Form Ip-1 - Vermont Insurance Premium Tax Return - 2010

ADVERTISEMENT

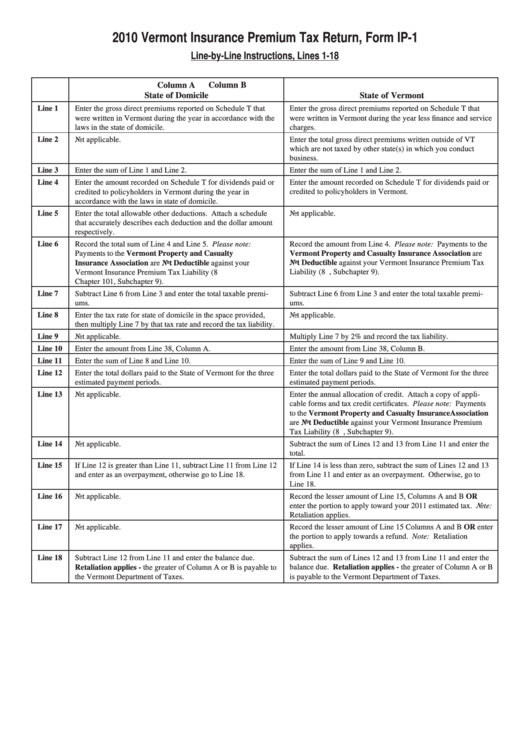

2010 Vermont Insurance Premium Tax Return, Form IP-1

Line-by-Line Instructions, Lines 1-18

Column A

Column B

State of Domicile

State of Vermont

Line 1

Enter the gross direct premiums reported on Schedule T that

Enter the gross direct premiums reported on Schedule T that

were written in Vermont during the year in accordance with the

were written in Vermont during the year less finance and service

laws in the state of domicile.

charges.

Line 2

Not applicable.

Enter the total gross direct premiums written outside of VT

which are not taxed by other state(s) in which you conduct

business.

Line 3

Enter the sum of Line 1 and Line 2.

Enter the sum of Line 1 and Line 2.

Line 4

Enter the amount recorded on Schedule T for dividends paid or

Enter the amount recorded on Schedule T for dividends paid or

credited to policyholders in Vermont.

credited to policyholders in Vermont during the year in

accordance with the laws in state of domicile.

Line 5

Enter the total allowable other deductions. Attach a schedule

Not applicable.

that accurately describes each deduction and the dollar amount

respectively.

Line 6

Record the total sum of Line 4 and Line 5. Please note:

Record the amount from Line 4. Please note: Payments to the

Payments to the Vermont Property and Casualty

Vermont Property and Casualty Insurance Association are

Insurance Association are Not Deductible against your

Not Deductible against your Vermont Insurance Premium Tax

Vermont Insurance Premium Tax Liability (8 V.S.A

Liability (8 V.S.A. Chapter 101, Subchapter 9).

Chapter 101, Subchapter 9).

Line 7

Subtract Line 6 from Line 3 and enter the total taxable premi-

Subtract Line 6 from Line 3 and enter the total taxable premi-

ums.

ums.

Line 8

Enter the tax rate for state of domicile in the space provided,

Not applicable.

then multiply Line 7 by that tax rate and record the tax liability.

Line 9

Not applicable.

Multiply Line 7 by 2% and record the tax liability.

Line 10

Enter the amount from Line 38, Column A.

Enter the amount from Line 38, Column B.

Line 11

Enter the sum of Line 8 and Line 10.

Enter the sum of Line 9 and Line 10.

Line 12

Enter the total dollars paid to the State of Vermont for the three

Enter the total dollars paid to the State of Vermont for the three

estimated payment periods.

estimated payment periods.

Line 13

Not applicable.

Enter the annual allocation of credit. Attach a copy of appli-

cable forms and tax credit certificates. Please note: Payments

to the Vermont Property and Casualty Insurance Association

are Not Deductible against your Vermont Insurance Premium

Tax Liability (8 V.S.A. Chapter 101, Subchapter 9).

Line 14

Not applicable.

Subtract the sum of Lines 12 and 13 from Line 11 and enter the

total.

Line 15

If Line 12 is greater than Line 11, subtract Line 11 from Line 12

If Line 14 is less than zero, subtract the sum of Lines 12 and 13

and enter as an overpayment, otherwise go to Line 18.

from Line 11 and enter as an overpayment. Otherwise, go to

Line 18.

Line 16

Not applicable.

Record the lesser amount of Line 15, Columns A and B OR

enter the portion to apply toward your 2011 estimated tax. Note:

Retaliation applies.

Line 17

Not applicable.

Record the lesser amount of Line 15 Columns A and B OR enter

the portion to apply towards a refund. Note: Retaliation

applies.

Line 18

Subtract Line 12 from Line 11 and enter the balance due.

Subtract the sum of Lines 12 and 13 from Line 11 and enter the

balance due. Retaliation applies - the greater of Column A or B

Retaliation applies - the greater of Column A or B is payable to

the Vermont Department of Taxes.

is payable to the Vermont Department of Taxes.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2