Instructions For Form Pa-40 Nrc-Ae - Consolidated Personal Income Tax Return

ADVERTISEMENT

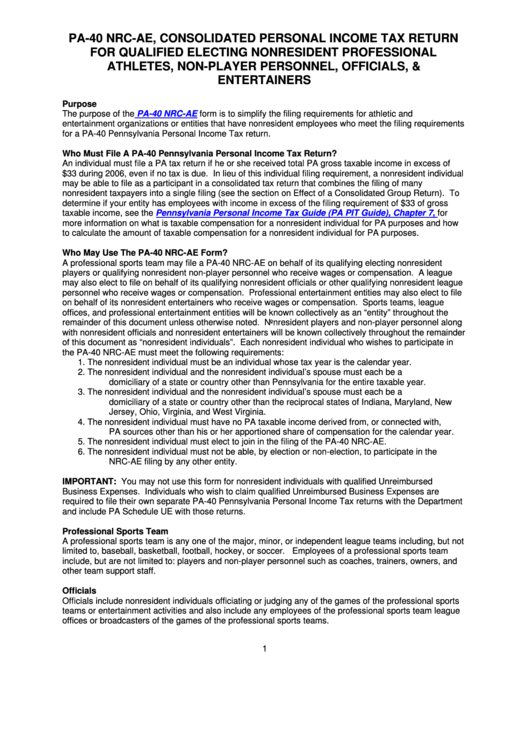

PA-40 NRC-AE, CONSOLIDATED PERSONAL INCOME TAX RETURN

FOR QUALIFIED ELECTING NONRESIDENT PROFESSIONAL

ATHLETES, NON-PLAYER PERSONNEL, OFFICIALS, &

ENTERTAINERS

Purpose

The purpose of the

PA-40 NRC-AE

form is to simplify the filing requirements for athletic and

entertainment organizations or entities that have nonresident employees who meet the filing requirements

for a PA-40 Pennsylvania Personal Income Tax return.

Who Must File A PA-40 Pennsylvania Personal Income Tax Return?

An individual must file a PA tax return if he or she received total PA gross taxable income in excess of

$33 during 2006, even if no tax is due. In lieu of this individual filing requirement, a nonresident individual

may be able to file as a participant in a consolidated tax return that combines the filing of many

nonresident taxpayers into a single filing (see the section on Effect of a Consolidated Group Return). To

determine if your entity has employees with income in excess of the filing requirement of $33 of gross

taxable income, see the

Pennsylvania Personal Income Tax Guide (PA PIT Guide), Chapter 7,

for

more information on what is taxable compensation for a nonresident individual for PA purposes and how

to calculate the amount of taxable compensation for a nonresident individual for PA purposes.

Who May Use The PA-40 NRC-AE Form?

A professional sports team may file a PA-40 NRC-AE on behalf of its qualifying electing nonresident

players or qualifying nonresident non-player personnel who receive wages or compensation. A league

may also elect to file on behalf of its qualifying nonresident officials or other qualifying nonresident league

personnel who receive wages or compensation. Professional entertainment entities may also elect to file

on behalf of its nonresident entertainers who receive wages or compensation. Sports teams, league

offices, and professional entertainment entities will be known collectively as an “entity” throughout the

remainder of this document unless otherwise noted. Nonresident players and non-player personnel along

with nonresident officials and nonresident entertainers will be known collectively throughout the remainder

of this document as “nonresident individuals”. Each nonresident individual who wishes to participate in

the PA-40 NRC-AE must meet the following requirements:

1.

The nonresident individual must be an individual whose tax year is the calendar year.

2.

The nonresident individual and the nonresident individual’s spouse must each be a

domiciliary of a state or country other than Pennsylvania for the entire taxable year.

3.

The nonresident individual and the nonresident individual’s spouse must each be a

domiciliary of a state or country other than the reciprocal states of Indiana, Maryland, New

Jersey, Ohio, Virginia, and West Virginia.

4.

The nonresident individual must have no PA taxable income derived from, or connected with,

PA sources other than his or her apportioned share of compensation for the calendar year.

5.

The nonresident individual must elect to join in the filing of the PA-40 NRC-AE.

6.

The nonresident individual must not be able, by election or non-election, to participate in the

NRC-AE filing by any other entity.

IMPORTANT: You may not use this form for nonresident individuals with qualified Unreimbursed

Business Expenses. Individuals who wish to claim qualified Unreimbursed Business Expenses are

required to file their own separate PA-40 Pennsylvania Personal Income Tax returns with the Department

and include PA Schedule UE with those returns.

Professional Sports Team

A professional sports team is any one of the major, minor, or independent league teams including, but not

limited to, baseball, basketball, football, hockey, or soccer. Employees of a professional sports team

include, but are not limited to: players and non-player personnel such as coaches, trainers, owners, and

other team support staff.

Officials

Officials include nonresident individuals officiating or judging any of the games of the professional sports

teams or entertainment activities and also include any employees of the professional sports team league

offices or broadcasters of the games of the professional sports teams.

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9