Form 320-C - Gross Production Request For Change - 2011

ADVERTISEMENT

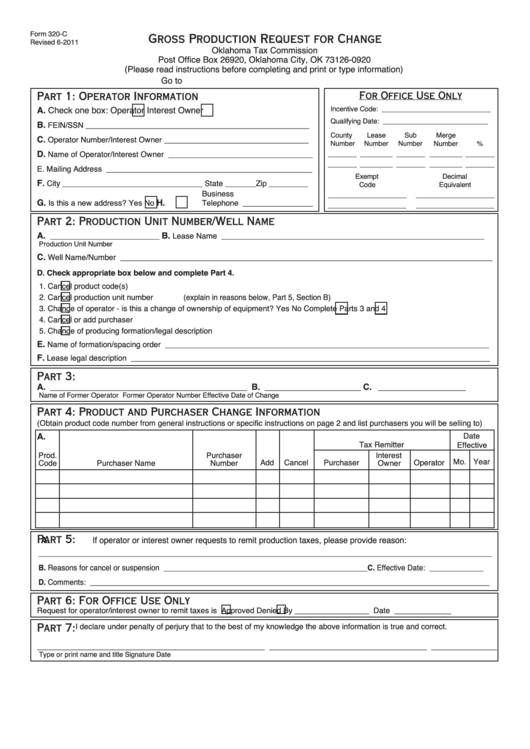

Form 320-C

Gross Production Request for Change

Revised 6-2011

Oklahoma Tax Commission

Post Office Box 26920, Oklahoma City, OK 73126-0920

(Please read instructions before completing and print or type information)

Go to for Gross Production Tax Rates

Part 1: Operator Information

For Office Use Only

Incentive Code: ____________________________

A. Check one box:

Operator

Interest Owner

Qualifying Date: ___________________________

B.

FEIN/SSN ___________________________________________________

County

Lease

Sub

Merge

C.

Operator Number/Interest Owner _________________________________

Number

Number

Number

Number

%

D.

Name of Operator/Interest Owner _________________________________

E. Mailing Address _______________________________________________

Exempt

Decimal

F.

City ________________________________ State _______ Zip _________

Code

Equivalent

Business

G.

H.

Is this a new address? Yes

No

Telephone ________________

Part 2: Production Unit Number/Well Name

A.

B.

_________________________

Lease Name ____________________________________________________________

Production Unit Number

C.

Well Name/Number _____________________________________________________________________________________

D. Check appropriate box below and complete Part 4.

1.

Cancel product code(s)

2.

Cancel production unit number (explain in reasons below, Part 5, Section B)

3.

Change of operator - is this a change of ownership of equipment?

Yes

No Complete Parts 3 and 4

4.

Cancel or add purchaser

5.

Change of producing formation/legal description

E.

Name of formation/spacing order __________________________________________________________________________

F.

Lease legal description __________________________________________________________________________________

Part 3:

A.

B.

C.

_____________________________________________

______________________

____________________

Name of Former Operator

Former Operator Number

Effective Date of Change

Part 4: Product and Purchaser Change Information

(Obtain product code number from general instructions or specific instructions on page 2 and list purchasers you will be selling to)

A.

B.

C.

D.

E.

F.

G.

Date

Tax Remitter

Effective

Prod.

Purchaser

Interest

Mo. Year

Add

Cancel

Purchaser

Operator

Code

Purchaser Name

Number

Owner

Part 5:

A. If operator or interest owner requests to remit production taxes, please provide reason:

_____________________________________________________________________________________________________________

B. Reasons for cancel or suspension _________________________________________________ C. Effective Date: _____________

D. Comments: ________________________________________________________________________________________________

Part 6: For Office Use Only

Request for operator/interest owner to remit taxes is

Approved

Denied

By _________________ Date _____________

Part 7:

I declare under penalty of perjury that to the best of my knowledge the above information is true and correct.

____________________________________________________

____________________________________ _______________

Type or print name and title

Signature

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2