Biofuel Production And Use Tax Credit Worksheet For Tax Year 2008

ADVERTISEMENT

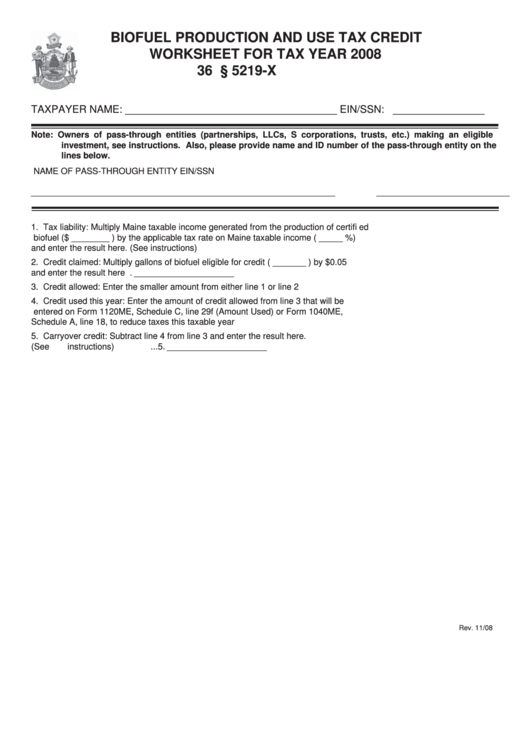

BIOFUEL PRODUCTION AND USE TAX CREDIT

WORKSHEET FOR TAX YEAR 2008

36 M.R.S.A. § 5219-X

TAXPAYER NAME: _____________________________________ EIN/SSN: ________________

Note: Owners of pass-through entities (partnerships, LLCs, S corporations, trusts, etc.) making an eligible

investment, see instructions. Also, please provide name and ID number of the pass-through entity on the

lines below.

NAME OF PASS-THROUGH ENTITY

EIN/SSN

________________________________________________________________

____________________________

1.

Tax liability: Multiply Maine taxable income generated from the production of certifi ed

biofuel ($ ________ ) by the applicable tax rate on Maine taxable income ( _____ %)

and enter the result here. (See instructions) ..................................................................... 1. _____________________

2.

Credit claimed: Multiply gallons of biofuel eligible for credit ( _______ ) by $0.05

and enter the result here ................................................................................................... 2. _____________________

3.

Credit allowed: Enter the smaller amount from either line 1 or line 2 ............................... 3. _____________________

4.

Credit used this year: Enter the amount of credit allowed from line 3 that will be

entered on Form 1120ME, Schedule C, line 29f (Amount Used) or Form 1040ME,

Schedule A, line 18, to reduce taxes this taxable year ..................................................... 4. _____________________

5.

Carryover credit: Subtract line 4 from line 3 and enter the result here.

(See instructions) .............................................................................................................. 5. _____________________

Rev. 11/08

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2