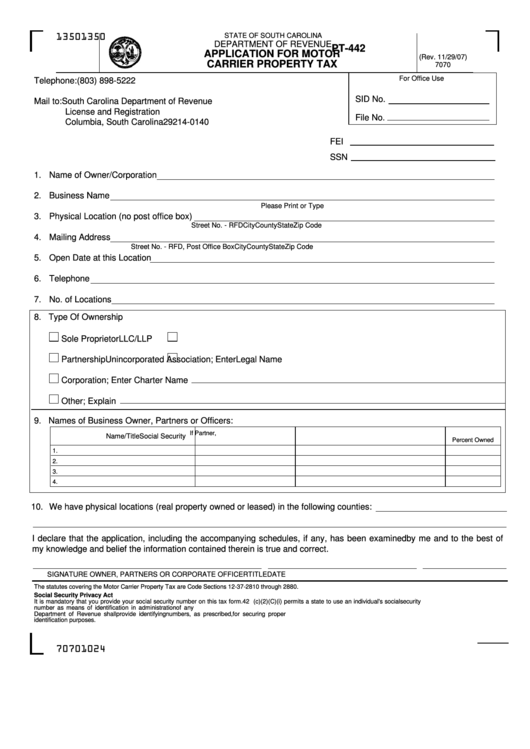

Form Pt-442 - Application For Motor 7070 Carrier Property Tax - 2007

ADVERTISEMENT

STATE OF SOUTH CAROLINA

1350

1350

DEPARTMENT OF REVENUE

PT-442

APPLICATION FOR MOTOR

(Rev. 11/29/07)

CARRIER PROPERTY TAX

7070

For Office Use

Telephone:

(803) 898-5222

SID No.

Mail to: South Carolina Department of Revenue

License and Registration

File No.

Columbia, South Carolina 29214-0140

FEI

SSN

1.

Name of Owner/Corporation

2.

Business Name

Please Print or Type

3.

Physical Location (no post office box)

Street No. - RFD

City

County

State

Zip Code

4.

Mailing Address

Street No. - RFD, Post Office Box

City

County

State

Zip Code

5.

Open Date at this Location

6.

Telephone

7.

No. of Locations

8. Type Of Ownership

Sole Proprietor

LLC/LLP

Partnership

Unincorporated Association; Enter Legal Name

Corporation; Enter Charter Name

Other; Explain

9. Names of Business Owner, Partners or Officers:

If Partner,

Name/Title

Social Security No.

Address

Percent Owned

1.

2.

3.

4.

10.

We have physical locations (real property owned or leased) in the following counties:

I declare that the application, including the accompanying schedules, if any, has been examined by me and to the best of

my knowledge and belief the information contained therein is true and correct.

SIGNATURE OWNER, PARTNERS OR CORPORATE OFFICER

TITLE

DATE

The statutes covering the Motor Carrier Property Tax are Code Sections 12-37-2810 through 2880.

Social Security Privacy Act

It is mandatory that you provide your social security number on this tax form. 42 U.S.C 405(c)(2)(C)(i) permits a state to use an individual's social security

number as means of identification in administration of any tax. SC Regulation 117-1 mandates that any person required to make a return to the SC

Department of Revenue shall provide identifying numbers, as prescribed, for securing proper identification. Your social security number is used for

identification purposes.

70701024

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1