Form Nc-415 - Tax Credit For Qualifying Expenses Of A Production Company - North Carolina Department Of Revenue

ADVERTISEMENT

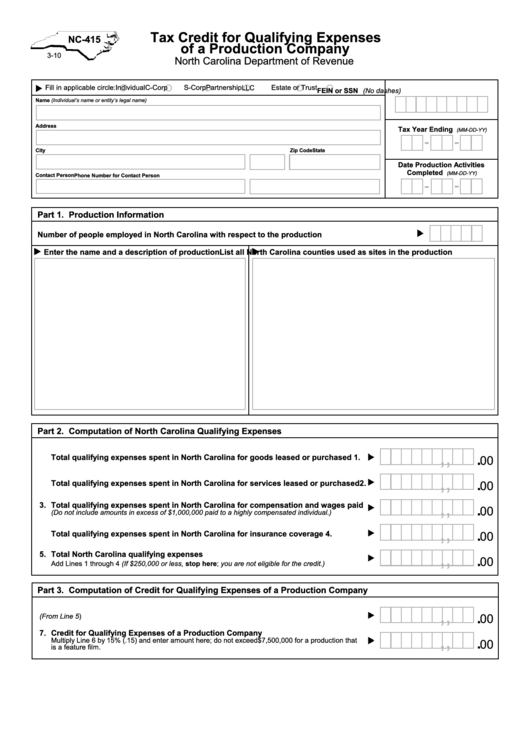

Tax Credit for Qualifying Expenses

NC-415

of a Production Company

3-10

North Carolina Department of Revenue

Fill in applicable circle:

Individual

C-Corp

S-Corp

Partnership

Estate or Trust

LLC

FEIN or SSN (No dashes)

Name (Individual’s name or entity’s legal name)

Address

Tax Year Ending

(MM-DD-YY)

City

State

Zip Code

Date Production Activities

Completed

(MM-DD-YY)

Contact Person

Phone Number for Contact Person

Part 1. Production Information

Number of people employed in North Carolina with respect to the production

Enter the name and a description of production

List all North Carolina counties used as sites in the production

Part 2. Computation of North Carolina Qualifying Expenses

,

,

.

1.

Total qualifying expenses spent in North Carolina for goods leased or purchased

00

,

,

.

2.

Total qualifying expenses spent in North Carolina for services leased or purchased

00

,

,

.

3.

Total qualifying expenses spent in North Carolina for compensation and wages paid

00

(Do not include amounts in excess of $1,000,000 paid to a highly compensated individual.)

,

,

.

4.

Total qualifying expenses spent in North Carolina for insurance coverage

00

,

,

.

5.

Total North Carolina qualifying expenses

00

Add Lines 1 through 4 (If $250,000 or less, stop here; you are not eligible for the credit.)

Part 3. Computation of Credit for Qualifying Expenses of a Production Company

,

,

.

6. Total North Carolina qualifying expenses

00

(From Line 5)

,

,

7.

Credit for Qualifying Expenses of a Production Company

.

Multiply Line 6 by 15% (.15) and enter amount here; do not exceed $7,500,000 for a production that

00

is a feature film.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2