Departmental Use Only

Departmental Use Only

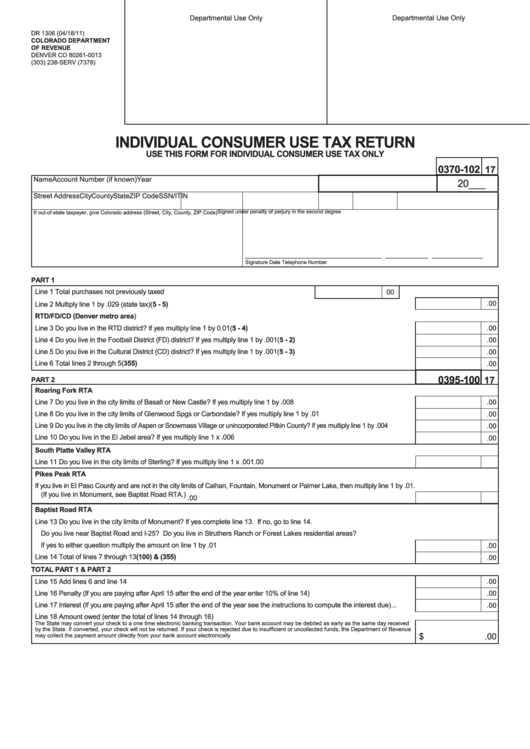

DR 1306 (04/18/11)

COLORADO DEPARTMENT

OF REVENUE

DENVER CO 80261-0013

(303) 238-SERV (7378)

INDIVIDUAL CONSUMER USE TAX RETURN

USE THIS FORM FOR INDIVIDUAL CONSUMER USE TAX ONLY

0370-102

17

Name

Account Number (if known)

Year

20___

Street Address

City

County

State

ZIP Code

SSN/ITIN

Signed under penalty of perjury in the second degree

If out-of-state taxpayer, give Colorado address (Street, City, County, ZIP Code)

___________________________________ ___________ _____________

Signature

Date

Telephone Number

PART 1

Line 1 Total purchases not previously taxed ....................................................................................

00

.00

Line 2 Multiply line 1 by .029 (state tax)........................................................................................................................................(5 - 5)

RTD/FD/CD (Denver metro area)

Line 3 Do you live in the RTD district? If yes multiply line 1 by 0.01 ...........................................................................................(5 - 4)

.00

Line 4 Do you live in the Football District (FD) district? If yes multiply line 1 by .001 .................................................................(5 - 2)

.00

Line 5 Do you live in the Cultural District (CD) district? If yes multiply line 1 by .001 .................................................................(5 - 3)

.00

Line 6 Total lines 2 through 5 ........................................................................................................................................................(355)

.00

0395-100

17

PART 2

Roaring Fork RTA

Line 7 Do you live in the city limits of Basalt or New Castle? If yes multiply line 1 by .008 ........................................................

.00

Line 8 Do you live in the city limits of Glenwood Spgs or Carbondale? If yes multiply line 1 by .01 ..........................................

.00

Line 9 Do you live in the city limits of Aspen or Snowmass Village or unincorporated Pitkin County? If yes multiply line 1 by .004 ....

.00

Line 10 Do you live in the El Jebel area? If yes multiply line 1 x .006 .........................................................................................

.00

South Platte Valley RTA

Line 11 Do you live in the city limits of Sterling? If yes multiply line 1 x .001...............................................................................

.00

Pikes Peak RTA

If you live in El Paso County and are not in the city limits of Calhan, Fountain, Monument or Palmer Lake, then multiply line 1 by .01.

(If you live in Monument, see Baptist Road RTA.) ....................................................................................................................

.00

Baptist Road RTA

Line 13 Do you live in the city limits of Monument? If yes complete line 13. If no, go to line 14.

Do you live near Baptist Road and I-25? Do you live in Struthers Ranch or Forest Lakes residential areas?

If yes to either question multiply the amount on line 1 by .01 ...................................................................................................

.00

Line 14 Total of lines 7 through 13 .....................................................................................................................................(100) & (355)

.00

TOTAL PART 1 & PART 2

Line 15 Add lines 6 and line 14 .....................................................................................................................................................

.00

Line 16 Penalty (If you are paying after April 15 after the end of the year enter 10% of line 14) ...............................................

.00

Line 17 Interest (If you are paying after April 15 after the end of the year see the instructions to compute the interest due) ...

.00

Line 18 Amount owed (enter the total of lines 14 through 16) .....................................................................................................

The State may convert your check to a one time electronic banking transaction. Your bank account may be debited as early as the same day received

by the State. If converted, your check will not be returned. If your check is rejected due to insufficient or uncollected funds, the Department of Revenue

$.

.00

may collect the payment amount directly from your bank account electronically

1

1