Montana Withholding Tax Tables - Montana Department Of Revenue - 2005

ADVERTISEMENT

Montana Department of Revenue

Don Hoffman

Judy Martz

Acting Director

Governor

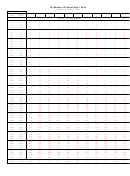

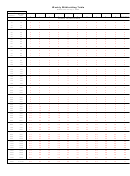

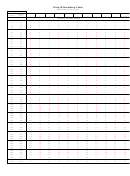

Montana Withholding Tax Tables

Significant Changes for 2005

The Montana Economic Development Tax Act (Senate Bill 407) was passed by the

2003 Legislative Assembly to provide comprehensive tax reform, including a reduction

of individual income tax rates.

The state tax rate table has been revised to provide for seven tax brackets with

marginal rates ranging from 1% to 6.9%. The tax rate reductions are effective

beginning with tax year 2005.

The department has revised the withholding tax tables for tax year 2005 to reflect these

new tax rates and tax brackets. The revised 2005 Withholding Tax Tables are now

available on the department’s website at

(click

on Forms & Resources / Downloadable Forms / Withholding Forms). In addition, a

booklet will be mailed to employers in November 2004.

These additional individual income tax changes, associated with the Montana Economic

Development Tax Act, are effective beginning with tax year 2005.

•

The current full deduction for federal income taxes paid during the tax year is

capped at $5,000 ($10,000 if married and filing jointly).

•

A new tax credit equal to 1% of the net capital gains is in effect for 2005 and

2006. This percentage increases to 2% beginning in tax year 2007.

•

The personal exemption and standard deduction amounts in current law were

adjusted to accommodate a new base year (tax year 2005) from which

adjustments to these items are calculated. The base amount for calculating

exemptions has increased from $800 to $1,900. The base amount for calculating

the standard deduction has increased from $665 to $1,580.

If you have any questions regarding the changes to the withholding tax tables or other

changes associated with the Montana Economic Development Tax Act, please call the

department’s Customer Service Center at (406) 444-6900.

Customer Service (406) 444-6900

TDD (406) 444-2830

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11