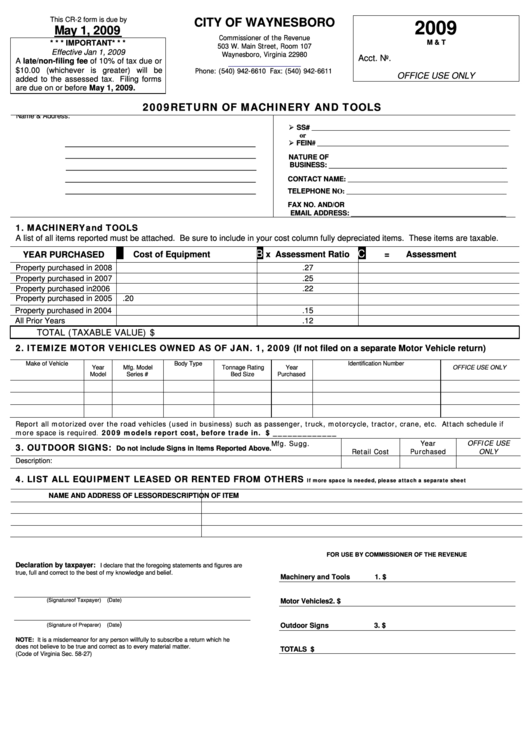

Form Cr-2 - Return Of Machinery And Tools - 2009

ADVERTISEMENT

This CR-2 form is due by

CITY OF WAYNESBORO

2009

May 1, 2009

Commissioner of the Revenue

* * * IMPORTANT * * *

M & T

503 W. Main Street, Room 107

Effective Jan 1, 2009

Waynesboro, Virginia 22980

Acct. No.

A late/non-filing fee of 10% of tax due or

Phone: (540) 942-6610 Fax: (540) 942-6611

$10.00 (whichever is greater) will be

OFFICE USE ONLY

added to the assessed tax. Filing forms

are due on or before May 1, 2009.

2009 RETURN OF MACHINERY AND TOOLS

Name & Address:

SS# _________________________________________________________

or

_________________________________

FEIN# _______________________________________________________

_________________________________

NATURE OF

_________________________________

BUSINESS: ______________________________________________

_________________________________

CONTACT NAME: ______________________________________________

_________________________________

TELEPHONE NO: ______________________________________________

FAX NO. AND/OR

EMAIL ADDRESS: ________________________________________

1. MACHINERY and TOOLS

A list of all items reported must be attached. Be sure to include in your cost column fully depreciated items. These items are taxable.

A

B

C

Cost of Equipment

x Assessment Ratio

=

Assessment

YEAR PURCHASED

Property purchased in 2008

.27

Property purchased in 2007

.25

Property purchased in 2006

.22

Property purchased in 2005

.20

Property purchased in 2004

.15

All Prior Years

.12

TOTAL (TAXABLE VALUE) $

2. ITEMIZE MOTOR VEHICLES OWNED AS OF JAN. 1, 2009 (If not filed on a separate Motor Vehicle return)

Make of Vehicle

Year

Mfg. Model

Body Type

Tonnage Rating

Year

Identification Number

OFFICE USE ONLY

Model

Series #

Bed Size

Purchased

Report all motorized over the road vehicles (used in business) such as passenger, truck, motorcycle, tractor, crane, etc. Attach schedule if

more space is required

2009 models report cost, before trade in. $ _____________

.

Mfg. Sugg.

Year

OFFICE USE

3. OUTDOOR SIGNS:

Do not include Signs in Items Reported Above.

Retail Cost

Purchased

ONLY

Description:

4. LIST ALL EQUIPMENT LEASED OR RENTED FROM OTHERS

If more space is needed, please attach a separate sheet

NAME AND ADDRESS OF LESSOR

DESCRIPTION OF ITEM

FOR USE BY COMMISSIONER OF THE REVENUE

Declaration by taxpayer:

I declare that the foregoing statements and figures are

true, full and correct to the best of my knowledge and belief.

Machinery and Tools

1.

$

(Signature of Taxpayer)

(Date)

Motor Vehicles

2.

$

)

(Signature of Preparer)

(Date

Outdoor Signs

3.

$

NOTE: It is a misdemeanor for any person willfully to subscribe a return which he

does not believe to be true and correct as to every material matter.

TOTALS

$

(Code of Virginia Sec. 58-27)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2