Declaration Of Estimated Tax For Individuals (Form 200-Es)

ADVERTISEMENT

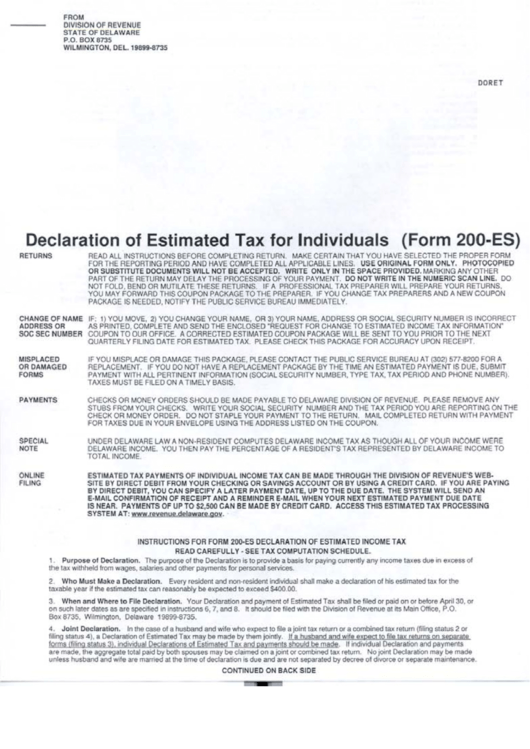

FROM

DIVISION OF REVENUE

STATE OF DELAWARE

P.O. BOX 8735

WILMINGTON, DEL. 19899-8735

DORET

RETURNS

Declaration of Estimated Tax for Individuals (Form 200-ES)

READ ALL INSTRUCTIONS BEFORE COMPLETING RETURN. MAKE CERTAIN THAT YOU HAVE SELECTED THE PROPER FORM

FOR THE REPORTING PERIOD AND HAVE COMPLETED ALL APPLICABLE LINES. USE ORIGINAL FORM ONLY. PHOTOCOPIED

OR SUBSTITUTE DOCUMENTS WILL NOT BE ACCEPTED. WRITE ONLY IN THE SPACE PROVIDED. MARKING ANY OTHER

PART OF THE RETURN MAY DELAY THE PROCESSING OF YOUR PAYMENT. DO NOT WRITE IN THE NUMERIC SCAN LINE. DO

NOT FOLD, BEND OR MUTILATE THESE RETURNS. IF A PROFESSIONAL TAX PREPARER WILL PREPARE YOUR RETURNS,

YOU MAY FORWARD THIS COUPON PACKAGE TO THE PREPARER. IF YOU CHANGE TAX PREPARERS AND A NEW COUPON

PACKAGE IS NEEDED, NOTIFY THE PUBLIC SERVICE BUREAU IMMEDIATELY.

CHANGE OF NAME IF: 1) YOU MOVE, 2) YOU CHANGE YOUR NAME, OR 3) YOUR NAME, ADDRESS OR SOCIAL SECURITY NUMBER IS INCORRECT

ADDRESS OR

AS PRINTED, COMPLETE AND SEND THE ENCLOSED "REQUEST FOR CHANGE TO ESTIMATED INCOME TAX INFORMATION"

SOC SEC NUMBER COUPON TO OUR OFFICE. A CORRECTED ESTIMATED COUPON PACKAGE WILL BE SENT TO YOU PRIOR TO THE NEXT

QUARTERLY FILING DATE FOR ESTIMATED TAX. PLEASE CHECK THIS PACKAGE FOR ACCURACY UPON RECEIPT.

MISPLACED

OR DAMAGED

FORMS

PAYMENTS

SPECIAL

NOTE

ONLINE

FILING

IF YOU MISPLACE OR DAMAGE THIS PACKAGE, PLEASE CONTACT THE PUBLIC SERVICE BUREAU AT (302) 577-8200 FOR A

REPLACEMENT. IF YOU DO NOT HAVE A REPLACEMENT PACKAGE BY THE TIME AN ESTIMATED PAYMENT IS DUE, SUBMIT

PAYMENT WITH ALL PERTINENT INFORMATION (SOCIAL SECURITY NUMBER, TYPE TAX, TAX PERIOD AND PHONE NUMBER).

TAXES MUST BE FILED ON A TIMELY BASIS.

CHECKS OR MONEY ORDERS SHOULD BE MADE PAYABLE TO DELAWARE DIVISION OF REVENUE. PLEASE REMOVE ANY

STUBS FROM YOUR CHECKS. WRITE YOUR SOCIAL SECURITY NUMBER AND THE TAX PERIOD YOU ARE REPORTING ON THE

CHECK OR MONEY ORDER. DO NOT STAPLE YOUR PAYMENT TO THE RETURN. MAIL COMPLETED RETURN WITH PAYMENT

FOR TAXES DUE IN YOUR ENVELOPE USING THE ADDRESS LISTED ON THE COUPON.

UNDER DELAWARE LAW A NON-RESIDENT COMPUTES DELAWARE INCOME TAX AS THOUGH ALL OF YOUR INCOME WERE

DELAWARE INCOME. YOU THEN PAY THE PERCENTAGE OF A RESIDENT'S TAX REPRESENTED BY DELAWARE INCOME TO

TOTAL INCOME.

ESTIMATED TAX PAYMENTS OF INDIVIDUAL INCOME TAX CAN BE MADE THROUGH THE DIVISION OF REVENUE'S WEB-

SITE BY DIRECT DEBIT FROM YOUR CHECKING OR SAVINGS ACCOUNT OR BY USING A CREDIT CARD. IF YOU ARE PAYING

BY DIRECT DEBIT, YOU CAN SPECIFY A LATER PAYMENT DATE, UP TO THE DUE DATE. THE SYSTEM WILL SEND AN

E-MAIL CONFIRMATION OF RECEIPT AND A REMINDER E-MAIL WHEN YOUR NEXT ESTIMATED PAYMENT DUE DATE

IS NEAR. PAYMENTS OF UP TO $2,500 CAN BE MADE BY CREDIT CARD. ACCESS THIS ESTIMATED TAX PROCESSING

SYSTEM AT:

.

INSTRUCTIONS FOR FORM 200-ES DECLARATION OF ESTIMATED INCOME TAX

READ CAREFULLY

-

SEE TAX COMPUTATION SCHEDULE.

1. Purpose of Declaration. The purpose of the Declaration is to provide a basis for paying currently any income taxes due in excess of

the tax withheld from wages, salaries and other payments for personal services.

2. Who Must Make a Declaration.

Every resident and non-resident individual shall make a declaration of his estimated tax for the

taxable year if the estimated tax can reasonably be expected to exceed $400.00.

3.

When and Where to File Declaration. Your Declaration and payment of Estimated Tax shall be filed or paid on or before April 30, or

on such later dates as are specified in instructions 6, 7, and 8. It should be filed with the Division of Revenue at its Main Office, P.O.

Box 8735, Wilmington, Delaware 19899-8735.

4. Joint

Declaration.

In the case of a husband and wife who expect to file a joint tax return or a combined tax return (filing status 2 or

filing status 4), a Declaration of Estimated Tax may be made by them jointly. If a husband and wife expect to file tax returns on separate

forms !filina status 3\. individual Declarations of Estimated Tax and pavments should be made. If individual Declaration and payments

are made, the aggregate total paid by both spouses may be claimed on a joint or combined tax return. No joint Declaration may be made

unless husband and wife are married at the time of declaration is due and are not separated by decree of divorce or separate maintenance.

CONTINUED ON BACK SIDE

.--'-

,

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3