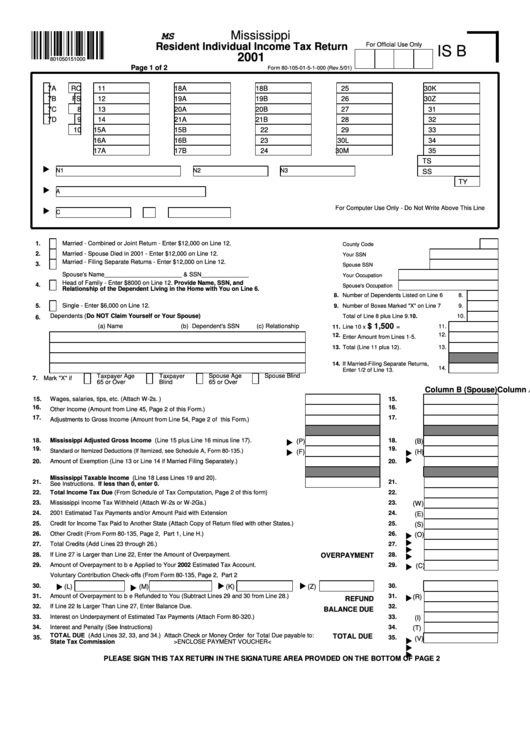

Form 80-105-01-5-2-000 - Resident Individual Income Tax Return - 2001

ADVERTISEMENT

Mississippi

MS

Resident Individual Income Tax Return

For Official Use Only

IS B

2001

801050151000

Page 1 of 2

Form 80-105-01-5-1-000 (Rev.5/01)

7A

RC

11

18A

18B

25

30K

7B

FS

12

19A

19B

26

30Z

7C

8

13

20A

20B

27

31

7D

9

14

21A

21B

28

32

10

15A

15B

22

29

33

16A

16B

23

30L

34

17A

17B

24

30M

35

TS

N1

N2

N3

SS

TY

A

For Computer Use Only - Do Not Write Above This Line

C

1.

Married - Combined or Joint Return - Enter $12,000 on Line 12.

County Code

2.

Married - Spouse Died in 2001 - Enter $12,000 on Line 12.

Your SSN

Married - Filing Separate Returns - Enter $12,000 on Line 12.

3.

Spouse SSN

Spouse's Name_______________________ & SSN______________

Your Occupation

Head of Family - Enter $8000 on Line 12. Provide Name, SSN, and

4.

Spouse's Occupation

Relationship of the Dependent Living in the Home with You on Line 6.

8.

Number of Dependents Listed on Line 6

8.

5.

Single - Enter $6,000 on Line 12.

9.

Number of Boxes Marked "X" on Line 7

9.

Dependents (Do NOT Claim Yourself or Your Spouse)

10.

Total of Line 8 plus Line 9.

10.

6.

$ 1,500

(a) Name

(b) Dependent's SSN

(c) Relationship

11.

=

11.

Line 10 x

12.

12.

Enter Amount from Lines 1-5.

13. Total (Line 11 plus 12).

13.

14. If Married-Filing Separate Returns,

14.

Enter 1/2 of Line 13.

Taxpayer Age

Taxpayer

Spouse Age

Spouse Blind

7. Mark "X" if

65 or Over

Blind

65 or Over

Column A (Taxpayer)

Column B (Spouse)

15.

Wages, salaries, tips, etc. (Attach W-2s. )

15.

16.

16.

Other Income (Amount from Line 45, Page 2 of this Form.)

17.

17.

Adjustments to Gross Income (Amount from Line 54, Page 2 of this Form.)

18.

Mississippi Adjusted Gross Income (Line 15 plus Line 16 minus line 17).

18.

(P)

(B)

19.

19.

Standard or Itemized Deductions (If Itemized, see Schedule A, Form 80-135.)

(F)

(H)

20.

Amount of Exemption (Line 13 or Line 14 if Married Filing Separately.)

20.

Mississippi Taxable Income (Line 18 Less Lines 19 and 20).

21.

21.

See Instructions. If less than 0, enter 0.

22.

Total Income Tax Due (From Schedule of Tax Computation, Page 2 of this form)

22.

23.

Mississippi Income Tax Withheld (Attach W-2s or W-2Gs.)

23.

(W)

24.

2001 Estimated Tax Payments and/or Amount Paid with Extension

24.

(E)

25.

Credit for Income Tax Paid to Another State (Attach Copy of Return filed with other States.)

25.

(S)

26.

Other Credit (From Form 80-135, Page 2, Part 1, Line H.)

26.

(O)

27.

Total Credits (Add Lines 23 through 26.)

27.

28.

If Line 27 is Larger than Line 22, Enter the Amount of Overpayment.

28.

OVERPAYMENT

29.

Amount of Overpayment to be Applied to Your 2002 Estimated Tax Account.

29.

(C)

Voluntary Contribution Check-offs (From Form 80-135, Page 2, Part 2

30.

30.

(L)

(M)

(K)

(Z)

31.

Amount of Overpayment to be Refunded to You (Subtract Lines 29 and 30 from Line 28.)

31.

(R)

REFUND

32.

If Line 22 Is Larger Than Line 27, Enter Balance Due.

32.

BALANCE DUE

33.

Interest on Underpayment of Estimated Tax Payments (Attach Form 80-320.)

33.

(I)

34.

Interest and Penalty (See Instructions)

34.

(T)

TOTAL DUE (Add Lines 32, 33, and 34.) Attach Check or Money Order for Total Due payable to:

TOTAL DUE

35.

35.

(V)

State Tax Commission

>ENCLOSE PAYMENT VOUCHER<

PLEASE SIGN THIS TAX RETURN IN THE SIGNATURE AREA PROVIDED ON THE BOTTOM OF PAGE 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2