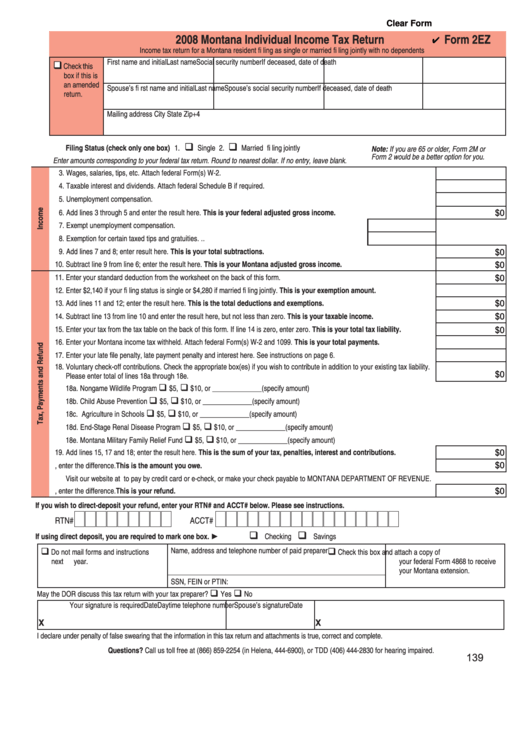

Form 2ez - Montana Individual Income Tax Return - 2008

ADVERTISEMENT

Clear Form

2008 Montana Individual Income Tax Return

Form 2EZ

Income tax return for a Montana resident fi ling as single or married fi ling jointly with no dependents

First name and initial

Last name

Social security number

If deceased, date of death

Check this

box if this is

an amended

Spouse’s fi rst name and initial

Last name

Spouse’s social security number If deceased, date of death

return.

Mailing address

City

State

Zip+4

Filing Status (check only one box) 1.

Single

2.

Married fi ling jointly

Note: If you are 65 or older, Form 2M or

Form 2 would be a better option for you.

Enter amounts corresponding to your federal tax return. Round to nearest dollar. If no entry, leave blank.

3. Wages, salaries, tips, etc. Attach federal Form(s) W-2. ..................................................................................................................... 3.

4. Taxable interest and dividends. Attach federal Schedule B if required. ............................................................................................. 4.

5. Unemployment compensation. ........................................................................................................................................................... 5.

$0

6. Add lines 3 through 5 and enter the result here. This is your federal adjusted gross income. ..................................................... 6.

7. Exempt unemployment compensation. .......................................................................................................7.

8. Exemption for certain taxed tips and gratuities. .. ........................................................................................8.

9. Add lines 7 and 8; enter result here. This is your total subtractions. ............................................................................................. 9.

$0

$0

10. Subtract line 9 from line 6; enter the result here. This is your Montana adjusted gross income. ............................................... 10.

11. Enter your standard deduction from the worksheet on the back of this form. .................................................................................. 11.

$0

12. Enter $2,140 if your fi ling status is single or $4,280 if married fi ling jointly. This is your exemption amount. .............................. 12.

$0

13. Add lines 11 and 12; enter the result here. This is the total deductions and exemptions. .......................................................... 13.

$0

14. Subtract line 13 from line 10 and enter the result here, but not less than zero. This is your taxable income. .............................. 14.

$0

15. Enter your tax from the tax table on the back of this form. If line 14 is zero, enter zero. This is your total tax liability. ............... 15.

16. Enter your Montana income tax withheld. Attach federal Form(s) W-2 and 1099. This is your total payments. .......................... 16.

17. Enter your late fi le penalty, late payment penalty and interest here. See instructions on page 6. ................................................... 17.

18. Voluntary check-off contributions. Check the appropriate box(es) if you wish to contribute in addition to your existing tax liability.

$0

Please enter total of lines 18a through 18e. ..................................................................................................................................... 18.

18a. Nongame Wildlife Program

$5,

$10, or ______________ (specify amount)

18b. Child Abuse Prevention

$5,

$10, or ______________ (specify amount)

18c. Agriculture in Schools

$5,

$10, or ______________ (specify amount)

18d. End-Stage Renal Disease Program

$5,

$10, or ______________ (specify amount)

18e. Montana Military Family Relief Fund

$5,

$10, or ______________ (specify amount)

$0

19. Add lines 15, 17 and 18; enter the result here. This is the sum of your tax, penalties, interest and contributions. ................. 19.

$0

20. If line 19 is greater than line 16, enter the difference. This is the amount you owe. .................................................................... 20.

Visit our website at mt.gov/revenue to pay by credit card or e-check, or make your check payable to MONTANA DEPARTMENT OF REVENUE.

$0

21. If line 16 is greater than line 19, enter the difference. This is your refund. .................................................................................... 21.

If you wish to direct-deposit your refund, enter your RTN# and ACCT# below. Please see instructions.

RTN#

ACCT#

If using direct deposit, you are required to mark one box. ►

Checking

Savings

Name, address and telephone number of paid preparer

Do not mail forms and instructions

Check this box and attach a copy of

next year.

your federal Form 4868 to receive

your Montana extension.

SSN, FEIN or PTIN:

May the DOR discuss this tax return with your tax preparer?

Yes

No

Your signature is required

Date

Daytime telephone number

Spouse’s signature

Date

X

X

I declare under penalty of false swearing that the information in this tax return and attachments is true, correct and complete.

Questions? Call us toll free at (866) 859-2254 (in Helena, 444-6900), or TDD (406) 444-2830 for hearing impaired.

139

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2