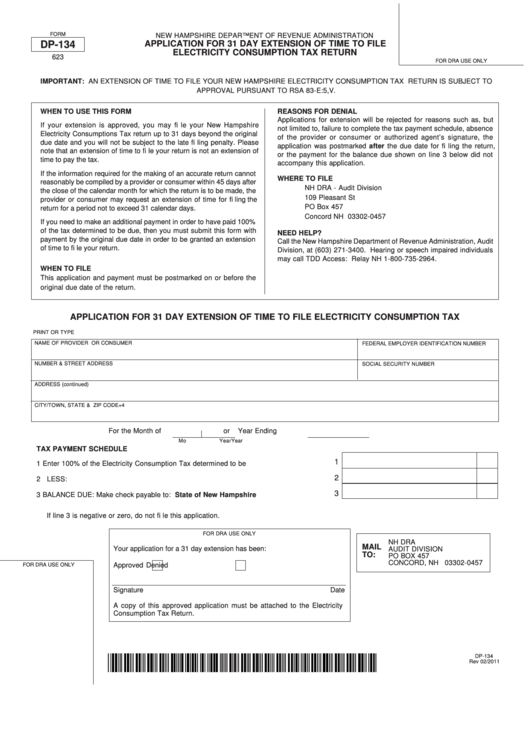

FORM

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

DP-134

APPLICATION FOR 31 DAY EXTENSION OF TIME TO FILE

ELECTRICITY CONSUMPTION TAX RETURN

623

FOR DRA USE ONLY

IMPORTANT: AN EXTENSION OF TIME TO FILE YOUR NEW HAMPSHIRE ELECTRICITY CONSUMPTION TAX RETURN IS SUBJECT TO

APPROVAL PURSUANT TO RSA 83-E:5,V.

WHEN TO USE THIS FORM

REASONS FOR DENIAL

Applications for extension will be rejected for reasons such as, but

If your extension is approved, you may fi le your New Hampshire

not limited to, failure to complete the tax payment schedule, absence

Electricity Consumptions Tax return up to 31 days beyond the original

of the provider or consumer or authorized agent’s signature, the

due date and you will not be subject to the late fi ling penalty. Please

application was postmarked after the due date for fi ling the return,

note that an extension of time to fi le your return is not an extension of

or the payment for the balance due shown on line 3 below did not

time to pay the tax.

accompany this application.

If the information required for the making of an accurate return cannot

WHERE TO FILE

reasonably be compiled by a provider or consumer within 45 days after

NH DRA - Audit Division

the close of the calendar month for which the return is to be made, the

109 Pleasant St

provider or consumer may request an extension of time for fi ling the

PO Box 457

return for a period not to exceed 31 calendar days.

Concord NH 03302-0457

If you need to make an additional payment in order to have paid 100%

of the tax determined to be due, then you must submit this form with

NEED HELP?

payment by the original due date in order to be granted an extension

Call the New Hampshire Department of Revenue Administration, Audit

of time to fi le your return.

Division, at (603) 271-3400. Hearing or speech impaired individuals

may call TDD Access: Relay NH 1-800-735-2964.

WHEN TO FILE

This application and payment must be postmarked on or before the

original due date of the return.

APPLICATION FOR 31 DAY EXTENSION OF TIME TO FILE ELECTRICITY CONSUMPTION TAX

PRINT OR TYPE

NAME OF PROVIDER OR CONSUMER

FEDERAL EMPLOYER IDENTIFICATION NUMBER

NUMBER & STREET ADDRESS

SOCIAL SECURITY NUMBER

ADDRESS (continued)

CITY/TOWN, STATE & ZIP CODE+4

For the Month of

or

Year Ending

Mo

Year

Year

TAX PAYMENT SCHEDULE

1

1 Enter 100% of the Electricity Consumption Tax determined to be due...................................

2

2 LESS: Credits.........................................................................................................................

3

3 BALANCE DUE: Make check payable to: State of New Hampshire...................................

If line 3 is negative or zero, do not fi le this application.

FOR DRA USE ONLY

NH DRA

MAIL

Your application for a 31 day extension has been:

AUDIT DIVISION

TO:

PO BOX 457

CONCORD, NH 03302-0457

Approved

Denied

FOR DRA USE ONLY

Signature

Date

A copy of this approved application must be attached to the Electricity

Consumption Tax Return.

DP-134

Rev 02/2011

1

1