Instructions For Form 8931 - Agricultural Chemicals Security Credit - Department Of Treasury

ADVERTISEMENT

2

Form 8931 (10-2008)

Page

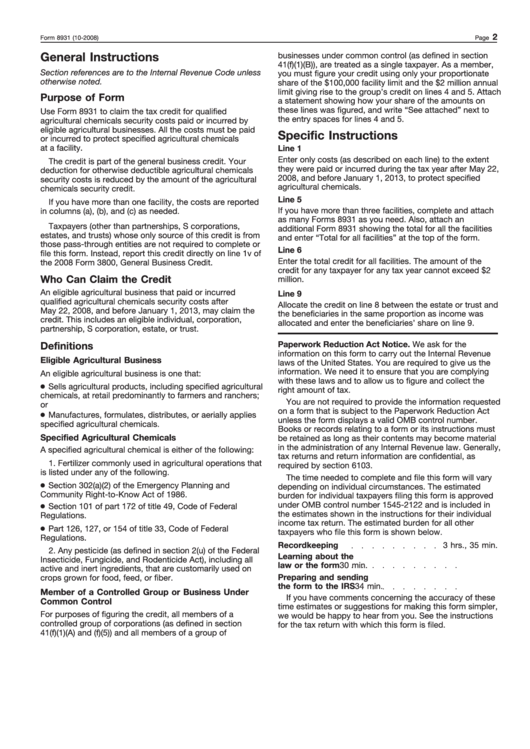

General Instructions

businesses under common control (as defined in section

41(f)(1)(B)), are treated as a single taxpayer. As a member,

Section references are to the Internal Revenue Code unless

you must figure your credit using only your proportionate

otherwise noted.

share of the $100,000 facility limit and the $2 million annual

limit giving rise to the group’s credit on lines 4 and 5. Attach

Purpose of Form

a statement showing how your share of the amounts on

these lines was figured, and write “See attached” next to

Use Form 8931 to claim the tax credit for qualified

the entry spaces for lines 4 and 5.

agricultural chemicals security costs paid or incurred by

eligible agricultural businesses. All the costs must be paid

Specific Instructions

or incurred to protect specified agricultural chemicals

at a facility.

Line 1

Enter only costs (as described on each line) to the extent

The credit is part of the general business credit. Your

they were paid or incurred during the tax year after May 22,

deduction for otherwise deductible agricultural chemicals

2008, and before January 1, 2013, to protect specified

security costs is reduced by the amount of the agricultural

agricultural chemicals.

chemicals security credit.

Line 5

If you have more than one facility, the costs are reported

If you have more than three facilities, complete and attach

in columns (a), (b), and (c) as needed.

as many Forms 8931 as you need. Also, attach an

Taxpayers (other than partnerships, S corporations,

additional Form 8931 showing the total for all the facilities

estates, and trusts) whose only source of this credit is from

and enter “Total for all facilities” at the top of the form.

those pass-through entities are not required to complete or

Line 6

file this form. Instead, report this credit directly on line 1v of

Enter the total credit for all facilities. The amount of the

the 2008 Form 3800, General Business Credit.

credit for any taxpayer for any tax year cannot exceed $2

Who Can Claim the Credit

million.

An eligible agricultural business that paid or incurred

Line 9

qualified agricultural chemicals security costs after

Allocate the credit on line 8 between the estate or trust and

May 22, 2008, and before January 1, 2013, may claim the

the beneficiaries in the same proportion as income was

credit. This includes an eligible individual, corporation,

allocated and enter the beneficiaries’ share on line 9.

partnership, S corporation, estate, or trust.

Paperwork Reduction Act Notice. We ask for the

Definitions

information on this form to carry out the Internal Revenue

Eligible Agricultural Business

laws of the United States. You are required to give us the

information. We need it to ensure that you are complying

An eligible agricultural business is one that:

with these laws and to allow us to figure and collect the

Sells agricultural products, including specified agricultural

right amount of tax.

chemicals, at retail predominantly to farmers and ranchers;

You are not required to provide the information requested

or

on a form that is subject to the Paperwork Reduction Act

Manufactures, formulates, distributes, or aerially applies

unless the form displays a valid OMB control number.

specified agricultural chemicals.

Books or records relating to a form or its instructions must

Specified Agricultural Chemicals

be retained as long as their contents may become material

in the administration of any Internal Revenue law. Generally,

A specified agricultural chemical is either of the following:

tax returns and return information are confidential, as

1. Fertilizer commonly used in agricultural operations that

required by section 6103.

is listed under any of the following.

The time needed to complete and file this form will vary

Section 302(a)(2) of the Emergency Planning and

depending on individual circumstances. The estimated

Community Right-to-Know Act of 1986.

burden for individual taxpayers filing this form is approved

under OMB control number 1545-2122 and is included in

Section 101 of part 172 of title 49, Code of Federal

the estimates shown in the instructions for their individual

Regulations.

income tax return. The estimated burden for all other

Part 126, 127, or 154 of title 33, Code of Federal

taxpayers who file this form is shown below.

Regulations.

Recordkeeping

3 hrs., 35 min.

2. Any pesticide (as defined in section 2(u) of the Federal

Learning about the

Insecticide, Fungicide, and Rodenticide Act), including all

law or the form

30 min.

active and inert ingredients, that are customarily used on

Preparing and sending

crops grown for food, feed, or fiber.

the form to the IRS

34 min.

Member of a Controlled Group or Business Under

If you have comments concerning the accuracy of these

Common Control

time estimates or suggestions for making this form simpler,

For purposes of figuring the credit, all members of a

we would be happy to hear from you. See the instructions

controlled group of corporations (as defined in section

for the tax return with which this form is filed.

41(f)(1)(A) and (f)(5)) and all members of a group of

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1