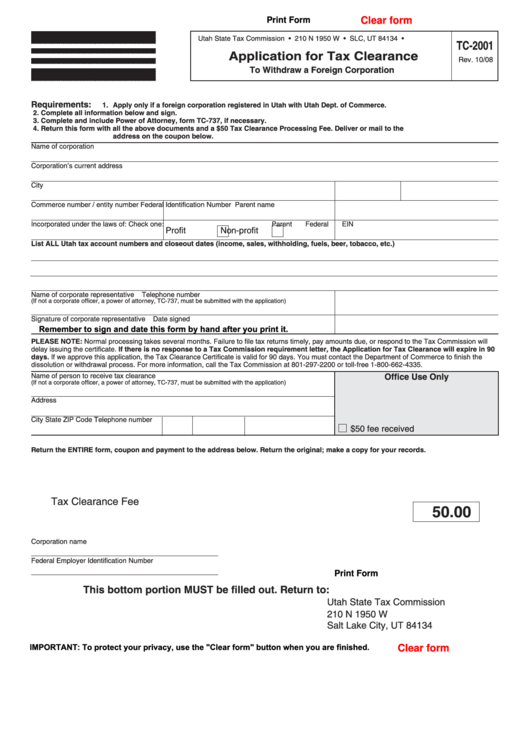

Print Form

Clear form

Utah State Tax Commission • 210 N 1950 W • SLC, UT 84134 • tax.utah.gov

TC-2001

Application for Tax Clearance

Rev. 10/08

To Withdraw a Foreign Corporation

Requirements:

1. Apply only if a foreign corporation registered in Utah with Utah Dept. of Commerce.

2. Complete all information below and sign.

3. Complete and include Power of Attorney, form TC-737, if necessary.

4. Return this form with all the above documents and a $50 Tax Clearance Processing Fee. Deliver or mail to the

address on the coupon below.

Name of corporation

Corporation’s current address

City

State

ZIP Code

Commerce number / entity number

Federal Identification Number

Parent name

Incorporated under the laws of:

Check one:

Parent Federal EIN

Profit

Non-profit

List ALL Utah tax account numbers and closeout dates (income, sales, withholding, fuels, beer, tobacco, etc.)

Name of corporate representative

Telephone number

(If not a corporate officer, a power of attorney, TC-737, must be submitted with the application)

Signature of corporate representative

Date signed

Remember to sign and date this form by hand after you print it.

PLEASE NOTE: Normal processing takes several months. Failure to file tax returns timely, pay amounts due, or respond to the Tax Commission will

delay issuing the certificate. If there is no response to a Tax Commission requirement letter, the Application for Tax Clearance will expire in 90

days. If we approve this application, the Tax Clearance Certificate is valid for 90 days. You must contact the Department of Commerce to finish the

dissolution or withdrawal process. For more information, call the Tax Commission at 801-297-2200 or toll-free 1-800-662-4335.

Name of person to receive tax clearance

Office Use Only

(If not a corporate officer, a power of attorney, TC-737, must be submitted with the application)

Address

City

State

ZIP Code

Telephone number

$50 fee received

Return the ENTIRE form, coupon and payment to the address below. Return the original; make a copy for your records.

Tax Clearance Fee

50.00

Corporation name

_ _ __ _____ __ __ _ _ _ __ __ _ __ _ __ __ _

Federal Employer Identification Number

_ _ __ _____ __ __ _ _ _ __ __ _ __ _ __ __ _

Print Form

This bottom portion MUST be filled out.

Return to:

Utah State Tax Commission

210 N 1950 W

Salt Lake City, UT 84134

IMPORTANT: To protect your privacy, use the "Clear form" button when you are finished.

Clear form

1

1