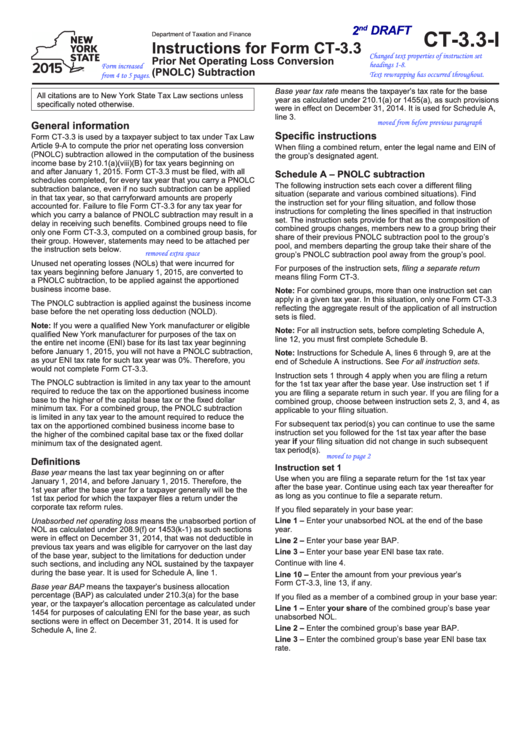

Instructions For Form Ct-3.3 - Prior Net Operating Loss Conversion (Pnolc) Subtraction - New York State Department Of Taxation And Finance - 2015

ADVERTISEMENT

2

DRAFT

nd

CT-3.3-I

Department of Taxation and Finance

Instructions for Form CT-3.3

Changed text properties of instruction set

Prior Net Operating Loss Conversion

headings 1-8.

Form increased

(PNOLC) Subtraction

Text rewrapping has occurred throughout.

from 4 to 5 pages.

Base year tax rate means the taxpayer’s tax rate for the base

All citations are to New York State Tax Law sections unless

year as calculated under 210.1(a) or 1455(a), as such provisions

specifically noted otherwise.

were in effect on December 31, 2014. It is used for Schedule A,

line 3.

moved from before previous paragraph

General information

Specific instructions

Form CT-3.3 is used by a taxpayer subject to tax under Tax Law

Article 9-A to compute the prior net operating loss conversion

When filing a combined return, enter the legal name and EIN of

(PNOLC) subtraction allowed in the computation of the business

the group’s designated agent.

income base by 210.1(a)(viii)(B) for tax years beginning on

and after January 1, 2015. Form CT-3.3 must be filed, with all

Schedule A – PNOLC subtraction

schedules completed, for every tax year that you carry a PNOLC

The following instruction sets each cover a different filing

subtraction balance, even if no such subtraction can be applied

situation (separate and various combined situations). Find

in that tax year, so that carryforward amounts are properly

the instruction set for your filing situation, and follow those

accounted for. Failure to file Form CT-3.3 for any tax year for

instructions for completing the lines specified in that instruction

which you carry a balance of PNOLC subtraction may result in a

set. The instruction sets provide for that as the composition of

delay in receiving such benefits. Combined groups need to file

combined groups changes, members new to a group bring their

only one Form CT-3.3, computed on a combined group basis, for

share of their previous PNOLC subtraction pool to the group’s

their group. However, statements may need to be attached per

pool, and members departing the group take their share of the

the instruction sets below.

removed extra space

group’s PNOLC subtraction pool away from the group’s pool.

Unused net operating losses (NOLs) that were incurred for

For purposes of the instruction sets, filing a separate return

tax years beginning before January 1, 2015, are converted to

means filing Form CT-3.

a PNOLC subtraction, to be applied against the apportioned

business income base.

Note: For combined groups, more than one instruction set can

apply in a given tax year. In this situation, only one Form CT-3.3

The PNOLC subtraction is applied against the business income

reflecting the aggregate result of the application of all instruction

base before the net operating loss deduction (NOLD).

sets is filed.

Note: If you were a qualified New York manufacturer or eligible

Note: For all instruction sets, before completing Schedule A,

qualified New York manufacturer for purposes of the tax on

line 12, you must first complete Schedule B.

the entire net income (ENI) base for its last tax year beginning

before January 1, 2015, you will not have a PNOLC subtraction,

Note: Instructions for Schedule A, lines 6 through 9, are at the

as your ENI tax rate for such tax year was 0%. Therefore, you

end of Schedule A instructions. See For all instruction sets.

would not complete Form CT-3.3.

Instruction sets 1 through 4 apply when you are filing a return

The PNOLC subtraction is limited in any tax year to the amount

for the 1st tax year after the base year. Use instruction set 1 if

required to reduce the tax on the apportioned business income

you are filing a separate return in such year. If you are filing for a

base to the higher of the capital base tax or the fixed dollar

combined group, choose between instruction sets 2, 3, and 4, as

minimum tax. For a combined group, the PNOLC subtraction

applicable to your filing situation.

is limited in any tax year to the amount required to reduce the

For subsequent tax period(s) you can continue to use the same

tax on the apportioned combined business income base to

instruction set you followed for the 1st tax year after the base

the higher of the combined capital base tax or the fixed dollar

year if your filing situation did not change in such subsequent

minimum tax of the designated agent.

tax period(s).

moved to page 2

Definitions

Instruction set 1

Base year means the last tax year beginning on or after

Use when you are filing a separate return for the 1st tax year

January 1, 2014, and before January 1, 2015. Therefore, the

after the base year. Continue using each tax year thereafter for

1st year after the base year for a taxpayer generally will be the

as long as you continue to file a separate return.

1st tax period for which the taxpayer files a return under the

corporate tax reform rules.

If you filed separately in your base year:

Unabsorbed net operating loss means the unabsorbed portion of

Line 1 – Enter your unabsorbed NOL at the end of the base

NOL as calculated under 208.9(f) or 1453(k-1) as such sections

year.

were in effect on December 31, 2014, that was not deductible in

Line 2 – Enter your base year BAP.

previous tax years and was eligible for carryover on the last day

Line 3 – Enter your base year ENI base tax rate.

of the base year, subject to the limitations for deduction under

Continue with line 4.

such sections, and including any NOL sustained by the taxpayer

during the base year. It is used for Schedule A, line 1.

Line 10 – Enter the amount from your previous year’s

Form CT-3.3, line 13, if any.

Base year BAP means the taxpayer’s business allocation

percentage (BAP) as calculated under 210.3(a) for the base

If you filed as a member of a combined group in your base year:

year, or the taxpayer’s allocation percentage as calculated under

Line 1 – Enter your share of the combined group’s base year

1454 for purposes of calculating ENI for the base year, as such

unabsorbed NOL.

sections were in effect on December 31, 2014. It is used for

Line 2 – Enter the combined group’s base year BAP.

Schedule A, line 2.

Line 3 – Enter the combined group’s base year ENI base tax

rate.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5