Instructions For Form 8872 - 2005

ADVERTISEMENT

Department of the Treasury

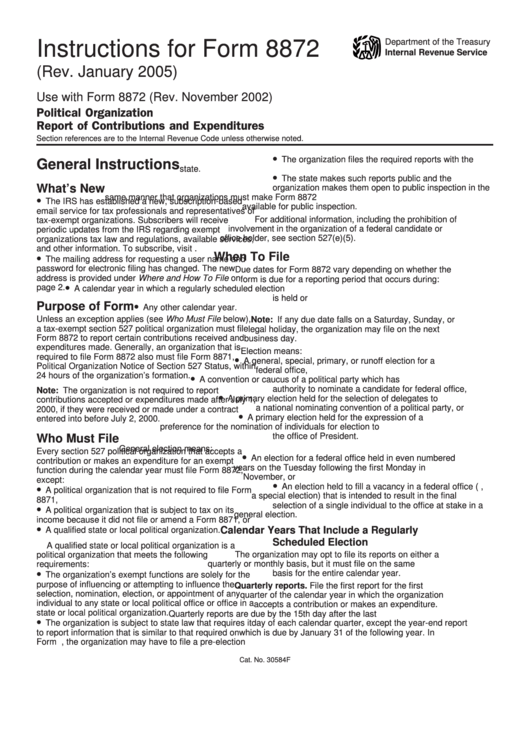

Instructions for Form 8872

Internal Revenue Service

(Rev. January 2005)

Use with Form 8872 (Rev. November 2002)

Political Organization

Report of Contributions and Expenditures

Section references are to the Internal Revenue Code unless otherwise noted.

•

The organization files the required reports with the

General Instructions

state.

•

The state makes such reports public and the

What’s New

organization makes them open to public inspection in the

•

same manner that organizations must make Form 8872

The IRS has established a new, subscription-based

available for public inspection.

email service for tax professionals and representatives of

For additional information, including the prohibition of

tax-exempt organizations. Subscribers will receive

involvement in the organization of a federal candidate or

periodic updates from the IRS regarding exempt

office holder, see section 527(e)(5).

organizations tax law and regulations, available services,

and other information. To subscribe, visit

•

When To File

The mailing address for requesting a user name and

password for electronic filing has changed. The new

Due dates for Form 8872 vary depending on whether the

address is provided under Where and How To File on

form is due for a reporting period that occurs during:

•

page 2.

A calendar year in which a regularly scheduled election

is held or

•

Purpose of Form

Any other calendar year.

Unless an exception applies (see Who Must File below),

Note: If any due date falls on a Saturday, Sunday, or

a tax-exempt section 527 political organization must file

legal holiday, the organization may file on the next

Form 8872 to report certain contributions received and

business day.

expenditures made. Generally, an organization that is

Election means:

•

required to file Form 8872 also must file Form 8871,

A general, special, primary, or runoff election for a

Political Organization Notice of Section 527 Status, within

federal office,

•

24 hours of the organization’s formation.

A convention or caucus of a political party which has

authority to nominate a candidate for federal office,

Note: The organization is not required to report

•

A primary election held for the selection of delegates to

contributions accepted or expenditures made after July 1,

a national nominating convention of a political party, or

2000, if they were received or made under a contract

•

A primary election held for the expression of a

entered into before July 2, 2000.

preference for the nomination of individuals for election to

the office of President.

Who Must File

General election means:

Every section 527 political organization that accepts a

•

An election for a federal office held in even numbered

contribution or makes an expenditure for an exempt

years on the Tuesday following the first Monday in

function during the calendar year must file Form 8872,

November, or

except:

•

•

An election held to fill a vacancy in a federal office (i.e.,

A political organization that is not required to file Form

a special election) that is intended to result in the final

8871,

selection of a single individual to the office at stake in a

•

A political organization that is subject to tax on its

general election.

income because it did not file or amend a Form 8871, or

•

Calendar Years That Include a Regularly

A qualified state or local political organization.

Scheduled Election

A qualified state or local political organization is a

The organization may opt to file its reports on either a

political organization that meets the following

quarterly or monthly basis, but it must file on the same

requirements:

•

basis for the entire calendar year.

The organization’s exempt functions are solely for the

purpose of influencing or attempting to influence the

Quarterly reports. File the first report for the first

selection, nomination, election, or appointment of any

quarter of the calendar year in which the organization

individual to any state or local political office or office in a

accepts a contribution or makes an expenditure.

state or local political organization.

Quarterly reports are due by the 15th day after the last

•

The organization is subject to state law that requires it

day of each calendar quarter, except the year-end report

to report information that is similar to that required on

which is due by January 31 of the following year. In

Form 8872.

addition, the organization may have to file a pre-election

Cat. No. 30584F

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4