Form Sc Sch.tc-11a - New Jobs And Capital Investment Credits For Plastics And Rubber Manufacturers - South Carolina Department Of Revenue

ADVERTISEMENT

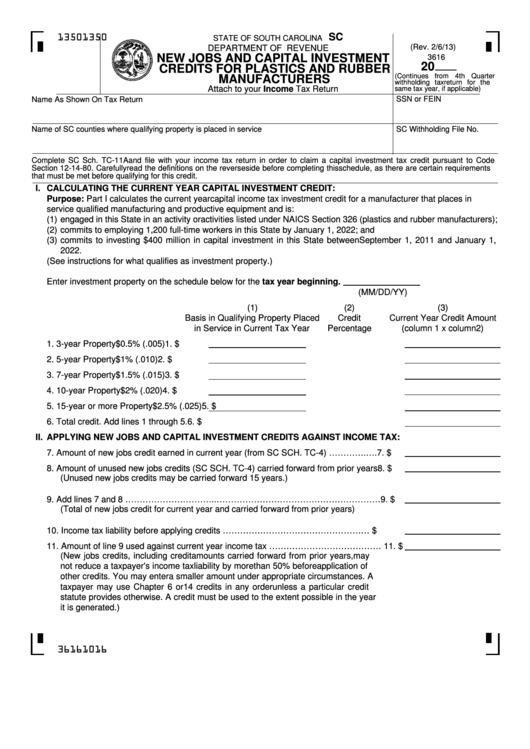

SC SCH.TC-11A

1350

1350

STATE OF SOUTH CAROLINA

(Rev. 2/6/13)

DEPARTMENT OF REVENUE

NEW JOBS AND CAPITAL INVESTMENT

3616

20

CREDITS FOR PLASTICS AND RUBBER

(Continues from 4th Quarter

MANUFACTURERS

withholding tax return for the

Attach to your Income Tax Return

same tax year, if applicable)

SSN or FEIN

Name As Shown On Tax Return

Name of SC counties where qualifying property is placed in service

SC Withholding File No.

Complete SC Sch. TC-11A and file with your income tax return in order to claim a capital investment tax credit pursuant to Code

Section 12-14-80. Carefully read the definitions on the reverse side before completing this schedule, as there are certain requirements

that must be met before qualifying for this credit.

I.

CALCULATING THE CURRENT YEAR CAPITAL INVESTMENT CREDIT:

Purpose: Part I calculates the current year capital income tax investment credit for a manufacturer that places in

service qualified manufacturing and productive equipment and is:

(1)

engaged in this State in an activity or activities listed under NAICS Section 326 (plastics and rubber manufacturers);

(2)

commits to employing 1,200 full-time workers in this State by January 1, 2022; and

(3)

commits to investing $400 million in capital investment in this State between September 1, 2011 and January 1,

2022.

(See instructions for what qualifies as investment property.)

Enter investment property on the schedule below for the tax year beginning

.

(MM/DD/YY)

(1)

(2)

(3)

Basis in Qualifying Property Placed

Credit

Current Year Credit Amount

in Service in Current Tax Year

Percentage

(column 1 x column2)

1. 3-year Property

$

0.5% (.005)

1. $

2. 5-year Property

$

1% (.010)

2. $

3. 7-year Property

$

1.5% (.015)

3. $

4. 10-year Property

$

2% (.020)

4. $

5. 15-year or more Property

$

2.5% (.025)

5. $

6. Total credit. Add lines 1 through 5.

6. $

II.

APPLYING NEW JOBS AND CAPITAL INVESTMENT CREDITS AGAINST INCOME TAX:

7. Amount of new jobs credit earned in current year (from SC SCH. TC-4) ………….….

7. $

8. Amount of unused new jobs credits (SC SCH. TC-4) carried forward from prior years

8. $

(Unused new jobs credits may be carried forward 15 years.)

9. Add lines 7 and 8 …………………………..………………………………………………… 9. $

(Total of new jobs credit for current year and carried forward from prior years)

10. Income tax liability before applying credits …………………………………………….... 10. $

11. Amount of line 9 used against current year income tax ………………………………… 11. $

(New jobs credits, including credit amounts carried forward from prior years, may

not reduce a taxpayer's income tax liability by more than 50% before application of

other credits. You may enter a smaller amount under appropriate circumstances. A

taxpayer may use Chapter 6 or 14 credits in any order unless a particular credit

statute provides otherwise. A credit must be used to the extent possible in the year

it is generated.)

36161016

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7