Instructions For Shedule It-40nol And Nol - Carryback/carryforward Shedule Template

ADVERTISEMENT

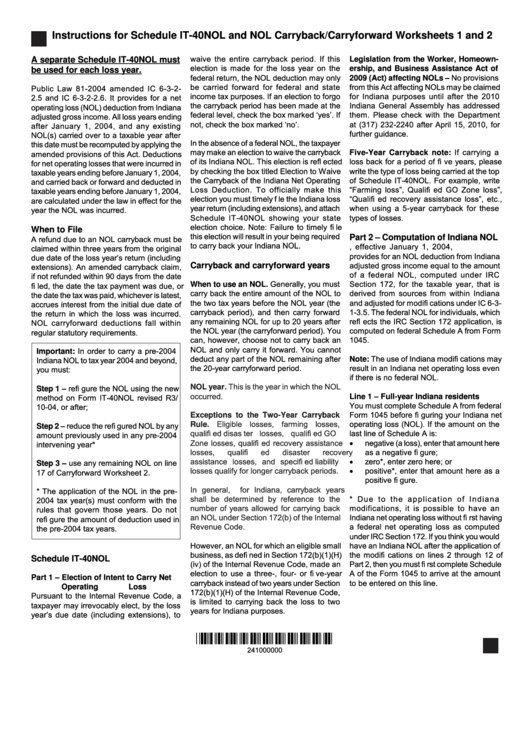

Instructions for Schedule IT-40NOL and NOL Carryback/Carryforward Worksheets 1 and 2

waive the entire carryback period. If this

A separate Schedule IT-40NOL must

Legislation from the Worker, Homeown-

election is made for the loss year on the

ership, and Business Assistance Act of

be used for each loss year.

federal return, the NOL deduction may only

2009 (Act) affecting NOLs – No provisions

be carried forward for federal and state

from this Act affecting NOLs may be claimed

Public Law 81-2004 amended IC 6-3-2-

income tax purposes. If an election to forgo

for Indiana purposes until after the 2010

2.5 and IC 6-3-2-2.6. It provides for a net

the carryback period has been made at the

Indiana General Assembly has addressed

operating loss (NOL) deduction from Indiana

federal level, check the box marked ‘yes’. If

them. Please check with the Department

adjusted gross income. All loss years ending

not, check the box marked ‘no’.

at (317) 232-2240 after April 15, 2010, for

after January 1, 2004, and any existing

further guidance.

NOL(s) carried over to a taxable year after

In the absence of a federal NOL, the taxpayer

this date must be recomputed by applying the

may make an election to waive the carryback

Five-Year Carryback note: If carrying a

amended provisions of this Act. Deductions

of its Indiana NOL. This election is refl ected

loss back for a period of fi ve years, please

for net operating losses that were incurred in

by checking the box titled Election to Waive

write the type of loss being carried at the top

taxable years ending before January 1, 2004,

the Carryback of the Indiana Net Operating

of Schedule IT-40NOL. For example, write

and carried back or forward and deducted in

Loss Deduction. To officially make this

“Farming loss”, Qualifi ed GO Zone loss”,

taxable years ending before January 1, 2004,

election you must timely f le the Indiana loss

“Qualifi ed recovery assistance loss”, etc.,

are calculated under the law in effect for the

year return (including extensions), and attach

when using a 5-year carryback for these

year the NOL was incurred.

Schedule IT-40NOL showing your state

types of losses.

election choice. Note: Failure to timely fi le

When to File

this election will result in your being required

Part 2 – Computation of Indiana NOL

A refund due to an NOL carryback must be

to carry back your Indiana NOL.

P.L. 81-2004, effective January 1, 2004,

claimed within three years from the original

provides for an NOL deduction from Indiana

due date of the loss year’s return (including

adjusted gross income equal to the amount

Carryback and carryforward years

extensions). An amended carryback claim,

of a federal NOL, computed under IRC

if not refunded within 90 days from the date

When to use an NOL. Generally, you must

Section 172, for the taxable year, that is

fi led, the date the tax payment was due, or

carry back the entire amount of the NOL to

derived from sources from within Indiana

the date the tax was paid, whichever is latest,

the two tax years before the NOL year (the

and adjusted for modifi cations under IC 6-3-

accrues interest from the initial due date of

carryback period), and then carry forward

1-3.5. The federal NOL for individuals, which

the return in which the loss was incurred.

any remaining NOL for up to 20 years after

refl ects the IRC Section 172 application, is

NOL carryforward deductions fall within

the NOL year (the carryforward period). You

computed on federal Schedule A from Form

regular statutory requirements.

can, however, choose not to carry back an

1045.

NOL and only carry it forward. You cannot

Important: In order to carry a pre-2004

deduct any part of the NOL remaining after

Note: The use of Indiana modifi cations may

Indiana NOL to tax year 2004 and beyond,

the 20-year carryforward period.

result in an Indiana net operating loss even

you must:

if there is no federal NOL.

NOL year. This is the year in which the NOL

Step 1 – refi gure the NOL using the new

occurred.

Line 1 – Full-year Indiana residents

method on Form IT-40NOL revised R3/

You must complete Schedule A from federal

10-04, or after;

Form 1045 before fi guring your Indiana net

Exceptions to the Two-Year Carryback

Rule. Eligible losses, farming losses,

operating loss (NOL). If the amount on the

Step 2 – reduce the refi gured NOL by any

qualifi ed disas ter losses, qualifi ed GO

last line of Schedule A is:

amount previously used in any pre-2004

Zone losses, qualifi ed recovery assistance

negative (a loss), enter that amount here

intervening year*

losses,

qualifi ed

disaster

recovery

as a negative fi gure;

assistance losses, and specifi ed liability

zero*, enter zero here; or

Step 3 – use any remaining NOL on line

losses qualify for longer carryback periods.

positive*, enter that amount here as a

17 of Carryforward Worksheet 2.

positive fi gure.

In general, for Indiana, carryback years

* The application of the NOL in the pre-

shall be determined by reference to the

* Due to the application of Indiana

2004 tax year(s) must conform with the

number of years allowed for carrying back

modifications, it is possible to have an

rules that govern those years. Do not

an NOL under Section 172(b) of the Internal

Indiana net operating loss without fi rst having

refi gure the amount of deduction used in

Revenue Code.

a federal net operating loss as computed

the pre-2004 tax years.

under IRC Section 172. If you think you would

However, an NOL for which an eligible small

have an Indiana NOL after the application of

business, as defi ned in Section 172(b)(1)(H)

the modifi cations on lines 2 through 12 of

Schedule IT-40NOL

(iv) of the Internal Revenue Code, made an

Part 2, then you must fi rst complete Schedule

election to use a three-, four- or fi ve-year

A of the Form 1045 to arrive at the amount

Part 1 – Election of Intent to Carry Net

carryback instead of two years under Section

to be entered on this line.

Operating Loss

172(b)(1)(H) of the Internal Revenue Code,

Pursuant to the Internal Revenue Code, a

is limited to carrying back the loss to two

taxpayer may irrevocably elect, by the loss

years for Indiana purposes.

year’s due date (including extensions), to

241000000

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5