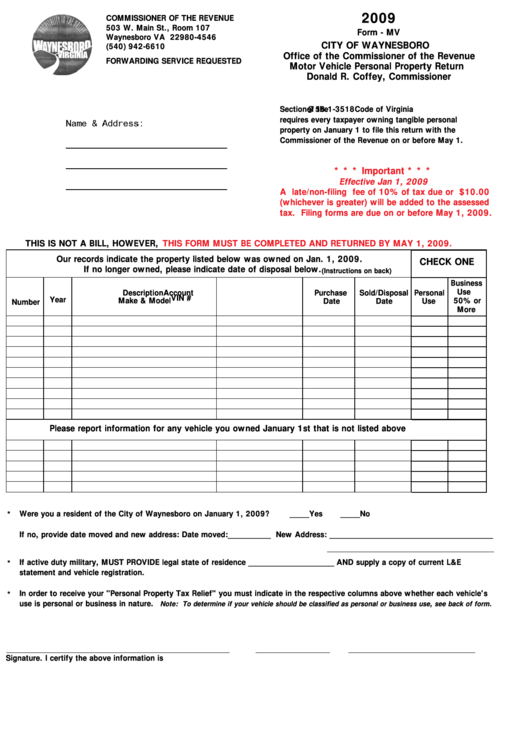

Form - Mv - Motor Vehicle Personal Property Return - 2009

ADVERTISEMENT

2009

COMMISSIONER OF THE REVENUE

503 W. Main St., Room 107

Form - MV

Waynesboro VA 22980-4546

CITY OF WAYNESBORO

(540) 942-6610

Office of the Commissioner of the Revenue

FORWARDING SERVICE REQUESTED

Motor Vehicle Personal Property Return

Donald R. Coffey, Commissioner

§

Section

58.1-3518

of the

Code of Virginia

requires every taxpayer owning tangible personal

property on January 1 to file this return with the

Commissioner of the Revenue on or before May 1.

* * * Important * * *

Effective Jan 1, 2009

A late/non-filing fee of 10% of tax due or $10.00

(whichever is greater) will be added to the assessed

tax. Filing forms are due on or before May 1, 2009.

THIS IS NOT A BILL, HOWEVER,

THIS FORM MUST BE COMPLETED AND RETURNED BY MAY 1, 2009.

Our records indicate the property listed below was owned on Jan. 1, 2009.

CHECK ONE

If no longer owned, please indicate date of disposal below.

(Instructions on back)

Business

Use

Account

Description

Purchase

Sold/Disposal

Personal

VIN #

Year

Make & Model

50% or

Date

Date

Use

Number

More

Please report information for any vehicle you owned January 1st that is not listed above

Were you a resident of the City of Waynesboro on January 1, 2009?

_____Yes

_____No

*

If no, provide date moved and new address: Date moved:___________ New Address: __________________________________________

If active duty military, MUST PROVIDE legal state of residence ______________________ AND supply a copy of current L&E

*

statement and vehicle registration.

In order to receive your "Personal Property Tax Relief" you must indicate in the respective columns above whether each vehicle's

*

use is personal or business in nature.

Note: To determine if your vehicle should be classified as personal or business use, see back of form.

Signature. I certify the above information is true.

Date

Phone

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2