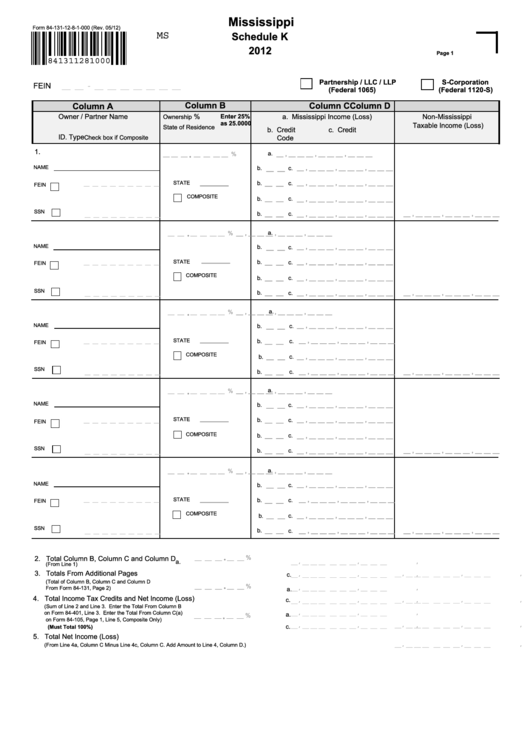

Form 84-131-12-8-1-000 - Mississippi Schedule K - 2012

ADVERTISEMENT

Mississippi

Form 84-131-12-8-1-000 (Rev. 05/12)

MS

Schedule K

2012

Page 1

841311281000

Partnership / LLC / LLP

S-Corporation

FEIN

__ __ - __ __ __ __ __ __ __

(Federal 1065)

(Federal 1120-S)

Column B

Column C

Column D

Column A

Owner / Partner Name

%

Enter 25%

a. Mississippi Income (Loss)

Non-Mississippi

Ownership

as 25.0000

Taxable Income (Loss)

State of Residence

b. Credit

c. Credit

ID. Type

Check box if Composite

Code

.

1.

a.

__ __ __

__ __ __ __ %

__ , __ __ __ , __ __ __ , __ __ __

NAME

__ , __ __ __ , __ __ __ , __ __ __

b.

__ __

c.

______

STATE

b.

__ __

__ , __ __ __ , __ __ __ , __ __ __

c.

__ __ __ __ __ __ __ __ __

FEIN

COMPOSITE

__ __

c.

b.

__ , __ __ __ , __ __ __ , __ __ __

SSN

b.

__ __

c.

__ , __ __ __ , __ __ __ , __ __ __

__ , __ __ __ , __ __ __ , __ __ __

__ __ __ __ __ __ __ __ __

.

a.

__ , __ __ __ , __ __ __ , __ __ __

__ __

__ __ __ __ %

NAME

__ __

__ , __ __ __ , __ __ __ , __ __ __

b.

c.

______

STATE

__ , __ __ __ , __ __ __ , __ __ __

b.

__ __

c.

__ __ __ __ __ __ __ __ __

FEIN

COMPOSITE

__ __

b.

c.

__ , __ __ __ , __ __ __ , __ __ __

SSN

b.

__ __

c.

__ , __ __ __ , __ __ __ , __ __ __

__ , __ __ __ , __ __ __ , __ __ __

__ __ __ __ __ __ __ __ __

.

a.

__ __

__ __ __ __ %

__ , __ __ __ , __ __ __ , __ __ __

NAME

b.

__ __

__ , __ __ __ , __ __ __ , __ __ __

c.

______

STATE

__ __

__ , __ __ __ , __ __ __ , __ __ __

b.

c.

__ __ __ __ __ __ __ __ __

FEIN

COMPOSITE

__ __

b.

c.

__ , __ __ __ , __ __ __ , __ __ __

SSN

__ __

b.

c.

__ , __ __ __ , __ __ __ , __ __ __

__ , __ __ __ , __ __ __ , __ __ __

__ __ __ __ __ __ __ __ __

.

a.

__ __

__ __ __ __ %

__ , __ __ __ , __ __ __ , __ __ __

NAME

__ , __ __ __ , __ __ __ , __ __ __

b.

__ __

c.

______

STATE

b.

__ __

__ , __ __ __ , __ __ __ , __ __ __

c.

__ __ __ __ __ __ __ __ __

FEIN

COMPOSITE

__ __

c.

b.

__ , __ __ __ , __ __ __ , __ __ __

SSN

b.

__ __

c.

__ , __ __ __ , __ __ __ , __ __ __

__ , __ __ __ , __ __ __ , __ __ __

__ __ __ __ __ __ __ __ __

.

a.

__ , __ __ __ , __ __ __ , __ __ __

__ __

__ __ __ __ %

NAME

__ __

__ , __ __ __ , __ __ __ , __ __ __

b.

c.

______

STATE

__ __

__ , __ __ __ , __ __ __ , __ __ __

__ __ __ __ __ __ __ __ __

b.

c.

FEIN

COMPOSITE

__ __

b.

c.

__ , __ __ __ , __ __ __ , __ __ __

SSN

b.

__ __

c.

__ , __ __ __ , __ __ __ , __ __ __

__ , __ __ __ , __ __ __ , __ __ __

__ __ __ __ __ __ __ __ __

.

__ __ __ __ __ %

2. Total Column B, Column C and Column D

,

,

,

a.

__ __ __ __ __ __ __ __ __ __

(From Line 1)

,

,

,

,

,

,

3. Totals From Additional Pages

__ __ __ __ __ __ __ __ __ __

c.

__ __ __ __ __ __ __ __ __ __

.

(Total of Column B, Column C and Column D

__ __ __ . __ __ %

,

,

,

From Form 84-131, Page 2)

__ __ __ __ __ __ __ __ __ __

a.

4. Total Income Tax Credits and Net Income (Loss)

,

,

,

,

,

,

c.

__ __ __ __ __ __ __ __ __ __

__ __ __ __ __ __ __ __ __ __

(Sum of Line 2 and Line 3. Enter the Total From Column B

.

,

,

,

on Form 84-401, Line 3. Enter the Total From Column C(a)

__ __ __ __ __ __ __ __ __ __

a.

__ __ __ __ __ %

on Form 84-105, Page 1, Line 5, Composite Only)

,

,

,

,

,

,

__ __ __ __ __ __ __ __ __ __

__ __ __ __ __ __ __ __ __ __

c.

(Must Total 100%)

5. Total Net Income (Loss)

,

,

,

__ __ __ __ __ __ __ __ __ __

(From Line 4a, Column C Minus Line 4c, Column C. Add Amount to Line 4, Column D.)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3