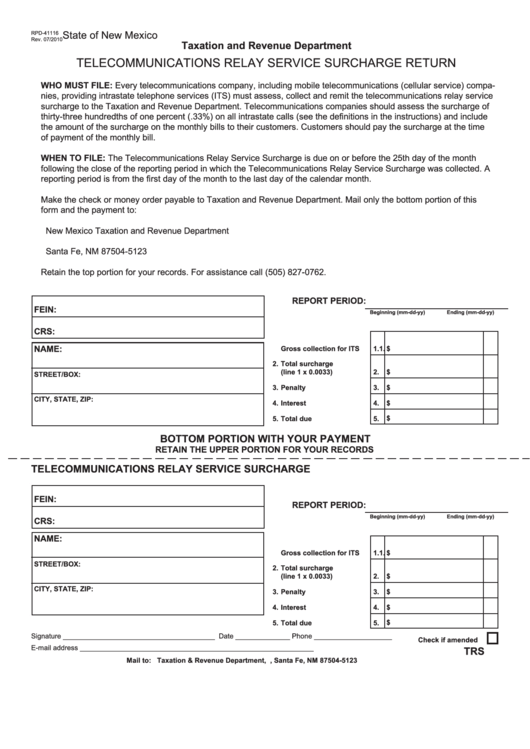

State of New Mexico

RPD-41116

Rev. 07/2010

Taxation and Revenue Department

TELECOMMUNICATIONS RELAY SERVICE SURCHARGE RETURN

WHO MUST FILE: Every telecommunications company, including mobile telecommunications (cellular service) compa-

nies, providing intrastate telephone services (ITS) must assess, collect and remit the telecommunications relay service

surcharge to the Taxation and Revenue Department. Telecommunications companies should assess the surcharge of

thirty-three hundredths of one percent (.33%) on all intrastate calls (see the definitions in the instructions) and include

the amount of the surcharge on the monthly bills to their customers. Customers should pay the surcharge at the time

of payment of the monthly bill.

WHEN TO FILE: The Telecommunications Relay Service Surcharge is due on or before the 25th day of the month

following the close of the reporting period in which the Telecommunications Relay Service Surcharge was collected. A

reporting period is from the first day of the month to the last day of the calendar month.

Make the check or money order payable to Taxation and Revenue Department. Mail only the bottom portion of this

form and the payment to:

New Mexico Taxation and Revenue Department

P.O. Box 25123

Santa Fe, NM 87504-5123

Retain the top portion for your records. For assistance call (505) 827-0762.

REPORT PERIOD:

FEIN:

Beginning (mm-dd-yy)

Ending (mm-dd-yy)

CRS:

NAME:

1.

Gross collection for ITS

1.

$

2.

Total surcharge

(line 1 x 0.0033)

2.

$

STREET/BOX:

3.

Penalty

3.

$

CITY, STATE, ZIP:

4.

Interest

4.

$

5.

Total due

5.

$

BOTTOM PORTION WITH YOUR PAYMENT

RETAIN THE UPPER PORTION FOR YOUR RECORDS

TELECOMMUNICATIONS RELAY SERVICE SURCHARGE

FEIN:

REPORT PERIOD:

Beginning (mm-dd-yy)

Ending (mm-dd-yy)

CRS:

NAME:

1.

Gross collection for ITS

1.

$

STREET/BOX:

Total surcharge

2.

(line 1 x 0.0033)

2.

$

CITY, STATE, ZIP:

3.

Penalty

3.

$

4.

Interest

4.

$

$

5.

Total due

5.

Signature _______________________________________ Date ______________ Phone ____________________

Check if amended

E-mail address ____________________________________________________________

TRS

Mail to: Taxation & Revenue Department, P.O. Box 25123, Santa Fe, NM 87504-5123

1

1 2

2