Instructions For Assessment Of Business Tangible Personal Property Form

ADVERTISEMENT

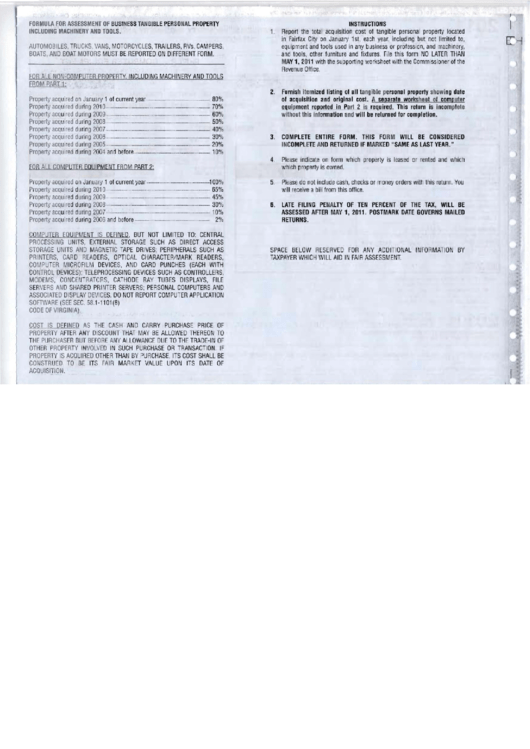

FORMULA FOR ASSESSMENT

OF

BUSINESS TANGIBLE

PERSONAL

PROPERTY

INCLUDING MACHINERY AND TOOLS.

AUTOMOBILES,

TR

UCKS,

VANS,

MO

TORCYCLES,

TRAILERS, RVs,

CAMPERS,

BOATS,

AND

BOAT MOTORS

MUST

BE REPORTED ON DIFFERENT FORM

.

FOR ALL NON-COMPUTER PROPERTY,

INCLUDING MACHINERY AND TOOLS

FROM PART 1:

Property acquired

on

January

1 of current year .................................................. 80%

Property

acquired during

201 0..···.··.. ·.··.......................................

· ··..

·...·········.......... 70%

Property acq uired durin

g

2009..·.. ·....·....··.··· .. ·...................... ·

..........

····...................... 60%

Property acquired duri ng

2008

...................................................................................

50%

Property acquired during

2007......................................................

..

...........................

40%

Property acquired during

2006

...................................................................................

30%

Property acq uired during

2005

...................................................................................

20%

Property

acquired

during 2004

and before

..........

... .............................................. 10%

FOR

ALL

COMPUTER

EQUIPMENT

FROM

PART 2:

Property acquired

on

Jan

uary

1 of current year ..................................................

~

00%

Property

acquired during

201

0...... ··· .. ·.. ·.. ·........·......·....·.. ·.. ·........ ........

·..............

......· 65%

Property

acquired

during

2009.................... ·.. ·.. ................

........·.... ·.. ·............·......

·.... 45%

Property

acquired

during

2008··

.. ·.. ·..........

·········..····· ..

·· ..·· ..

·.... ·· .. ·....·.. ··

..

···............... 30%

Property acquired during

2007

..........................................

.........................................

10%

Property acquired

during

2006

and

before

............................................................ 2%

COMPUTE

R

EQUIPMENT

IS

DE

FINED,

BUT NOT LIMITED TO: CENTRAL

PROCESSING

UNITS,

EXTERNAL

STORAGE SUCH AS DIRECT ACCESS

STORAGE

UNITS AND MAGNETIC

TAPE DRIVES; PERIPHERALS SUCH AS

PRINTERS

,

CAR

D

READERS, OPTI

CAL

CHARACTER/MARK READERS,

COMPUTER

MICROFILM

DEVIC

E

S,

AND

CARD PUNCHES (EACH WITH

CONTROL

DEVIC

ES):

TELEPROCESSING DEVICES SUCH AS CONTROLLERS,

MODE

MS,

CON

CENTRATORS,

CATHODE

RAY

TUBES DISPLAYS, FILE

SERVERS AN

D

SHAR

ED

PRINTER SERVERS;

PERSONAL COMPUTERS AND

ASSOCIATED DISPLAY

DEVICES.

DO NOT REPORT COMPUTER APPLICATION

SOFTWARE (SE

E

SEC. 58.1-1101 (8)

CODE

OF

VIRGINIA).

COST

IS

DEFI

NED

AS

THE

C

ASH AND

CAR

RY

PURCHASE

PRICE UF

PROPERTY AFTER

ANY

DI SCOUNT THAT

MAY

BE ALLOWED THEREON TO

THE

PURCHASER

BUT BEFORE

ANY

ALLOWANCE DUE TO THE TRADE-IN OF

OTH

ER

PROPERTY

INVOLVE

D

IN SUCH PU RCHASE OR TRANSACTION. IF

PROPERTY

IS ACQUIRED

OTHER

THAN BY

PURCHASE, ITS COST SHALL BE

CONSTRUED

TO BE

ITS

F

AI

R

MARKET

VALUE UPON ITS DATE OF

ACQUISITION

.

INSTRUCTIONS

1.

Report the total acquisition cost of tangible personal property located

in Fairfax City on January

1

st,

each

year,

including but not limited

to,

equipment and tools used in any business or profeSSion

,

and machinery,

and

tools,

other furniture and fixtures. File this form NO LATER THAN

MAY 1, 2011 with the supporting worksheet with the Commissioner of the

Revenue Office.

2.

Furnish

ilemized listing of all

tangible

personal property showing date

of acquisition and original cost.

A

separate worksheet

of

computer

equipment reported in

Part

2

is

required. This return is

incomplete

without this

information

and

will be returned for completion.

3.

COMPLETE ENTIRE FORM. THIS

FORM

WILL BE CONSID ERED

INC OMPLETE

AND RETURNED IF MARKED "SAME AS LAST YEAR."

4.

Please indicate on form which property is leased or rented and which

which property is owned.

5.

Please do not include cash

,

checks or money orders with this return

.

You

will receive a bill from this office.

6. LATE FILING PENALTY OF TEN PERCENT OF THE TAX, WILL BE

ASSESSED AFTER

MAY

1, 2011. POSTMARK DATE GOVERNS MAILED

RETURNS.

SPACE BELOW RESERVED FOR ANY ADDITIONAL INFORMATION BY

TAXPAYER WHICH WILL AID IN FAIR ASSESSMENT.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1