Form Publication 784 - Department Of Treasury Internal Revenue Service - Certificate Of Subordination Of Federal Tax Lien

ADVERTISEMENT

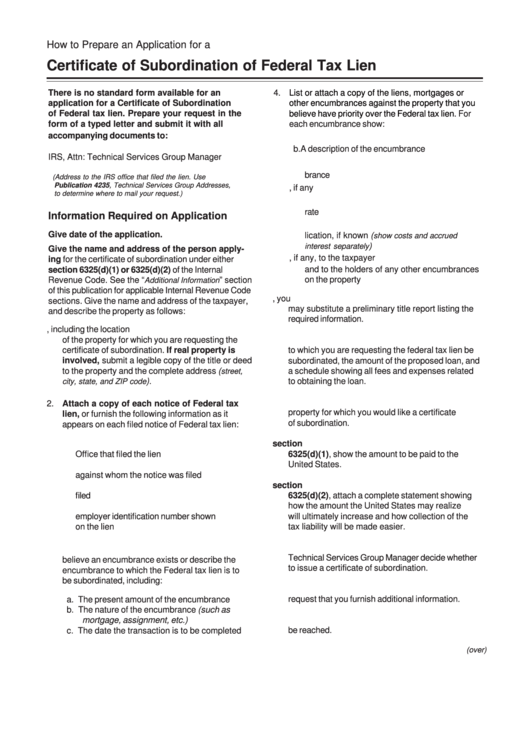

How to Prepare an Application for a

Certificate of Subordination of Federal Tax Lien

There is no standard form available for an

4.

List or attach a copy of the liens, mortgages or

application for a Certificate of Subordination

other encumbrances against the property that you

of Federal tax lien. Prepare your request in the

believe have priority over the Federal tax lien.

For

form of a typed letter and submit it with all

each encumbrance show:

accompanying documents to:

a. The name and address of the holder

b. A description of the encumbrance

IRS, Attn: Technical Services Group Manager

c. The date of the agreement to the encum-

brance

(Address to the IRS office that filed the lien. Use

Publication 4235, Technical Services Group Addresses,

d. The date and place of the recording, if any

to determine where to mail your request.)

e. The original principal amount and the interest

rate

Information Required on Application

f. The amount due as of the date of the app-

Give date of the application.

lication, if known (

show costs and accrued

)

interest separately

Give the name and address of the person apply-

g. Your family relationship, if any, to the taxpayer

ing for the certificate of subordination under either

and to the holders of any other encumbrances

section 6325(d)(1) or 6325(d)(2) of the Internal

on the property

Revenue Code. See the “

” section

Additional Information

of this publication for applicable Internal Revenue Code

5. Instead of the information in 4a through f above, you

sections. Give the name and address of the taxpayer,

may substitute a preliminary title report listing the

and describe the property as follows:

required information.

1. Give a detailed description, including the location

of the property for which you are requesting the

6. The name and address of any new mortgage holder

certificate of subordination. If real property is

to which you are requesting the federal tax lien be

involved, submit a legible copy of the title or deed

subordinated, the amount of the proposed loan, and

to the property and the complete address (

a schedule showing all fees and expenses related

street,

).

to obtaining the loan.

city, state, and ZIP code

7. Furnish an estimate of the fair market value of the

2. Attach a copy of each notice of Federal tax

property for which you would like a certificate

lien, or furnish the following information as it

of subordination.

appears on each filed notice of Federal tax lien:

a. The location of the Internal Revenue

8. If you are submitting the application under section

Office that filed the lien

6325(d)(1), show the amount to be paid to the

United States.

b. The name and address of the taxpayer

against whom the notice was filed

c. The date and place the notice was

9. If you are submitting the application under section

6325(d)(2), attach a complete statement showing

filed

how the amount the United States may realize

d. The taxpayer social security number or

employer identification number shown

will ultimately increase and how collection of the

tax liability will be made easier.

on the lien

10. Furnish any other information that might help the

3. Submit a copy of each instrument to which you

Technical Services Group Manager decide whether

believe an encumbrance exists or describe the

to issue a certificate of subordination.

encumbrance to which the Federal tax lien is to

be subordinated, including:

11. The Technical Services Group Manager may

request that you furnish additional information.

a. The present amount of the encumbrance

b. The nature of the encumbrance (such as

mortgage, assignment, etc.)

12. Give a daytime telephone number where you may

be reached.

c. The date the transaction is to be completed

(over)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2