Form Ifta-116 - Fuel Use Tax Refund For B20 Fuel - State Of New York

ADVERTISEMENT

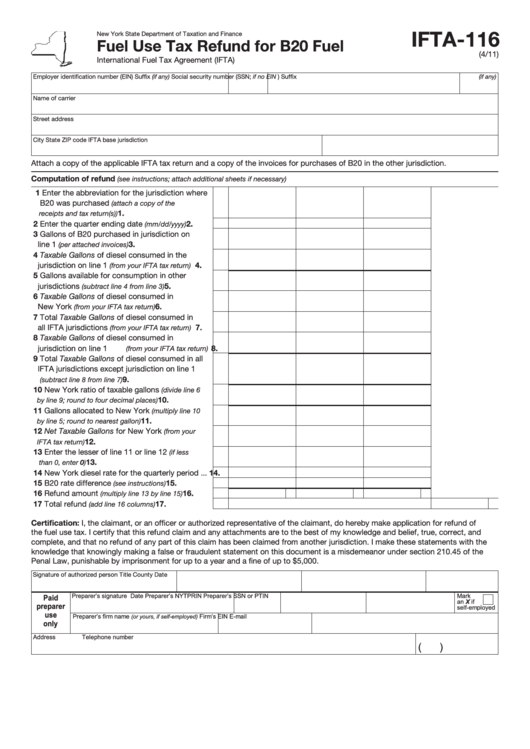

IFTA-116

New York State Department of Taxation and Finance

Fuel Use Tax Refund for B20 Fuel

(4/11)

International Fuel Tax Agreement (IFTA)

Employer identification number (EIN)

Suffix (if any) Social security number (SSN; if no EIN )

Suffix (if any)

Name of carrier

Street address

City

State

ZIP code

IFTA base jurisdiction

Attach a copy of the applicable IFTA tax return and a copy of the invoices for purchases of B20 in the other jurisdiction.

Computation of refund

(see instructions; attach additional sheets if necessary)

1 Enter the abbreviation for the jurisdiction where

B20 was purchased

(attach a copy of the

...................................

1.

receipts and tax return(s))

2 Enter the quarter ending date

.......

2.

(mm/dd/yyyy)

3 Gallons of B20 purchased in jurisdiction on

3.

line 1

.............................

(per attached invoices)

4 Taxable Gallons of diesel consumed in the

jurisdiction on line 1

4.

(from your IFTA tax return)

5 Gallons available for consumption in other

5.

jurisdictions

.............

(subtract line 4 from line 3)

6 Taxable Gallons of diesel consumed in

New York

.................

6.

(from your IFTA tax return)

7 Total Taxable Gallons of diesel consumed in

7.

all IFTA jurisdictions

(from your IFTA tax return)

8 Taxable Gallons of diesel consumed in

jurisdiction on line 1

8.

(from your IFTA tax return)

9 Total Taxable Gallons of diesel consumed in all

IFTA jurisdictions except jurisdiction on line 1

9.

.................................

(subtract line 8 from line 7)

10 New York ratio of taxable gallons

(divide line 6

................ 10.

by line 9; round to four decimal places)

11 Gallons allocated to New York

(multiply line 10

........................ 11.

by line 5; round to nearest gallon)

12 Net Taxable Gallons for New York

(from your

................................................. 12.

IFTA tax return)

13 Enter the lesser of line 11 or line 12

(if less

.................................................. 13.

than 0, enter 0)

14 New York diesel rate for the quarterly period ... 14.

15 B20 rate difference

................... 15.

(see instructions)

16 Refund amount

........... 16.

(multiply line 13 by line 15)

17 Total refund

........................ 17.

(add line 16 columns)

Certification: I, the claimant, or an officer or authorized representative of the claimant, do hereby make application for refund of

the fuel use tax. I certify that this refund claim and any attachments are to the best of my knowledge and belief, true, correct, and

complete, and that no refund of any part of this claim has been claimed from another jurisdiction. I make these statements with the

knowledge that knowingly making a false or fraudulent statement on this document is a misdemeanor under section 210.45 of the

Penal Law, punishable by imprisonment for up to a year and a fine of up to $5,000.

Signature of authorized person

Title

County

Date

Preparer’s signature

Date

Preparer’s NYTPRIN

Preparer’s SSN or PTIN

Mark

Paid

an X if

preparer

self-employed

use

Preparer’s firm name

Firm’s EIN

E-mail

(or yours, if self-employed)

only

Address

Telephone number

(

)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2