Tax Credit For Dependent Health Benefits Paid Worksheet 36 M.r.s.a. 5219-O - 2008

ADVERTISEMENT

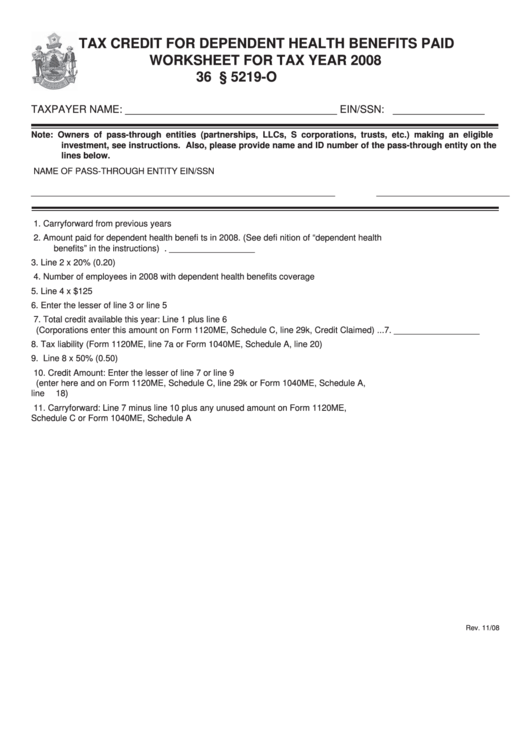

TAX CREDIT FOR DEPENDENT HEALTH BENEFITS PAID

WORKSHEET FOR TAX YEAR 2008

36 M.R.S.A. § 5219-O

TAXPAYER NAME: _____________________________________ EIN/SSN: ________________

Note: Owners of pass-through entities (partnerships, LLCs, S corporations, trusts, etc.) making an eligible

investment, see instructions. Also, please provide name and ID number of the pass-through entity on the

lines below.

NAME OF PASS-THROUGH ENTITY

EIN/SSN

________________________________________________________________

____________________________

1. Carryforward from previous years ...........................................................................................1. __________________

2. Amount paid for dependent health benefi ts in 2008. (See defi nition of “dependent health

benefi ts” in the instructions) ....................................................................................................2. __________________

3. Line 2 x 20% (0.20) .................................................................................................................3. __________________

4. Number of employees in 2008 with dependent health benefi ts coverage ..............................4. __________________

5. Line 4 x $125 ..........................................................................................................................5. __________________

6. Enter the lesser of line 3 or line 5 ...........................................................................................6. __________________

7. Total credit available this year: Line 1 plus line 6

(Corporations enter this amount on Form 1120ME, Schedule C, line 29k, Credit Claimed) ...7. __________________

8. Tax liability (Form 1120ME, line 7a or Form 1040ME, Schedule A, line 20) ...........................8. __________________

9. Line 8 x 50% (0.50) ................................................................................................................9. __________________

10. Credit Amount: Enter the lesser of line 7 or line 9

(enter here and on Form 1120ME, Schedule C, line 29k or Form 1040ME, Schedule A,

line 18) ..................................................................................................................................10. __________________

11. Carryforward: Line 7 minus line 10 plus any unused amount on Form 1120ME,

Schedule C or Form 1040ME, Schedule A ........................................................................... 11. __________________

Rev. 11/08

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1