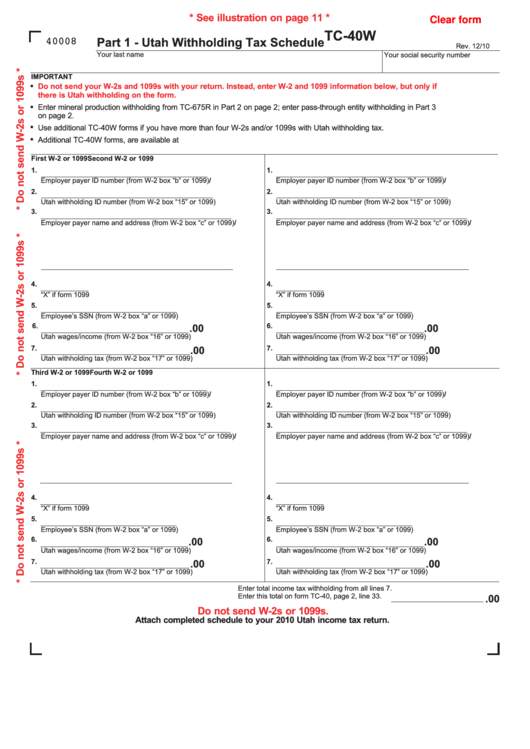

* See illustration on page 11 *

Clear form

TC-40W

40008

Part 1 - Utah Withholding Tax Schedule

Rev. 12/10

Your last name

Your social security number

IMPORTANT

Do not send your W-2s and 1099s with your return. Instead, enter W-2 and 1099 information below, but only if

there is Utah withholding on the form.

Enter mineral production withholding from TC-675R in Part 2 on page 2; enter pass-through entity withholding in Part 3

on page 2.

Use additional TC-40W forms if you have more than four W-2s and/or 1099s with Utah withholding tax.

Additional TC-40W forms, are available at tax.utah.gov/forms.

First W-2 or 1099

Second W-2 or 1099

1.

1.

Employer payer ID number (from W-2 box “b” or 1099)

/

Employer payer ID number (from W-2 box “b” or 1099)

/

2.

2.

Utah withholding ID number (from W-2 box “15” or 1099)

Utah withholding ID number (from W-2 box “15” or 1099)

3.

3.

Employer payer name and address (from W-2 box “c” or 1099)

/

Employer payer name and address (from W-2 box “c” or 1099)

/

4.

4.

“X” if form 1099

“X” if form 1099

5.

5.

Employee’s SSN (from W-2 box “a” or 1099)

Employee’s SSN (from W-2 box “a” or 1099)

6.

6.

.00

.00

Utah wages/income (from W-2 box “16” or 1099)

Utah wages/income (from W-2 box “16” or 1099)

7.

7.

.00

.00

Utah withholding tax (from W-2 box “17” or 1099)

Utah withholding tax (from W-2 box “17” or 1099)

Third W-2 or 1099

Fourth W-2 or 1099

1.

1.

Employer payer ID number (from W-2 box “b” or 1099)

/

Employer payer ID number (from W-2 box “b” or 1099)

/

2.

2.

Utah withholding ID number (from W-2 box “15” or 1099)

Utah withholding ID number (from W-2 box “15” or 1099)

3.

3.

Employer payer name and address (from W-2 box “c” or 1099)

/

Employer payer name and address (from W-2 box “c” or 1099)

/

4.

4.

“X” if form 1099

“X” if form 1099

5.

5.

Employee’s SSN (from W-2 box “a” or 1099)

Employee’s SSN (from W-2 box “a” or 1099)

6.

6.

.00

.00

Utah wages/income (from W-2 box “16” or 1099)

Utah wages/income (from W-2 box “16” or 1099)

7.

7.

.00

.00

Utah withholding tax (from W-2 box “17” or 1099)

Utah withholding tax (from W-2 box “17” or 1099)

Enter total income tax withholding from all lines 7.

Enter this total on form TC-40, page 2, line 33.

.00

Do not send W-2s or 1099s.

Attach completed schedule to your 2010 Utah income tax return.

1

1 2

2