Form Rt129 - International Fuel Tax Agreement (Ifta) Application

ADVERTISEMENT

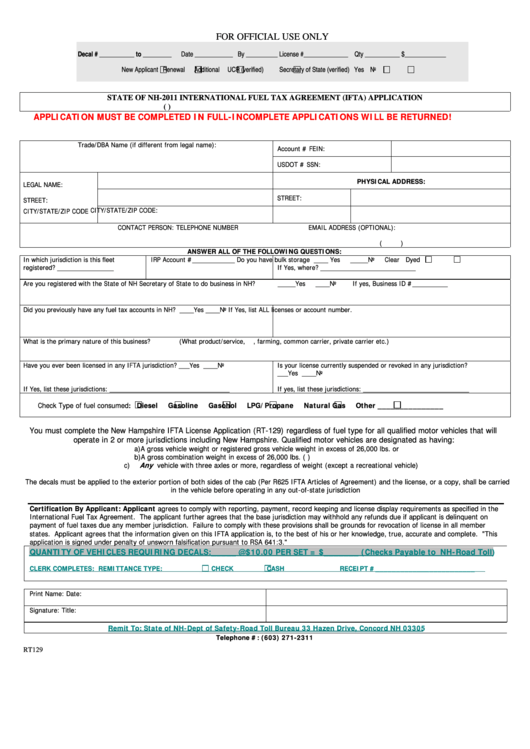

FOR OFFICIAL USE ONLY

Decal # ___________ to _________

Date ____________ By __________ License #______________ Qty ___________ $_____________

New Applicant

Renewal

Additional

UCR (verified)

Secretary of State (verified)

Yes

No

STATE OF NH-2011 INTERNATIONAL FUEL TAX AGREEMENT (IFTA) APPLICATION

( )

APPLICATION MUST BE COMPLETED IN FULL-INCOMPLETE APPLICATIONS WILL BE RETURNED!

Trade/DBA Name (if different from legal name):

Account #

FEIN:

USDOT #

SSN:

PHYSICAL ADDRESS:

LEGAL NAME:

STREET:

STREET:

CITY/STATE/ZIP CODE:

CITY/STATE/ZIP CODE

CONTACT PERSON:

TELEPHONE NUMBER

EMAIL ADDRESS (OPTIONAL):

(

)

ANSWER ALL OF THE FOLLOWING QUESTIONS:

In which jurisdiction is this fleet

IRP Account #____________

Do you have bulk storage ____ Yes

_____No

Clear

Dyed

registered? ________________

If Yes, where? ___________________________

Are you registered with the State of NH Secretary of State to do business in NH?

_____Yes

____No

If yes, Business ID #__________

Did you previously have any fuel tax accounts in NH? ____Yes ____No

If Yes, list ALL licenses or account number.

What is the primary nature of this business?

(What product/service, i.e.

Logging, farming, common carrier, private carrier etc.)

Have you ever been licensed in any IFTA jurisdiction? ___Yes ____No

Is your license currently suspended or revoked in any jurisdiction?

___Yes ____No

If Yes, list these jurisdictions: __________________________________

If yes, list these jurisdictions: ______________________________

Check Type of fuel consumed

Diesel

Gasoline

Gasohol

LPG/Propane

Natural Gas

Other _______________

:

You must complete the New Hampshire IFTA License Application (RT-129) regardless of fuel type for all qualified motor vehicles that will

operate in 2 or more jurisdictions including New Hampshire. Qualified motor vehicles are designated as having:

a)

A gross vehicle weight or registered gross vehicle weight in excess of 26,000 lbs. or

b)

A gross combination weight in excess of 26,000 lbs. (i.e. a vehicle hauling a trailer)

Any

c)

vehicle with three axles or more, regardless of weight (except a recreational vehicle)

The decals must be applied to the exterior portion of both sides of the cab (Per R625 IFTA Articles of Agreement) and the license, or a copy, shall be carried

in the vehicle before operating in any out-of-state jurisdiction

Certification By Applicant: Applicant agrees to comply with reporting, payment, record keeping and license display requirements as specified in the

International Fuel Tax Agreement. The applicant further agrees that the base jurisdiction may withhold any refunds due if applicant is delinquent on

payment of fuel taxes due any member jurisdiction. Failure to comply with these provisions shall be grounds for revocation of license in all member

states. Applicant agrees that the information given on this IFTA application is, to the best of his or her knowledge, true, accurate and complete. "This

application is signed under penalty of unsworn falsification pursuant to RSA 641:3."

QUANTITY OF VEHICLES REQUIRING DECALS:_____ @$10.00 PER SET = $_______ (Checks Payable to NH-Road Toll)

CLERK COMPLETES: REMITTANCE TYPE:

CHECK

CASH

RECEIPT #________________________

Print Name:

Date:

Signature:

Title:

Remit To: State of NH-Dept of Safety-Road Toll Bureau 33 Hazen Drive, Concord NH 03305

Telephone #: (603) 271-2311

RT129

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3