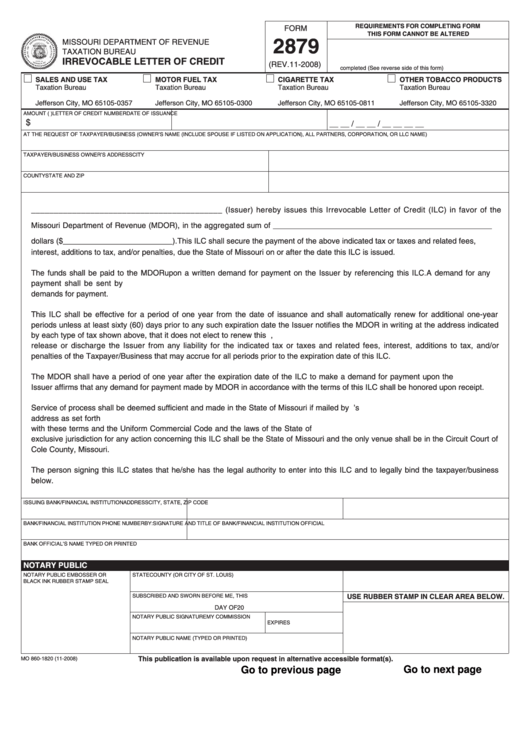

REQUIREMENTS FOR COMPLETING FORM

FORM

THIS FORM CANNOT BE ALTERED

2879

MISSOURI DEPARTMENT OF REVENUE

1. Issued by a banking/financial institution located in the United States

2. Signed by bank official

TAXATION BUREAU

3. Must be notarized

IRREVOCABLE LETTER OF CREDIT

4. Authorization for Release of Confidential Information must be

(REV.11-2008)

completed (See reverse side of this form)

SALES AND USE TAX

MOTOR FUEL TAX

CIGARETTE TAX

OTHER TOBACCO PRODUCTS

Taxation Bureau

Taxation Bureau

Taxation Bureau

Taxation Bureau

P.O. Box 357

P.O. Box 300

P.O. Box 811

P.O. Box 3320

Jefferson City, MO 65105-0357

Jefferson City, MO 65105-0300

Jefferson City, MO 65105-0811

Jefferson City, MO 65105-3320

AMOUNT (U.S. CURRENCY)

LETTER OF CREDIT NUMBER

DATE OF ISSUANCE

$

__ __ / __ __ / __ __ __ __

AT THE REQUEST OF TAXPAYER/BUSINESS (OWNER’S NAME (INCLUDE SPOUSE IF LISTED ON APPLICATION), ALL PARTNERS, CORPORATION, OR LLC NAME)

TAXPAYER/BUSINESS OWNER’S ADDRESS

CITY

COUNTY

STATE AND ZIP

__________________________________________ (Issuer) hereby issues this Irrevocable Letter of Credit (ILC) in favor of the

Missouri Department of Revenue (MDOR), in the aggregated sum of __________________________________________________

dollars ($_________________________). This ILC shall secure the payment of the above indicated tax or taxes and related fees,

interest, additions to tax, and/or penalties, due the State of Missouri on or after the date this ILC is issued.

The funds shall be paid to the MDOR upon a written demand for payment on the Issuer by referencing this ILC. A demand for any

payment shall be sent by U.S. mail with return receipt or personal service. The Issuer shall upon receipt honor all partial or full

demands for payment.

This ILC shall be effective for a period of one year from the date of issuance and shall automatically renew for additional one-year

periods unless at least sixty (60) days prior to any such expiration date the Issuer notifies the MDOR in writing at the address indicated

by each type of tax shown above, that it does not elect to renew this ILC. Any election not to renew the ILC shall not operate to relieve,

release or discharge the Issuer from any liability for the indicated tax or taxes and related fees, interest, additions to tax, and/or

penalties of the Taxpayer/Business that may accrue for all periods prior to the expiration date of this ILC.

The MDOR shall have a period of one year after the expiration date of the ILC to make a demand for payment upon the Issuer. The

Issuer affirms that any demand for payment made by MDOR in accordance with the terms of this ILC shall be honored upon receipt.

Service of process shall be deemed sufficient and made in the State of Missouri if mailed by U.S. mail with return receipt to the Issuer’s

address as set forth below. This agreement and any legal action pertaining thereto shall be governed by and construed in accordance

with these terms and the Uniform Commercial Code and the laws of the State of Missouri. The parties understand and agree that the

exclusive jurisdiction for any action concerning this ILC shall be the State of Missouri and the only venue shall be in the Circuit Court of

Cole County, Missouri.

The person signing this ILC states that he/she has the legal authority to enter into this ILC and to legally bind the taxpayer/business

below.

ISSUING BANK/FINANCIAL INSTITUTION

ADDRESS

CITY, STATE, ZIP CODE

BANK/FINANCIAL INSTITUTION PHONE NUMBER

BY: SIGNATURE AND TITLE OF BANK/FINANCIAL INSTITUTION OFFICIAL

BANK OFFICIAL’S NAME TYPED OR PRINTED

NOTARY PUBLIC

NOTARY PUBLIC EMBOSSER OR

STATE

COUNTY (OR CITY OF ST. LOUIS)

BLACK INK RUBBER STAMP SEAL

SUBSCRIBED AND SWORN BEFORE ME, THIS

USE RUBBER STAMP IN CLEAR AREA BELOW.

DAY OF

20

NOTARY PUBLIC SIGNATURE

MY COMMISSION

EXPIRES

NOTARY PUBLIC NAME (TYPED OR PRINTED)

This publication is available upon request in alternative accessible format(s).

MO 860-1820 (11-2008)

Go to previous page

Go to next page

1

1 2

2