Print

Print

Clear

Clear

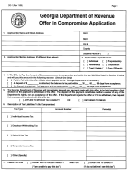

(p) I/We understand that Department employees may contact third

right to contest, in court or otherwise, the amount of the liability.

parties in order to respond to this request and I/we authorize the

(l) If I/we fail to meet any of the terms and conditions of the offer

Department to make such contacts. Further, by authorizing the

and the offer defaults, the Department may:

Department to contact third parties, I/we understand that I/we will

not receive notice of third parties contacted in connection with this

• issue and record a tax execution, if applicable, regarding all

request.

tax liabilities identified in Section 2 of this application;

(q) I/We are offering to compromise all the liabilities assessed

• initiate all appropriate enforced collection activity, including

against me/us as of the date of this offer and under the taxpayer

levy and garnishment, to collect any outstanding tax liabilities

identification numbers listed in Section 2 above. I/We authorize

identified in Section 2 of this application without further notice

the Department to amend Section 2 to include any assessed

of any kind;

liabilities we failed to list on Form OIC-1.

• disregard the offer amount and apply all amounts already

(r)

Any subsequent modification to an Offer in Compromise

paid under the offer against the original amount of the liability.

settlement will result in an additional $100 cost assessment.

(m) The Department will continue to add interest on the amount

(s) If a Short Term Deferred Payment Offer is selected under

the Department determines is due after default. The interest will

Section 5 of this application, I authorize the Georgia Department of

continue to accrue until I/we completely satisfy the amount owed.

Revenue and its designated financial agent to initiate a monthly

ACH electronic funds withdrawal entry to the financial institution

(n) The Department generally files a state tax execution to protect

account indicated in Section 5 for payments of my state taxes

the Government’s interest on offers with deferred payments

included in this offer and the financial institution to debit the entry

involving sales tax and withholding taxes. Also, the Department

to this account. I also authorize the financial institutions involved in

may file a state tax execution during the offer investigation. This

the processing of electric payments of state taxes to receive

state tax execution will be released when the payment terms of

confidential tax information necessary to answer inquiries and

the offer agreement have been satisfied.

resolve issues related to those payments. This authorization is to

(o) I/we understand that the Department will recoup the $280 cost

remain in full force and effect until I notify the Department to

of processing the offer from me/us if I/we do not fully satisfy the

terminate the authorization.

Short Term Deferred Payment

terms of offer or any modification thereto.

Offers involving sales tax or withholding tax will continue to

accrue at the statutory 12% interest rate.

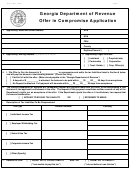

Section 9

Mandatory Signatures

Under penalties of perjury, I declare that I have examined this offer, including accompanying schedules and statements,

and to the best of my knowledge and belief, it is true, correct and complete. I understand that to willfully prepare or present

a document that is fraudulent or false is a criminal misdemeanor under O.C.G.A. § 48-1-6.

Signature of Taxpayer

Daytime Telephone Number

Date (mmddyyyy)

Signature of Taxpayer

Daytime Telephone Number

Date (mmddyyyy)

Section 10

Application Prepared by Someone Other than the Taxpayer

If this application was prepared by someone other than the taxpayer, please fill in that person’s name and address below.

Name of Preparer

Signature of Preparer

Date (mmddyyyy)

Address (Street, City, State, and ZIP code)

Section 11

Third Party Designee

Do you want to allow another person to discuss this offer with the Georgia Department of Revenue?

No

Yes (if yes, complete information

below) Note: You must submit Form RD-1061 Power of Attorney if you want to authorize someone else to make decisions and act on your behalf

regarding this offer.

Designee’s Name

Telephone Number

Mail this application and all attachments to the following address:

Georgia Department of Revenue

Offer in Compromise Program

1800 Century Blvd., NE, Suite 17205

Atlanta, Georgia 30345-3209

Georgia Department of Revenue

page 3

Form OIC-1S

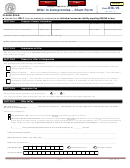

1

1 2

2 3

3