

i dent if a trustee moves in or out of Oregon during the tax

are deferring gain on exchanged property? If so, be sure to

year. See part-year resident instructions.

check the box on the front of Form 41, “Form 24 is at tached.”

If a trustee is a corporate fiduciary engaged in in ter state

Then com plete and attach Oregon Form 24 to the re turn. See

trust administration, the trust is an Oregon res i dent only if

“Taxpayer assistance.”

the trustee conducts the major part of the trust’s ad min is -

In the year that the gain is finally recognized for fed er al pur-

tra tion in Oregon.

pos es, you will need to file a return and report the portion of

Funeral trust. A resident funeral trust is a qualified fu ner al

the gain that is subject to Oregon tax a tion. This law change

trust (QFT) that has the meaning given in section 685 of

applies to tax years 1998 and later.

the Internal Revenue Code (IRC). A resident funeral trust

Capital gain on liquidated farm assets. A reduced tax rate

is re quired to be established under the law of this state, or

is available if you sold or ex changed cap i tal assets used in

is es tab lished by contract, for the funeral home or cem e tery

farm ing activities. The sale or exchange must represent a

to provide services or merchandise in Oregon.

substantially com plete termination of a farm ing business

Name of Fiduciary. Enter the name and address of the ex-

you own. The sale cannot be to a fam i ly member. See in-

ec u tor or trustee in the space marked “Name of Fi du cia ry.”

struc tions for line 25 (ORS 316.045).

If there are co-fiduciaries, enter the name and ad dress of the

one who signs the return.

Filing requirements

A fiduciary return must be filed for:

Contents

• Resident estates or trusts required to file a federal Form

General information........................................................1

1041 or 990-T.

Filing requirements .........................................................1

• All estates and trusts upon termination to report the final

Residency definitions......................................................1

distribution to beneficiaries.

Extension of time for filing ............................................2

• Ancillary Oregon estates with federal gross income of $600

Form 41 instructions ......................................................2

or more for the tax year.

Schedule 1—Oregon changes......................................4

• Nonresident estates with federal gross income of $600 or

Schedule 2—Fiduciary ad just ment ............................4

more from Oregon sources for the tax year.

Part-year resident and nonresident fiduciaries...........5

• All estates that want to establish a fiscal tax year, even if

Oregon source income ....................................................5

the estate had less than $600 of federal gross inc ome for

How to assemble the return...........................................5

the tax year.

Taxpayer assistance.........................................................6

• Part-year resident trusts with federal gross income of $600

Form 41 .............................................................................7

or more from Oregon sources for the tax year.

Form 41-V, payment voucher ........................................9

• Nonresident trusts with federal gross income of $600 or

more from Oregon sources for the tax year.

150-101-041 (Rev. 12-05)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6