Form Tc108 - Application For Correction Of Assessed Value For One, Two Or Three-Family House Or Other Class One Property Only - 2011

ADVERTISEMENT

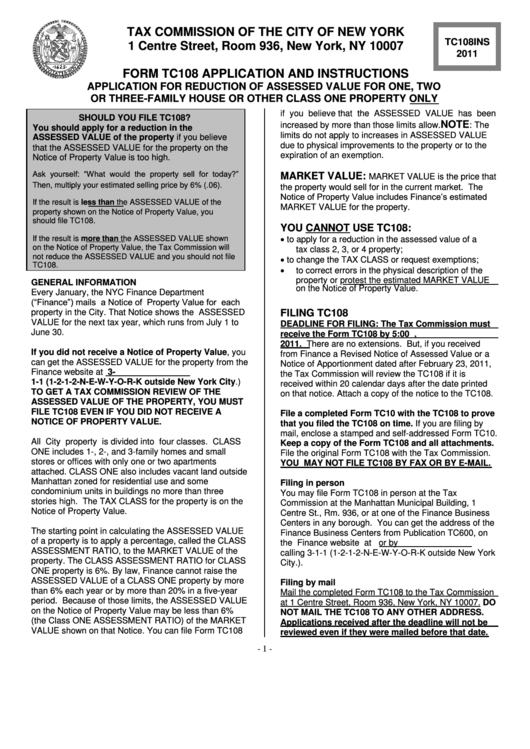

TAX COMMISSION OF THE CITY OF NEW YORK

TC108INS

1 Centre Street, Room 936, New York, NY 10007

2011

FORM TC108 APPLICATION AND INSTRUCTIONS

APPLICATION FOR REDUCTION OF ASSESSED VALUE FOR ONE, TWO

OR THREE-FAMILY HOUSE OR OTHER CLASS ONE PROPERTY ONLY

if you believe that the ASSESSED VALUE has been

SHOULD YOU FILE TC108?

NOTE

increased by more than those limits allow.

: The

You should apply for a reduction in the

limits do not apply to increases in ASSESSED VALUE

ASSESSED VALUE of the property if you believe

due to physical improvements to the property or to the

that the ASSESSED VALUE for the property on the

expiration of an exemption.

Notice of Property Value is too high.

Ask yourself: “What would the property sell for today?”

MARKET VALUE:

MARKET VALUE is the price that

Then, multiply your estimated selling price by 6% (.06).

the property would sell for in the current market. The

Notice of Property Value includes Finance’s estimated

If the result is less than the ASSESSED VALUE of the

MARKET VALUE for the property.

property shown on the Notice of Property Value, you

should file TC108.

YOU CANNOT USE TC108:

If the result is more than the ASSESSED VALUE shown

to apply for a reduction in the assessed value of a

on the Notice of Property Value, the Tax Commission will

tax class 2, 3, or 4 property;

not reduce the ASSESSED VALUE and you should not file

to change the TAX CLASS or request exemptions;

TC108.

to correct errors in the physical description of the

property or protest the estimated MARKET VALUE

GENERAL INFORMATION

on the Notice of Property Value.

Every

January,

the

NYC

Finance

Department

(“Finance”) mails a Notice of Property Value for each

property in the City. That Notice shows the ASSESSED

FILING TC108

VALUE for the next tax year, which runs from July 1 to

DEADLINE FOR FILING: The Tax Commission must

June 30.

receive the Form TC108 by 5:00 P.M. on March 15,

2011. There are no extensions. But, if you received

If you did not receive a Notice of Property Value, you

from Finance a Revised Notice of Assessed Value or a

can get the ASSESSED VALUE for the property from the

Notice of Apportionment dated after February 23, 2011,

Finance website at nyc.gov/propertytaxes or by calling 3-

the Tax Commission will review the TC108 if it is

1-1 (1-2-1-2-N-E-W-Y-O-R-K outside New York City.)

received within 20 calendar days after the date printed

TO GET A TAX COMMISSION REVIEW OF THE

on that notice. Attach a copy of the notice to the TC108.

ASSESSED VALUE OF THE PROPERTY, YOU MUST

FILE TC108 EVEN IF YOU DID NOT RECEIVE A

File a completed Form TC10 with the TC108 to prove

NOTICE OF PROPERTY VALUE.

that you filed the TC108 on time. If you are filing by

mail, enclose a stamped and self-addressed Form TC10.

All City property is divided into four classes. CLASS

Keep a copy of the Form TC108 and all attachments.

ONE includes 1-, 2-, and 3-family homes and small

File the original Form TC108 with the Tax Commission.

stores or offices with only one or two apartments

YOU MAY NOT FILE TC108 BY FAX OR BY E-MAIL.

attached. CLASS ONE also includes vacant land outside

Manhattan

zoned

for residential

use

and some

Filing in person

condominium units in buildings no more than three

You may file Form TC108 in person at the Tax

stories high. The TAX CLASS for the property is on the

Commission at the Manhattan Municipal Building, 1

Notice of Property Value.

Centre St., Rm. 936, or at one of the Finance Business

Centers in any borough. You can get the address of the

The starting point in calculating the ASSESSED VALUE

Finance Business Centers from Publication TC600, on

of a property is to apply a percentage, called the CLASS

the Finance website at nyc.gov/propertytaxes or by

ASSESSMENT RATIO, to the MARKET VALUE of the

calling 3-1-1 (1-2-1-2-N-E-W-Y-O-R-K outside New York

property. The CLASS ASSESSMENT RATIO for CLASS

City.).

ONE property is 6%. By law, Finance cannot raise the

ASSESSED VALUE of a CLASS ONE property by more

Filing by mail

than 6% each year or by more than 20% in a five-year

Mail the completed Form TC108 to the Tax Commission

period. Because of those limits, the ASSESSED VALUE

at 1 Centre Street, Room 936, New York, NY 10007. DO

on the Notice of Property Value may be less than 6%

NOT MAIL THE TC108 TO ANY OTHER ADDRESS.

(the Class ONE ASSESSMENT RATIO) of the MARKET

Applications received after the deadline will not be

VALUE shown on that Notice. You can file Form TC108

reviewed even if they were mailed before that date.

- 1 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4