Instructions For Completing Form Bt-1c - State Of Indiana

ADVERTISEMENT

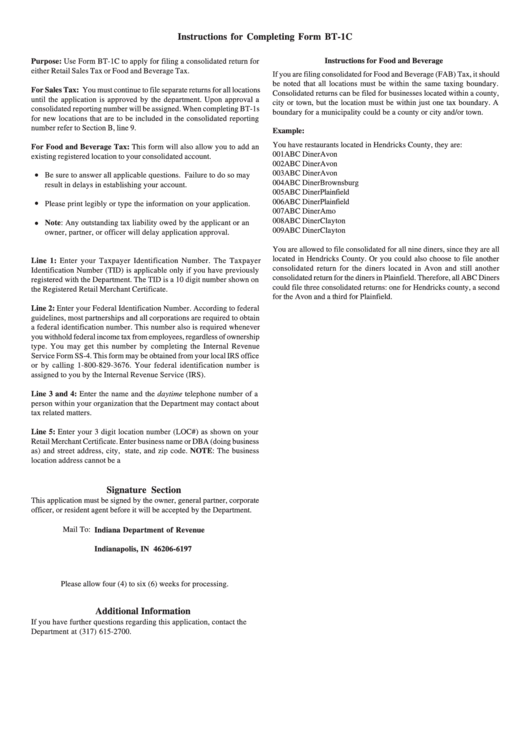

Instructions for Completing Form BT-1C

Instructions for Food and Beverage

Purpose: Use Form BT-1C to apply for filing a consolidated return for

either Retail Sales Tax or Food and Beverage Tax.

If you are filing consolidated for Food and Beverage (FAB) Tax, it should

be noted that all locations must be within the same taxing boundary.

For Sales Tax: You must continue to file separate returns for all locations

Consolidated returns can be filed for businesses located within a county,

until the application is approved by the department. Upon approval a

city or town, but the location must be within just one tax boundary. A

consolidated reporting number will be assigned. When completing BT-1s

boundary for a municipality could be a county or city and/or town.

for new locations that are to be included in the consolidated reporting

number refer to Section B, line 9.

Example:

You have restaurants located in Hendricks County, they are:

For Food and Beverage Tax: This form will also allow you to add an

001

ABC Diner

Avon

existing registered location to your consolidated account.

002

ABC Diner

Avon

003

ABC Diner

Avon

Be sure to answer all applicable questions. Failure to do so may

004

ABC Diner

Brownsburg

result in delays in establishing your account.

005

ABC Diner

Plainfield

006

ABC Diner

Plainfield

Please print legibly or type the information on your application.

007

ABC Diner

Amo

008

ABC Diner

Clayton

Note: Any outstanding tax liability owed by the applicant or an

009

ABC Diner

Clayton

owner, partner, or officer will delay application approval.

You are allowed to file consolidated for all nine diners, since they are all

located in Hendricks County. Or you could also choose to file another

Line 1: Enter your Taxpayer Identification Number. The Taxpayer

consolidated return for the diners located in Avon and still another

Identification Number (TID) is applicable only if you have previously

consolidated return for the diners in Plainfield. Therefore, all ABC Diners

registered with the Department. The TID is a 10 digit number shown on

could file three consolidated returns: one for Hendricks county, a second

the Registered Retail Merchant Certificate.

for the Avon and a third for Plainfield.

Line 2: Enter your Federal Identification Number. According to federal

guidelines, most partnerships and all corporations are required to obtain

a federal identification number. This number also is required whenever

you withhold federal income tax from employees, regardless of ownership

type. You may get this number by completing the Internal Revenue

Service Form SS-4. This form may be obtained from your local IRS office

or by calling 1-800-829-3676. Your federal identification number is

assigned to you by the Internal Revenue Service (IRS).

Line 3 and 4: Enter the name and the daytime telephone number of a

person within your organization that the Department may contact about

tax related matters.

Line 5: Enter your 3 digit location number (LOC#) as shown on your

Retail Merchant Certificate. Enter business name or DBA (doing business

as) and street address, city, state, and zip code. NOTE: The business

location address cannot be a P.O. Box number.

Signature Section

This application must be signed by the owner, general partner, corporate

officer, or resident agent before it will be accepted by the Department.

Mail To:

Indiana Department of Revenue

P.O. 6197

Indianapolis, IN 46206-6197

Please allow four (4) to six (6) weeks for processing.

Additional Information

If you have further questions regarding this application, contact the

Department at (317) 615-2700.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1