Print

Clear

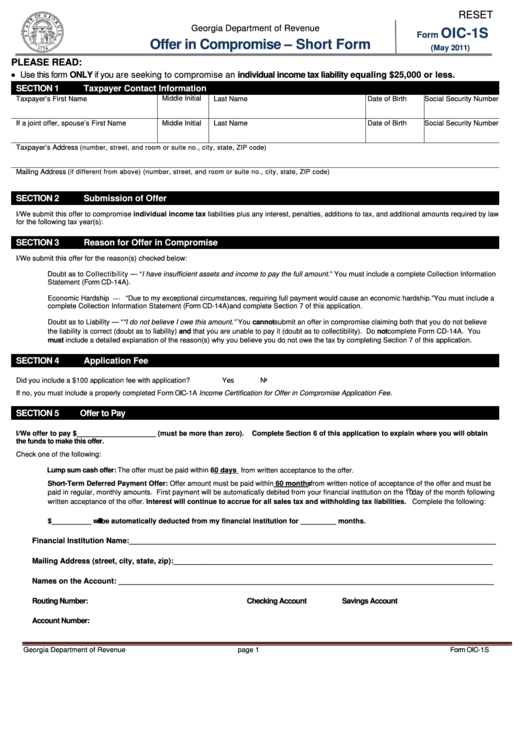

RESET

Georgia Department of Revenue

OIC-1S

Form

Offer in Compromise – Short Form

(May 2011)

PLEASE READ:

• Use this form ONLY if you are seeking to compromise an individual income tax liability equaling $25,000 or less.

SECTION 1

Taxpayer Contact Information

Taxpayer’s First Name

Middle Initial

Last Name

Date of Birth

Social Security Number

If a joint offer, spouse’s First Name

Middle Initial

Last Name

Date of Birth

Social Security Number

Taxpayer’s Address

(number, street, and room or suite no., city, state, ZIP code)

Mailing Address

(if different from above) (number, street, and room or suite no., city, state, ZIP code)

SECTION 2

Submission of Offer

I/We submit this offer to compromise individual income tax liabilities plus any interest, penalties, additions to tax, and additional amounts required by law

for the following tax year(s):

SECTION 3

Reason for Offer in Compromise

I/We submit this offer for the reason(s) checked below:

Doubt as to Collectibility — “I have insufficient assets and income to pay the full amount.” You must include a complete Collection Information

Statement (Form CD-14A).

Economic Hardship — “Due to my exceptional circumstances, requiring full payment would cause an economic hardship.” You must include a

complete Collection Information Statement (Form CD-14A) and complete Section 7 of this application.

Doubt as to Liability — ““I do not believe I owe this amount.” You cannot submit an offer in compromise claiming both that you do not believe

the liability is correct (doubt as to liability) and that you are unable to pay it (doubt as to collectibility). Do not complete Form CD-14A. You

must include a detailed explanation of the reason(s) why you believe you do not owe the tax by completing Section 7 of this application.

SECTION 4

Application Fee

Did you include a $100 application fee with application?

Yes

No

If no, you must include a properly completed Form OIC-1A Income Certification for Offer in Compromise Application Fee.

SECTION 5

Offer to Pay

I/We offer to pay $____________________ (must be more than zero).

Complete Section 6 of this application to explain where you will obtain

the funds to make this offer.

Check one of the following:

Lump sum cash offer: The offer must be paid within 60 days from written acceptance to the offer.

Short-Term Deferred Payment Offer: Offer amount must be paid within 60 months from written notice of acceptance of the offer and must be

th

paid in regular, monthly amounts. First payment will be automatically debited from your financial institution on the 10

day of the month following

written acceptance of the offer. Interest will continue to accrue for all sales tax and withholding tax liabilities. Complete the following:

$__________ will be automatically deducted from my financial institution for _________ months.

Financial Institution Name:_____________________________________________________________________________________

Mailing Address (street, city, state, zip):__________________________________________________________________________

Names on the Account: _______________________________________________________________________________________

Routing Number:

Checking Account

Savings Account

Account Number:

Georgia Department of Revenue

page 1

Form OIC-1S

1

1 2

2 3

3