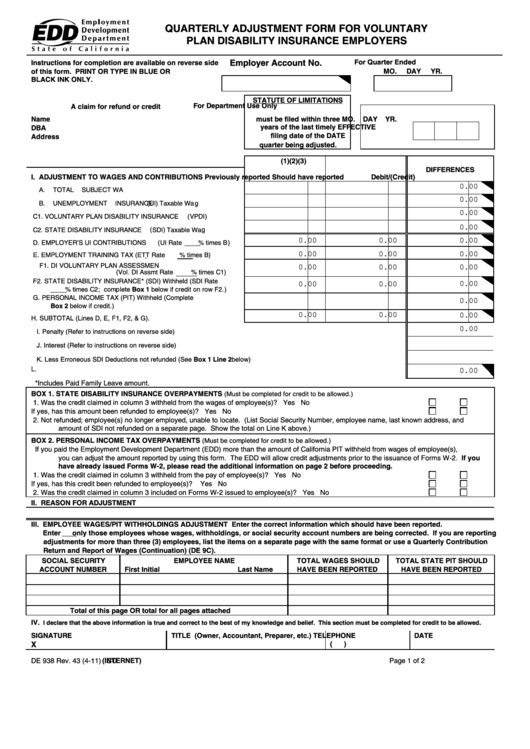

QUARTERLY ADJUSTMENT FORM FOR VOLUNTARY

PLAN DISABILITY INSURANCE EMPLOYERS

Instructions for completion are available on reverse side

For Quarter Ended

Employer Account No.

of this form. PRINT OR TYPE IN BLUE OR

MO.

DAY

YR.

BLACK INK ONLY.

STATUTE OF LIMITATIONS

For Department Use Only

A claim for refund or credit

Name

must be filed within three

MO.

DAY

YR.

years of the last timely

EFFECTIVE

DBA

filing date of the

DATE

Address

quarter being adjusted.

(1)

(2)

(3)

DIFFERENCES

I. ADJUSTMENT TO WAGES AND CONTRIBUTIONS

Previously reported

Should have reported

Debit/(Credit)

0.00

A. TOTAL SUBJECT WAGES.............................................................

0.00

B. UNEMPLOYMENT INSURANCE (UI) Taxable Wages...................

0.00

C1. VOLUNTARY PLAN DISABILITY INSURANCE (VPDI) WAGES ...

0.00

C2. STATE DISABILITY INSURANCE (SDI) Taxable Wages...............

0.00

0.00

0.00

D. EMPLOYER’S UI CONTRIBUTIONS (UI Rate

0.00

% times B) .....

0.00

0.00

0.00

E. EMPLOYMENT TRAINING TAX (ETT Rate

0.00

% times B) .........

0.00

0.00

0.00

F1. DI VOLUNTARY PLAN ASSESSMENT..........................................

(Vol. DI Assmt Rate

00.00% times C1)

0.00

0.00

0.00

F2. STATE DISABILITY INSURANCE* (SDI) Withheld (SDI Rate

0.00

% times C2; complete Box 1 below if credit on row F2.) .......

0.00

G. PERSONAL INCOME TAX (PIT) Withheld (Complete

Box 2 below if credit.).....................................................................

0.00

0.00

0.00

H. SUBTOTAL (Lines D, E, F1, F2, & G). ............................

0.00

I.

Penalty (Refer to instructions on reverse side)........................................................................................................

J. Interest (Refer to instructions on reverse side)........................................................................................................

K. Less Erroneous SDI Deductions not refunded (See Box 1 Line 2 below) ..............................................................

0.00

L. Total.........................................................................................................................................................................

*Includes Paid Family Leave amount.

BOX 1. STATE DISABILITY INSURANCE OVERPAYMENTS

(Must be completed for credit to be allowed.)

1. Was the credit claimed in column 3 withheld from the wages of employee(s)?.................................................................

Yes

No

If yes, has this amount been refunded to employee(s)? ....................................................................................................

Yes

No

2. Not refunded; employee(s) no longer employed, unable to locate. (List Social Security Number, employee name, last known address, and

amount of SDI not refunded on a separate page. Show the total on Line K above.)

BOX 2. PERSONAL INCOME TAX OVERPAYMENTS

(Must be completed for credit to be allowed.)

If you paid the Employment Development Department (EDD) more than the amount of California PIT withheld from wages of employee(s),

you can adjust the amount reported by using this form. The EDD will allow credit adjustments prior to the issuance of Forms W-2. If you

have already issued Forms W-2, please read the additional information on page 2 before proceeding.

1. Was the credit claimed in column 3 withheld from the pay of employee(s)? .....................................................................

Yes

No

If yes, has this credit been refunded to employee(s)? .......................................................................................................

Yes

No

2. Was the credit claimed in column 3 included on Forms W-2 issued to employee(s)? .......................................................

Yes

No

II. REASON FOR ADJUSTMENT

III. EMPLOYEE WAGES/PIT WITHHOLDINGS ADJUSTMENT Enter the correct information which should have been reported.

Enter only those employees whose wages, withholdings, or social security account numbers are being corrected. If you are reporting

adjustments for more than three (3) employees, list the items on a separate page with the same format or use a Quarterly Contribution

Return and Report of Wages (Continuation) (DE 9C).

SOCIAL SECURITY

EMPLOYEE NAME

TOTAL WAGES SHOULD

TOTAL STATE PIT SHOULD

ACCOUNT NUMBER

First Initial

Last Name

HAVE BEEN REPORTED

HAVE BEEN REPORTED

Total of this page OR total for all pages attached

IV.

.

I declare that the above information is true and correct to the best of my knowledge and belief. This section must be completed for credit to be allowed

SIGNATURE

TITLE (Owner, Accountant, Preparer, etc.)

TELEPHONE

DATE

X

(

)

DE 938 Rev. 43 (4-11)

(INTERNET)

P.O. Box 826880 / Sacramento CA 94280-0001

Page 1 of 2

CU

1

1