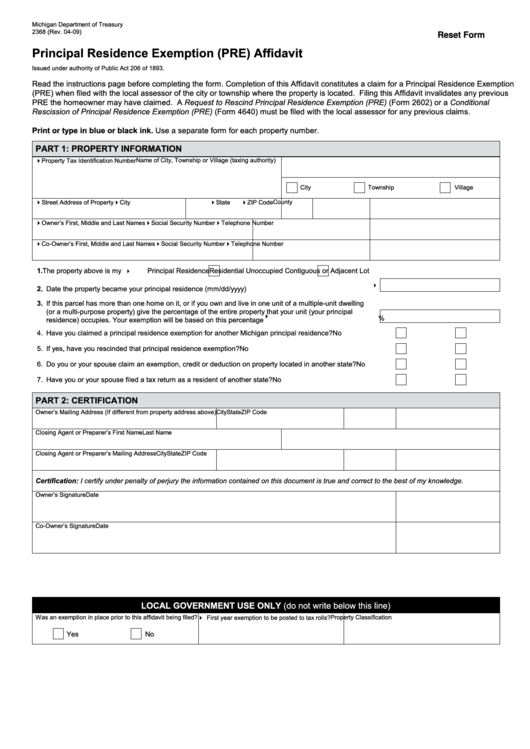

Michigan Department of Treasury

2368 (Rev. 04-09)

Reset Form

Principal Residence Exemption (PRE) Affidavit

Issued under authority of Public Act 206 of 1893.

Read the instructions page before completing the form. Completion of this Affidavit constitutes a claim for a Principal Residence Exemption

(PRE) when filed with the local assessor of the city or township where the property is located. Filing this Affidavit invalidates any previous

PRE the homeowner may have claimed. A Request to Rescind Principal Residence Exemption (PRE) (Form 2602) or a Conditional

Rescission of Principal Residence Exemption (PRE) (Form 4640) must be filed with the local assessor for any previous claims.

Print or type in blue or black ink. Use a separate form for each property number.

PART 1: PROPERTY INFORMATION

Name of City, Township or Village (taxing authority)

4Property Tax Identification Number

City

Township

Village

County

4Street Address of Property

4ZIP Code

4City

4State

4Owner’s First, Middle and Last Names

4Social Security Number

4Telephone Number

4Co-Owner’s First, Middle and Last Names

4Social Security Number

4Telephone Number

1. The property above is my ...................................

Principal Residence

Residential Unoccupied Contiguous or Adjacent Lot

4

4

2. Date the property became your principal residence (mm/dd/yyyy) ................................................................

3. If this parcel has more than one home on it, or if you own and live in one unit of a multiple-unit dwelling

(or a multi-purpose property) give the percentage of the entire property that your unit (your principal

4

%

residence) occupies. Your exemption will be based on this percentage .......................................................

4. Have you claimed a principal residence exemption for another Michigan principal residence? ..............................

Yes

No

5. If yes, have you rescinded that principal residence exemption? ..............................................................................

Yes

No

6. Do you or your spouse claim an exemption, credit or deduction on property located in another state? ..................

Yes

No

7. Have you or your spouse filed a tax return as a resident of another state? .............................................................

Yes

No

PART 2: CERTIFICATION

Owner’s Mailing Address (If different from property address above) City

State

ZIP Code

Closing Agent or Preparer’s First Name

Last Name

Closing Agent or Preparer’s Mailing Address

City

State

ZIP Code

Certification: I certify under penalty of perjury the information contained on this document is true and correct to the best of my knowledge.

Owner’s Signature

Date

Co-Owner’s Signature

Date

LOCAL GOVERNMENT USE ONLY (do not write below this line)

Was an exemption in place prior to this affidavit being filed?

4 First year exemption to be posted to tax rolls?

Property Classification

Yes

No

1

1 2

2