Form Dr-15 Csn - Sales And Use Tax Return - Line-By-Line Instructions - Department Of Revenue

ADVERTISEMENT

DR-15 CSN

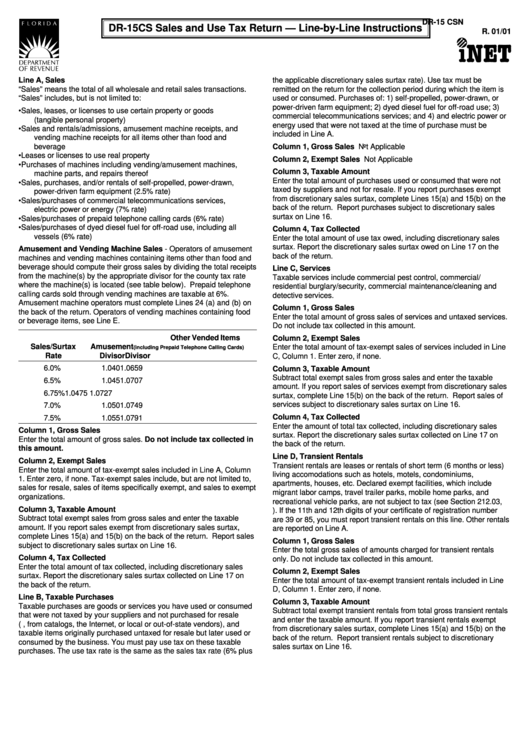

DR-15CS Sales and Use Tax Return — Line-by-Line Instructions

R. 01/01

Line A, Sales

the applicable discretionary sales surtax rate). Use tax must be

“Sales” means the total of all wholesale and retail sales transactions.

remitted on the return for the collection period during which the item is

“Sales” includes, but is not limited to:

used or consumed. Purchases of: 1) self-propelled, power-drawn, or

power-driven farm equipment; 2) dyed diesel fuel for off-road use; 3)

•

Sales, leases, or licenses to use certain property or goods

commercial telecommunications services; and 4) and electric power or

(tangible personal property)

energy used that were not taxed at the time of purchase must be

•

Sales and rentals/admissions, amusement machine receipts, and

included in Line A.

vending machine receipts for all items other than food and

beverage

Column 1, Gross Sales Not Applicable

•

Leases or licenses to use real property

Column 2, Exempt Sales Not Applicable

•

Purchases of machines including vending/amusement machines,

Column 3, Taxable Amount

machine parts, and repairs thereof

Enter the total amount of purchases used or consumed that were not

•

Sales, purchases, and/or rentals of self-propelled, power-drawn,

taxed by suppliers and not for resale. If you report purchases exempt

power-driven farm equipment (2.5% rate)

from discretionary sales surtax, complete Lines 15(a) and 15(b) on the

•

Sales/purchases of commercial telecommunications services,

back of the return. Report purchases subject to discretionary sales

electric power or energy (7% rate)

surtax on Line 16.

•

Sales/purchases of prepaid telephone calling cards (6% rate)

•

Sales/purchases of dyed diesel fuel for off-road use, including all

Column 4, Tax Collected

vessels (6% rate)

Enter the total amount of use tax owed, including discretionary sales

surtax. Report the discretionary sales surtax owed on Line 17 on the

Amusement and Vending Machine Sales - Operators of amusement

back of the return.

machines and vending machines containing items other than food and

beverage should compute their gross sales by dividing the total receipts

Line C, Services

from the machine(s) by the appropriate divisor for the county tax rate

Taxable services include commercial pest control, commercial/

where the machine(s) is located (see table below). Prepaid telephone

residential burglary/security, commercial maintenance/cleaning and

calling cards sold through vending machines are taxable at 6%.

detective services.

Amusement machine operators must complete Lines 24 (a) and (b) on

Column 1, Gross Sales

the back of the return. Operators of vending machines containing food

Enter the total amount of gross sales of services and untaxed services.

or beverage items, see Line E.

Do not include tax collected in this amount.

Other Vended Items

Column 2, Exempt Sales

Sales/Surtax

Amusement

Enter the total amount of tax-exempt sales of services included in Line

(including Prepaid Telephone Calling Cards)

Rate

Divisor

Divisor

C, Column 1. Enter zero, if none.

6.0%

1.040

1.0659

Column 3, Taxable Amount

Subtract total exempt sales from gross sales and enter the taxable

6.5%

1.045

1.0707

amount. If you report sales of services exempt from discretionary sales

6.75%

1.0475

1.0727

surtax, complete Line 15(b) on the back of the return. Report sales of

services subject to discretionary sales surtax on Line 16.

7.0%

1.050

1.0749

Column 4, Tax Collected

7.5%

1.055

1.0791

Enter the amount of total tax collected, including discretionary sales

Column 1, Gross Sales

surtax. Report the discretionary sales surtax collected on Line 17 on

Enter the total amount of gross sales. Do not include tax collected in

the back of the return.

this amount.

Line D, Transient Rentals

Column 2, Exempt Sales

Transient rentals are leases or rentals of short term (6 months or less)

Enter the total amount of tax-exempt sales included in Line A, Column

living accomodations such as hotels, motels, condominiums,

1. Enter zero, if none. Tax-exempt sales include, but are not limited to,

apartments, houses, etc. Declared exempt facilities, which include

sales for resale, sales of items specifically exempt, and sales to exempt

migrant labor camps, travel trailer parks, mobile home parks, and

organizations.

recreational vehicle parks, are not subject to tax (see Section 212.03,

Column 3, Taxable Amount

F.S.). If the 11th and 12th digits of your certificate of registration number

Subtract total exempt sales from gross sales and enter the taxable

are 39 or 85, you must report transient rentals on this line. Other rentals

amount. If you report sales exempt from discretionary sales surtax,

are reported on Line A.

complete Lines 15(a) and 15(b) on the back of the return. Report sales

Column 1, Gross Sales

subject to discretionary sales surtax on Line 16.

Enter the total gross sales of amounts charged for transient rentals

Column 4, Tax Collected

only. Do not include tax collected in this amount.

Enter the total amount of tax collected, including discretionary sales

Column 2, Exempt Sales

surtax. Report the discretionary sales surtax collected on Line 17 on

Enter the total amount of tax-exempt transient rentals included in Line

the back of the return.

D, Column 1. Enter zero, if none.

Line B, Taxable Purchases

Column 3, Taxable Amount

Taxable purchases are goods or services you have used or consumed

Subtract total exempt transient rentals from total gross transient rentals

that were not taxed by your suppliers and not purchased for resale

and enter the taxable amount. If you report transient rentals exempt

(e.g., from catalogs, the Internet, or local or out-of-state vendors), and

from discretionary sales surtax, complete Lines 15(a) and 15(b) on the

taxable items originally purchased untaxed for resale but later used or

back of the return. Report transient rentals subject to discretionary

consumed by the business. You must pay use tax on these taxable

sales surtax on Line 16.

purchases. The use tax rate is the same as the sales tax rate (6% plus

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4